Nobel Laureate: U.S. stocks look like a bubble. Worry less about Fed, more about valuation

American Nobel Prize Laureate, Yale University economics professor, economist and best-selling author Robert Shiller is seriously worried about the stock market.

In an interview with the Financial Times Shiller said:

“It looks to me a bit like a bubble again with essentially a tripling of stock prices since 2009 in just six years and at the same time people losing confidence in the valuation of the market.”

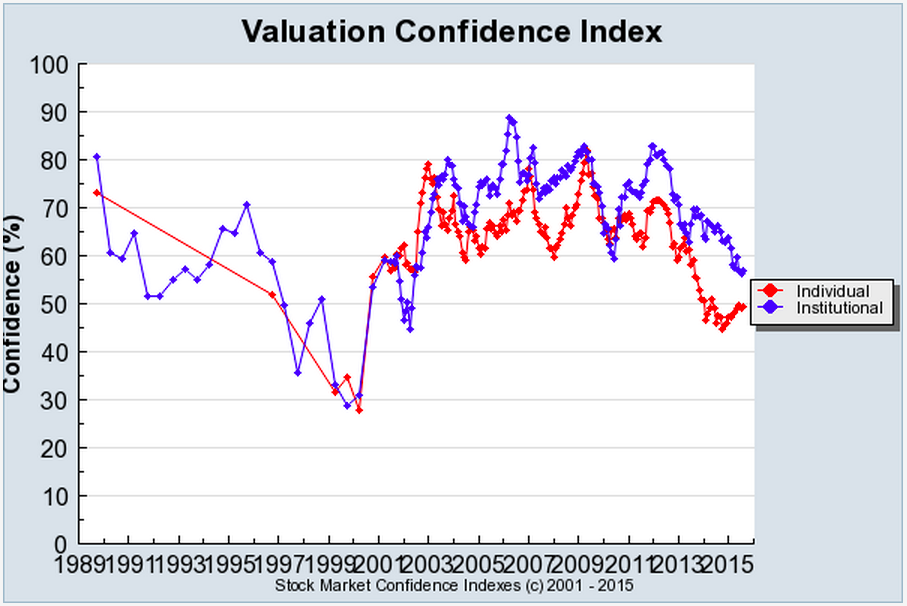

Shiller has the data to prove his case too - an index that measures stock market confidence which is compiled by asking investors if they think the stock market is overvalued, fairly valued, or undervalued.

What really concerns him is that the fall in investor confidence corresponds with an increase in the valuation and overall index level of the market.

In other words, investors keep buying stocks although they don't really think stocks are, on balance, a good deal. It is thus something like a fear than optimism which fuels rally in the equity market.

The pattern is similar to what went on for years before the popping of the tech bubble which Shiller famously caught and explained when his book "Irrational Exuberance" was first published at the bubble's peak in 2000.

The idea of a bubble in the stock market and that fears are driving equities higher is not fresh for Shiller.

About a year ago, he said that our worries were pushing the stock market to new records.

In many conversations this year, Shiller reiterated there is a "bubble element" in what's going on in the stock market, and there is hardly optimism about the future.

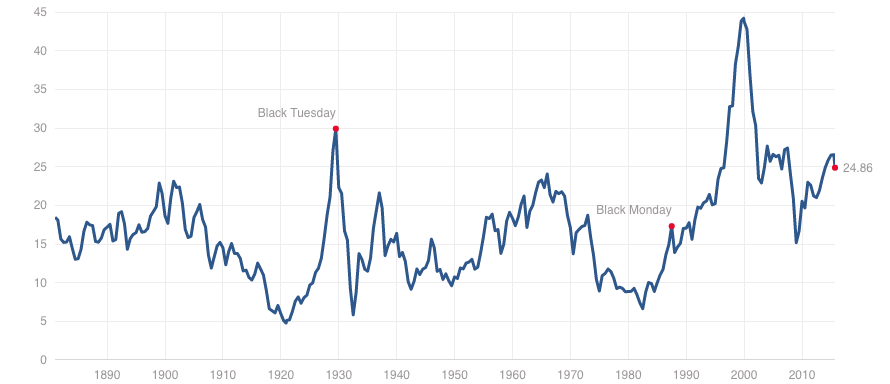

Besides the confidence index, Shiller is also famous for his CAPE, or Cyclically-Adjusted Price-to-Earnings Ratio, which gauges inflation-adjusted earnings over a 10-year rolling period.

The main purpose is to give investors a longer-term insight

on whether current stock prices are cheap, fairly-valued, or expensive

relative to history.

In an interview with the FT, Shiller added that he found this measure "substantially predicts" stock returns over the next decade.

At the moment, the Shiller CAPE ratio makes stocks look pretty expensive, meaning returns will probably be wretched going forward.