Fundamental Weekly Forecasts for US Dollar, GBPUSD, AUDUSD, USDJPY and GOLD

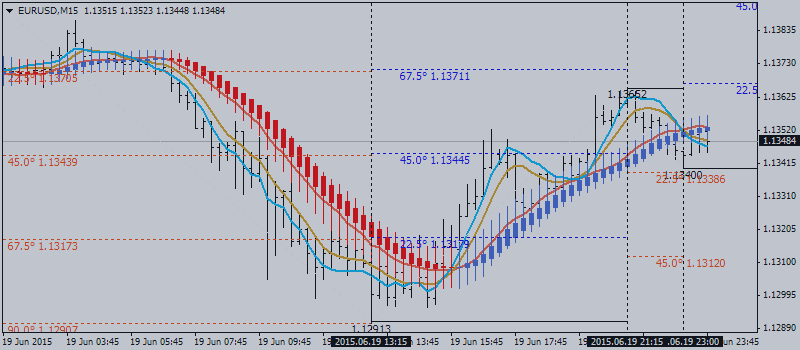

US Dollar - "Rate forecasts will be the natural theme that we return to so long as something more dramatic doesn’t present itself going forward. And really, only one theme has proven itself capable of overriding: risk trends. Risk appetite remains buoyant, but conviction is all but absent. A resolution to Greece and/or stimulus from China to halt the Shanghai’s plunge are possible. However, the true risk is deleveraging finally starting. In that open shift towards safety, the Dollar would surge."

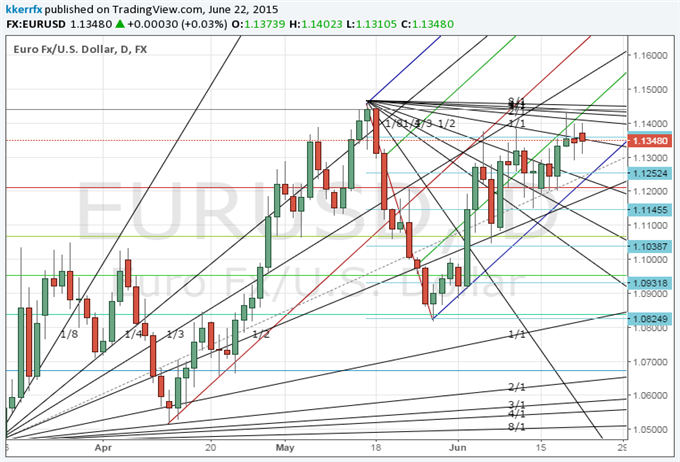

GBPUSD - "With GBP/USD retracing 50% of the decline from back in July 2014, the risk for a more delayed Fed liftoff may spur a further advance in the exchange rate, and the inflation prints coming out of the U.S. economy may continue to dampen the appeal of the greenback should the figures fall short of market expectations."

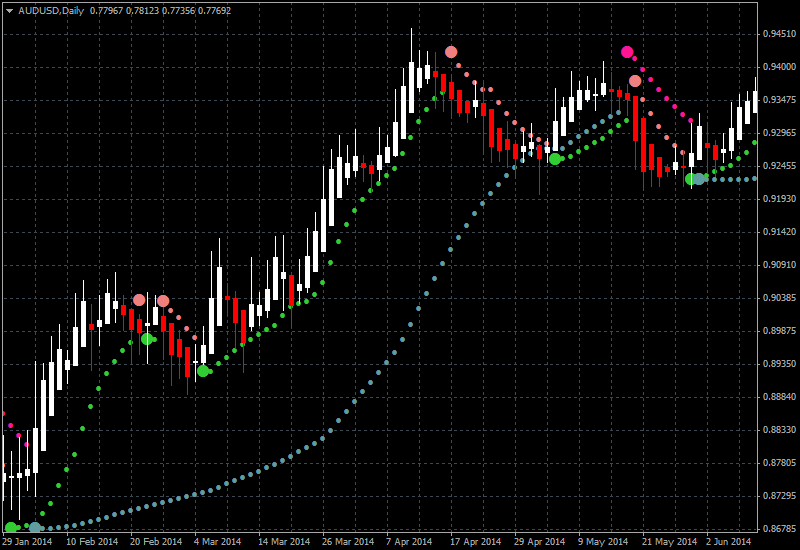

AUDUSD - "Turning to Greece, the markets appear fairly sanguine for now despite continued deadlock between Athens and its creditors. A bit under two weeks remains until the expiry of the current bailout program and the scheduled repayment of €1.6 billion to the IMF. That seems to represent a red line for investors. In the interim, traders seem determined to hold out for an 11th hour compromise."

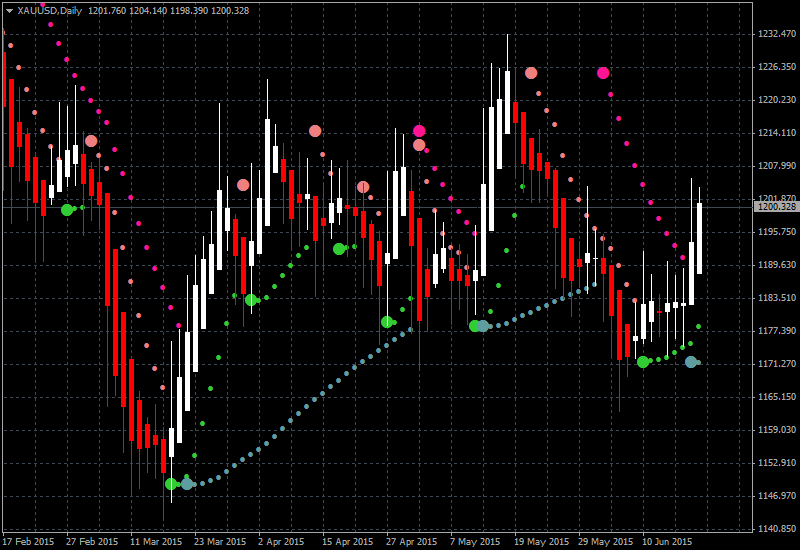

GOLD - "From a technical standpoint gold broke out of a descending pitchfork formation off the May high with the rally extending as high as 1192 before pulling back into the close of the week. Bullion remains at risk while below 1197 with a breach above 1204 needed to put the long-side back into focus. Key near-term support rests at 1163/64 where the 61.8% extension of the decline off the May highs converges on the 76.4% retracement off the advance off the March low. A break below this level targets the November 2014 TL support / 1150/51. Note that daily momentum has continued to hold above the 40-threshold on this pullback off the May highs, supporting the argument that gold may be attempting to base here. We’ll look for a break of the monthly opening range alongside the 40-50 RSI range for guidance heading into next week."

USDJPY - "In times of market turmoil we have most often seen the Japanese Yen outperform its major counterparts, and we believe that similar episodes in the future would push the JPY higher across the board (USDJPY lower). Barring such an outcome, however, we see little reason to believe that the US Dollar will break substantially in either direction versus the recently slow-moving Japanese Yen."