U.S. Stocks Steady as Oil Rebounds.

Baxalta shares take off after Shire takeover offer declared

U.S. stock records steadied Tuesday as unrefined costs bounced back, helping stem a decrease in expansive oil-organization stocks.

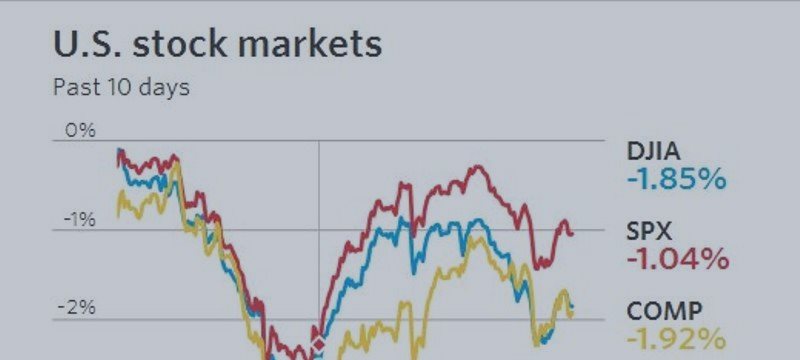

The Dow Jones Industrial Average rose 11 focuses, or 0.06%, to 17610. The S&P 500 climbed 2 focuses, or 0.1%, to 2100 while the Nasdaq Composite included 5.6 focuses, or 0.1%, to 5120.

Oil costs, which have tumbled more than half since the previous summer, recouped Monday. Raw petroleum fates were up 2.2% to $46.17 a barrel. Vitality organizations in the S&P 500 were the greatest gainers in the list, up 0.9%. Chevron Corp. shares climbed 1% to $86.43.

Shares of Baxalta, Inc. taken off 12.5% to $37.28 after Dublin-based Shire PLC said it offered to procure the uncommon sickness treatment producer for generally $30.6 billion.

What's more, in the background, financial specialists keep on parsing monetary information for intimations on when the Federal Reserve could start raising rates without precedent for about 10 years.

"Simply on the grounds that they're setting off up to 25 premise focuses doesn't mean they're heading off to 8%," said Kenny Polcari, executive at O'Neil Securities. "A quarter century focuses is not going to annihilate anybody. I believe it's excessively insignificant."

Monetary information discharged Tuesday included U.S. processing plant requests that rose 1.8% in June. The center movements to work business sector reports later in the week, coming full circle with the administration's job report for July on Friday.

Stoxx Europe 600 fell 0.3% to 398.33,

The Shanghai Composite Index shut 3.7% higher after Chinese powers late Monday moved to clasp down on short offering by executing guidelines under which speculators must hold up no less than one day to cover their positions and pay back advances used to purchase offers.

At the point when shorting a stock, speculators offer obtained partakes in the conviction they can purchase them back at a much lower cost later on, stashing the distinction.

Financial specialists likewise kept a sharp eye on the principle stock file in Athens on Tuesday, which fell 4.5% in right on time exchange and was down 2.5% as of late.

On Monday, the benchmark Athex Composite opened without precedent for a little more than five weeks and shut 16% lower, speaking to its greatest fall in rate terms since at any rate January 1991, as indicated by Thomson Reuters information.

In different markets, the euro was somewhat higher against the dollar at $1.098. Gold prospects added 0.2% to $1091.20 an ounce.

Treasury costs slipped, pushing the 10-year yield up to 2.170% from 2.150% on Monday. https://www.mql5.com/en/signals/120434#!tab=history

Baxalta shares take off after Shire takeover offer declared

U.S. stock records steadied Tuesday as unrefined costs bounced back, helping stem a decrease in expansive oil-organization stocks.

The Dow Jones Industrial Average rose 11 focuses, or 0.06%, to 17610. The S&P 500 climbed 2 focuses, or 0.1%, to 2100 while the Nasdaq Composite included 5.6 focuses, or 0.1%, to 5120.

Oil costs, which have tumbled more than half since the previous summer, recouped Monday. Raw petroleum fates were up 2.2% to $46.17 a barrel. Vitality organizations in the S&P 500 were the greatest gainers in the list, up 0.9%. Chevron Corp. shares climbed 1% to $86.43.

Shares of Baxalta, Inc. taken off 12.5% to $37.28 after Dublin-based Shire PLC said it offered to procure the uncommon sickness treatment producer for generally $30.6 billion.

What's more, in the background, financial specialists keep on parsing monetary information for intimations on when the Federal Reserve could start raising rates without precedent for about 10 years.

"Simply on the grounds that they're setting off up to 25 premise focuses doesn't mean they're heading off to 8%," said Kenny Polcari, executive at O'Neil Securities. "A quarter century focuses is not going to annihilate anybody. I believe it's excessively insignificant."

Monetary information discharged Tuesday included U.S. processing plant requests that rose 1.8% in June. The center movements to work business sector reports later in the week, coming full circle with the administration's job report for July on Friday.

Stoxx Europe 600 fell 0.3% to 398.33,

The Shanghai Composite Index shut 3.7% higher after Chinese powers late Monday moved to clasp down on short offering by executing guidelines under which speculators must hold up no less than one day to cover their positions and pay back advances used to purchase offers.

At the point when shorting a stock, speculators offer obtained partakes in the conviction they can purchase them back at a much lower cost later on, stashing the distinction.

Financial specialists likewise kept a sharp eye on the principle stock file in Athens on Tuesday, which fell 4.5% in right on time exchange and was down 2.5% as of late.

On Monday, the benchmark Athex Composite opened without precedent for a little more than five weeks and shut 16% lower, speaking to its greatest fall in rate terms since at any rate January 1991, as indicated by Thomson Reuters information.

In different markets, the euro was somewhat higher against the dollar at $1.098. Gold prospects added 0.2% to $1091.20 an ounce.

Treasury costs slipped, pushing the 10-year yield up to 2.170% from 2.150% on Monday. https://www.mql5.com/en/signals/120434#!tab=history