The Missing Diamond Shortage

Long promised diamond supply gap stubbornly refuses to materialize

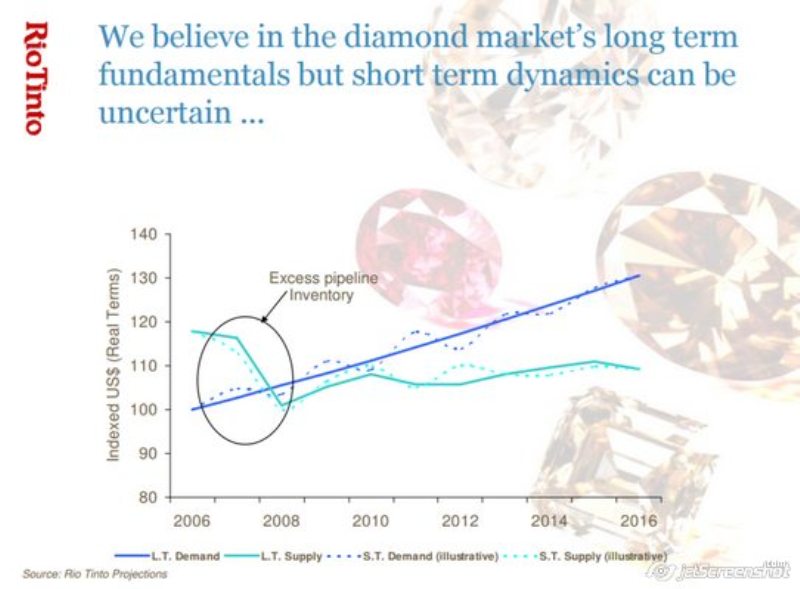

If you’ve ever been to a diamond investment pitch you’ve probably seen ‘The Chart,’ the one where diamond demand soars, while supply trails forlornly in its wake.

For at least the last decade the looming supply gap has been a presentation staple, illuminating the the dearth of new mines and ever expanding appetites for luxury from Shanghai to Mumbai. The only problem is that the x axis keeps shifting, it’s always jam tomorrow.

Underpinning the projection is the dearth of new projects -- decades having passed since the last major find, and most of the diamonds near the Earth’s surface have already been dug up. Output for diamonds peaked in 2006 with 176 million carats mined, and then fell to about 146 million carats in 2013.

The diamond industry is heavily dependent on seven giant mines, all aging rapidly. For example, De Beers’s Jwaneng and Orapa mines in Botswana are the world’s two biggest, holding about about 20 percent of the world’s diamond resources. They were opened in 1982 and 1971 respectively and nothing of their scale has been found since.

At the same time, the industry points to rapidly expanding demand from an emerging middle class in China and India. De Beers forecast last year that the global diamond industry would grow from $25 billion in 2013 to $31 billion in 2018, fueled by those growth markets.

That hope is often dashed however. De Beers sold its stockpile in the early 2000s. Last year, an industry credit crunch broadsided cutting and polishing centers from Antwerp to Surat in India. The clampdown on graft in China isn’t helping either.

The argument presented by the diamond industry is that price fills the supply gap. But while rough diamond prices have gained about 63 percent in the past 10 years, most of the growth came in a three year period from 2008 before a sharp correction in 2011.

“It’s just an indicator. The fundamentals for our industry are still right,” said Stuart Brown, chief executive officer of Firestone Diamonds Ltd. and a former finance chief at De Beers. “Imagine if it was the other way round and I was trying to sell you an investment showing demand dropping and supply going through the roof. If I wanted you to give me some money you wouldn’t be very keen.”

seemore https://www.mql5.com/en/signals/111330