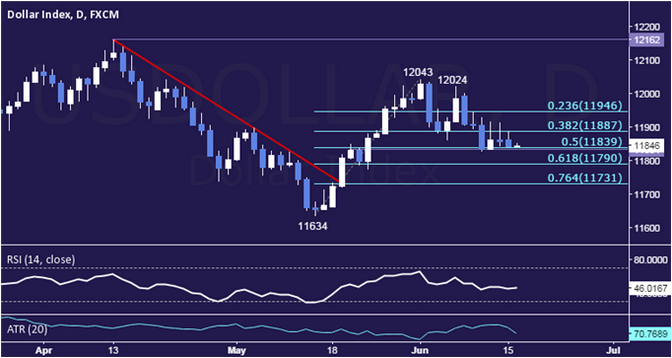

US DOLLAR TECHNICAL ANALYSIS

Prices stopped to process misfortunes subsequent to sliding to the weakest level in three weeks. Close term backing is at 11834-9 territory (May 20 nearby, 50% Fibonacci retracement), with a break beneath that on an every day shutting premise uncovering the 61.8% level at 11790. On the other hand, a move over the 38.2% Fib at 11887 opens the entryway for a test of the 23.6% retracement at 1194

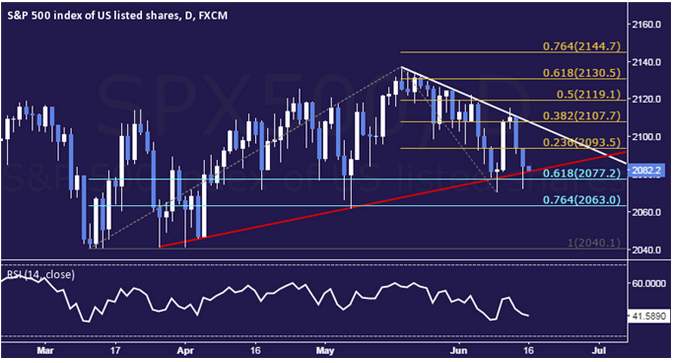

S & P 500 TECHNICAL ANALYSIS

Prices pulled back to test rising pattern line bolster set from late-March lows by and by, an obstruction fortified by the 61.8% Fibonacci retracement at 2077.20. A break underneath that objectives the 76.4% level at 2063.00. On the other hand, a turn over the 23.6% Fib development at 2093.50 objectives the 38.2% limit at 2107.7

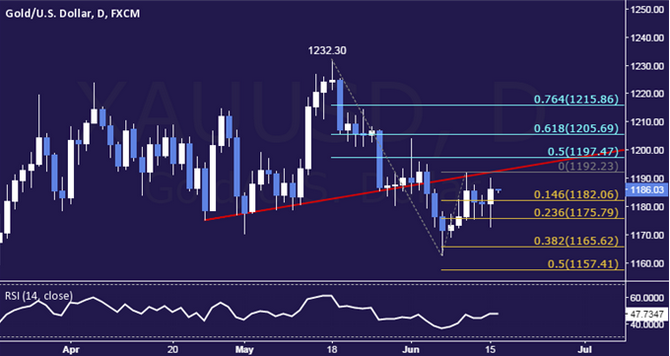

GOLD TECHNICAL ANALYSIS

Prices keep on treading water underneath the $1200/oz figure. A break over the June 10 high at 1192.23 uncovered the 50% Fibonacci retracement at 1197.47. On the other hand, a move underneath the 14.6% Fib development at 1182.06 objectives the 23.6% edge at 1175.7

CRUDE OIL TECHNICAL ANALYSIS

Costs may be continuing the recuperation propelled from mid-January lows subsequent to finishing a Flag continuation design. Close term resistance is at 66.69, the 23.6% Fibonacci development, with a break over that uncovering the 38.2% level at 70.25. On the other hand, a move underneath the 63.08-39 region (Flag top resistance-turned-support at, rising pattern line) focuses on the 38.2% Fib retracement at 60.27.

Low DD Agresive Trade every day

https://www.mql5.com/en/signals/112290

https://www.mql5.com/en/signals/111926

https://www.mql5.com/en/signals/111928

https://www.mql5.com/en/signals/111987

https://www.mql5.com/en/signals/111863

https://www.mql5.com/en/signals/111924