Something to Read - Theory Of Stochastic Processes : With Applications to Financial Mathematics and Risk Theory

This book is a collection of exercises covering all the main topics in

the modern theory of stochastic processes and its applications,

including finance, actuarial mathematics, queuing theory, and risk

theory.

The aim of this book is to provide the reader with the theoretical and

practical material necessary for deeper understanding of the main topics

in the theory of stochastic processes and its related fields.

The book is divided into chapters according to the various topics. Each

chapter contains problems, hints, solutions, as well as a self-contained

theoretical part which gives all the necessary material for solving the

problems. References to the literature are also given.

The exercises have various levels of complexity and vary from simple

ones, useful for students studying basic notions and technique, to very

advanced ones that reveal some important theoretical facts and

constructions.

This book is one of the largest collections of problems in the theory of

stochastic processes and its applications. The problems in this book

can be useful for undergraduate and graduate students, as well as for

specialists in the theory of stochastic processes.

---------

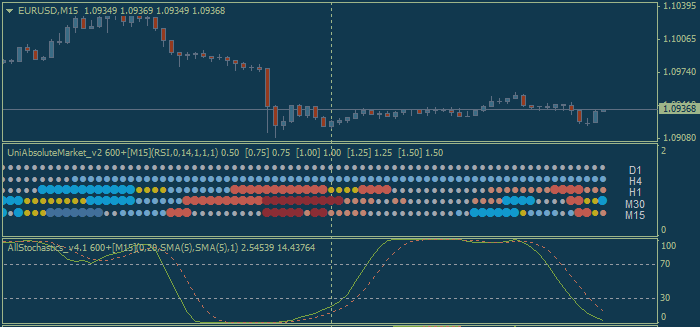

Stochastic is a simple momentum oscillator developed by George C. Lane

in the late 1950’s. Being a momentum oscillator, Stochastic can help

determine when a currency pair is overbought or oversold. Since the

oscillator is over 50 years old, it has stood the test of time, which is

a large reason why many traders use it to this day.

Though there are multiple variations of Stochastic, today we’ll focus solely on Slow Stochastic.

Slow stochastic is found at the bottom of your chart and is made up of

two moving averages. These moving averages are bound between 0 and 100.

The blue line is the %K line and the red line is the %D line. Since %D

is a moving average of %K, the red line will also lag or trail the blue

line.

Traders are constantly looking for ways to catch new trends that are developing. Therefore, momentum oscillators can provide clues when the market’s momentum is slowing down, which often precedes a shift in trend. As a result, a trader using stochastic can see these shifts in trend on their chart.