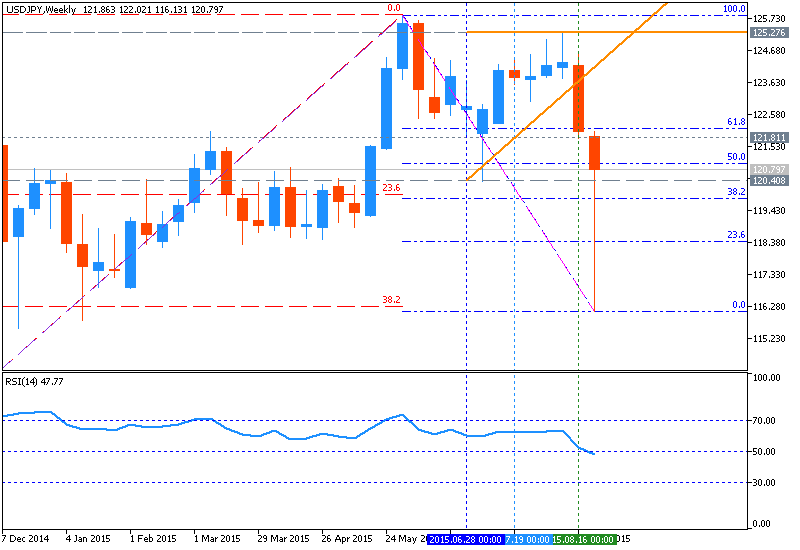

USDJPY Price Action Analysis - 50.0% Fibo level crossing for correction

28 August 2015, 13:32

0

1 498

W1 price is located above 200 period SMA (200-SMA)

and 100 period SMA (100-SMA) for the primary bearish with

secondary ranging between Fibo resistance level at 125.85 and Fibo

support level at 116.13:

- The price is ranging between Fibo resistance level at 125.85 and Fibo support level at 116.13;

- The price is breaking 50.0% Fibo level at 121.02 from above to below for the secondary correction to be started;

- "Immediate attention pricewise looks be on 125.65/80 (and with good reason as there is a lot of stuff there including the 200-day moving average and the July closing low), but if USD/JPY does have a little more upside left then it will be hard to see this zone holding up so we can’t rule out a push to Gann resistance at 121.45 or even 122.55. Assuming USD/JPY does peter out then this is where things will get interesting as it should lead to some sort of retest into a more important cyclical pivot around the end of next week/start of the week of September 7th."

Trend:

- W1 - ranging bullish