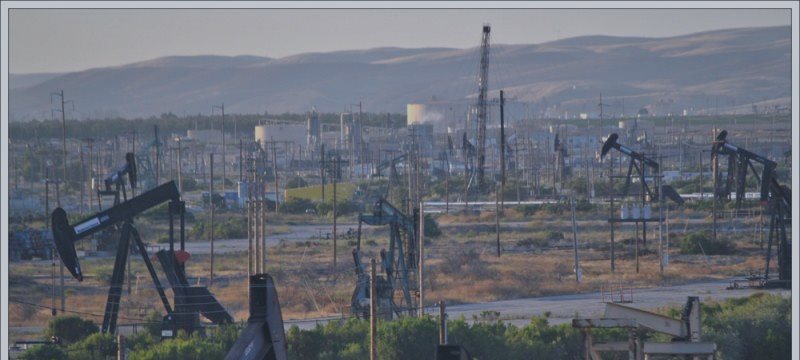

THE oil cost has fallen by more than 40% since June, when it was $115 a barrel. It is presently underneath $70. This comes after about five years of security. At a meeting in Vienna on November 27th the Organization of Petroleum Exporting Countries, which controls about 40% of the world business sector, neglected to achieve concession to creation checks, sending the value tumbling. Likewise hard hit are oil-sending out nations, for example, Russia (where the rouble has hit record lows), Nigeria, Iran and Venezuela. Why is the cost of oil falling?

The oil cost is incompletely controlled by genuine supply and request, and halfway by desire. Interest for vitality is firmly identified with monetary action. It likewise spikes in the winter in the northern half of the globe, and amid summers in nations which utilize cooling. Supply can be influenced by climate (which avoids tankers stacking) and by geopolitical surprises. On the off chance that makers think the cost is staying high, they contribute, which after a slack helps supply. Correspondingly, low costs lead to a speculation dry season. OPEC's choices shape desires: in the event that it controls supply strongly, it can send costs spiking. Saudi Arabia delivers about 10m barrels a day—33% of the OPEC complete.

Four things are currently influencing the photo. Interest is low in view of feeble financial movement, expanded productivity, and a developing change far from oil to different energizes. Second, turmoil in Iraq and Libya—two major oil makers with almost 4m barrels a day consolidated—has not influenced their yield. The business sector is more cheery about geopolitical danger. Thirdly, America has turned into the world's biggest oil maker. Despite the fact that it doesn't send out unrefined petroleum, it now imports a great deal less, making a considerable measure of extra supply. At long last, the Saudis and their Gulf partners have chosen not to give up their own piece of the overall industry to restore the cost. They could control creation strongly, however the principle advantages would go to nations they despise, for example, Iran and Russia. Saudi Arabia can endure lower oil costs effortlessly. It has $900 billion available for later. Its own oil costs almost no (around $5-6 for each barrel) to escape starting from the earliest stage.

The fundamental impact of this is on the least secure and most powerless bits of the oil business. These incorporate American frackers who have obtained vigorously on the desire of proceeding with high costs. They additionally incorporate Western oil organizations with high-cost undertakings including penetrating in profound water or in the Arctic, or managing developing and progressively lavish fields, for example, the North Sea. In any case, the best agony is in nations where the administrations are reliant on a high oil cost to pay for unreasonable outside enterprises and lavish social projects. These incorporate Russia (which is as of now hit by Western assents taking after its intruding in Ukraine) and Iran (which is paying to keep the Assad administration above water in Syria). Confident people think monetary torment may make these nations more agreeable to global weight. Worry warts expect that when cornered, they may lash out in disperation. https://www.mql5.com/en/signals/120434#!tab=history

The oil cost is incompletely controlled by genuine supply and request, and halfway by desire. Interest for vitality is firmly identified with monetary action. It likewise spikes in the winter in the northern half of the globe, and amid summers in nations which utilize cooling. Supply can be influenced by climate (which avoids tankers stacking) and by geopolitical surprises. On the off chance that makers think the cost is staying high, they contribute, which after a slack helps supply. Correspondingly, low costs lead to a speculation dry season. OPEC's choices shape desires: in the event that it controls supply strongly, it can send costs spiking. Saudi Arabia delivers about 10m barrels a day—33% of the OPEC complete.

Four things are currently influencing the photo. Interest is low in view of feeble financial movement, expanded productivity, and a developing change far from oil to different energizes. Second, turmoil in Iraq and Libya—two major oil makers with almost 4m barrels a day consolidated—has not influenced their yield. The business sector is more cheery about geopolitical danger. Thirdly, America has turned into the world's biggest oil maker. Despite the fact that it doesn't send out unrefined petroleum, it now imports a great deal less, making a considerable measure of extra supply. At long last, the Saudis and their Gulf partners have chosen not to give up their own piece of the overall industry to restore the cost. They could control creation strongly, however the principle advantages would go to nations they despise, for example, Iran and Russia. Saudi Arabia can endure lower oil costs effortlessly. It has $900 billion available for later. Its own oil costs almost no (around $5-6 for each barrel) to escape starting from the earliest stage.

The fundamental impact of this is on the least secure and most powerless bits of the oil business. These incorporate American frackers who have obtained vigorously on the desire of proceeding with high costs. They additionally incorporate Western oil organizations with high-cost undertakings including penetrating in profound water or in the Arctic, or managing developing and progressively lavish fields, for example, the North Sea. In any case, the best agony is in nations where the administrations are reliant on a high oil cost to pay for unreasonable outside enterprises and lavish social projects. These incorporate Russia (which is as of now hit by Western assents taking after its intruding in Ukraine) and Iran (which is paying to keep the Assad administration above water in Syria). Confident people think monetary torment may make these nations more agreeable to global weight. Worry warts expect that when cornered, they may lash out in disperation. https://www.mql5.com/en/signals/120434#!tab=history