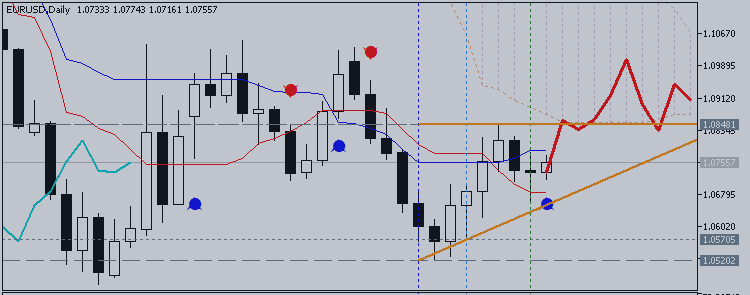

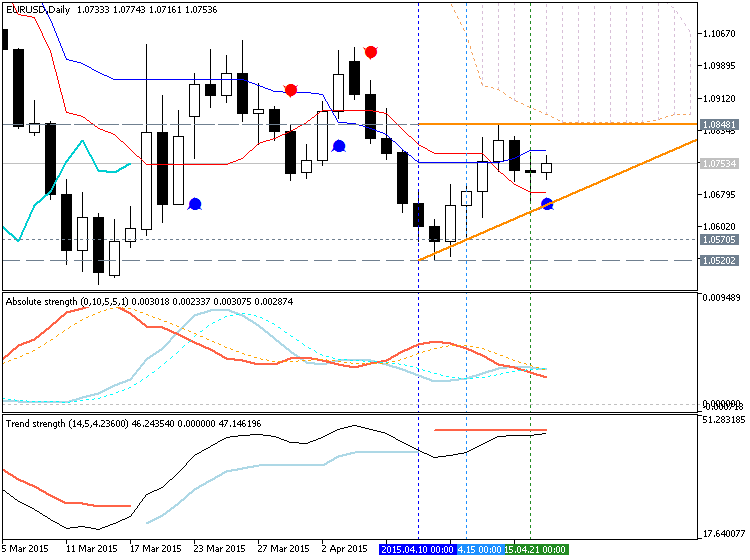

EURUSD Daily Technical Analysis - possible daily reversal to bullish with 1.0878 resistance level

- Tenkan-sen line is located below Kijun-sen line of Ichimoku indicator with 1.0878 resistance level on D1 timeframe for bearish market condition to be continuing

- Price channel indicator is showing good signal for uptrend on open D1 bar.

- AbsoluteStrength indicator and TrendStrength indicators are in contradiction with each other indicating possible sideway market condition for D1 price to be ranging between 1.0520 support and 1.0878 resistance levels.

- "The Euro is digesting gains against the US Dollar after rising as expected after showing a bullish Morning Star candlestick pattern. Near-term resistance is at 1.1040, the March 18 high, with a break above that on a daily closing basis exposing the 38.2% Fibonacci retracement at 1.1266. Alternatively, a move back below the March 31 low at 1.0712 clears the way for a test of the 1.0461-1.0554 area (March 13 low, 23.6% Fibonacci expansion)".

- "We see the Euro trend as broadly bearish, in line with our long-term outlook. As such, we will approach on-coming gains as corrective in the context of a larger structural decline and position for opportunities to enter short after the move higher is exhausted".

- Chinkou Span line of Ichimoku indicator is located below and very close to the price for possible breakout of the price movement on daily timeframe.

Trend:

- H4 - ranging

- D1 - ranging

- W1 - ranging bearish

- MN1 - bearish breakdown