The responsibility for restoring the oil price back to a balance lies on the shoulders of countries like the US, not on the Organization of the Petroleum Exporting Countries (OPEC), a top Goldman Sachs analyst told CNBC in an interview.

Michele Della Vigna, head of European energy research at Goldman

Sachs, said non-OPEC oil producers were the ones to have created the oversupply in the

market which has weighed on prices.

"I think the market has realized that where we need

to find the adjustment is onshore U.S. and that's where the market is

focused."

"The adjustment is starting to happen there. Clearly an OPEC cut would help getting to the equilibrium faster, but at the end of the day, it is non-OPEC that needs to sort out the oversupply that it has created."

To date, weak global demand and booming U.S. shale oil production have been seen as two key reasons behind oil's price plunge, which has fallen

around 50 percent since mid-June last year.

OPEC's unwillingness to trim its output at its last meeting in November has also put the commodity under the pressure.

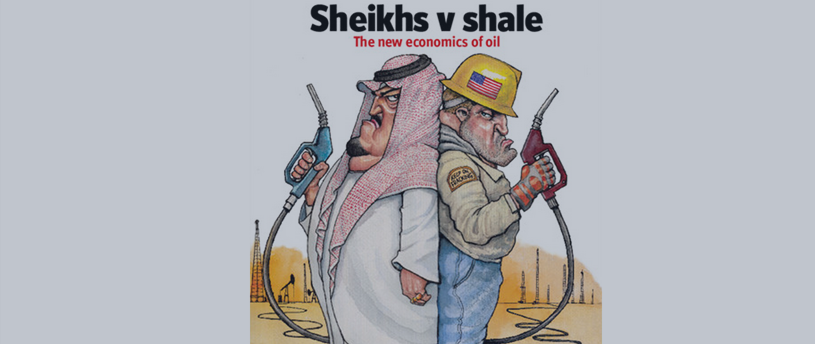

The 12 countries belonging to OPEC are able to extract oil from the ground at a cheaper cost than U.S. shale firms, and there has been speculation that the two industries could be playing a "game of chicken" before cutting back to ease oversupply.

So far, the U.S. has bared the brunt of the cut in

production, with the recent data from the EIA (Energy Information Administration) showing a drop in the amount of rigs that are in operation and

a drop in U.S. output for the first time since lthe end of 2014.

This boosted oil for a while, with gains of around $2. But the commodity edged lower again on

Thursday morning, with West Texas Intermediate (WTI) futures falling 0.13 percent to 49.95 a barrel by 9:00 a.m. London time, and Brent crude futures falling 0.2 percent to $56.91 a barrel.

Negotiations over Iran's nuclear deal have also dented the price of oil over recent days, as talks overran a self-imposed deadline.

Mr Della Vigna repeated his call for

Brent to find an "equilibrium" of $70 by year-end, also saying that

the near-term risk is for it to fall to $40 a barrel during

the summer months.

A "super spike" to above $100 a

barrel was becoming increasingly unlikely and $25 a barrel for

oil was also not a likely scenario, he added.

Another analyst, Amrita Sen, from Energy Aspects, told CNBC a day earlier that oil prices were unlikely to fall much lower than their current levels. She argued that demand for the commodity was "phenomenal" and was absorbing a lot of the oil that was being produced.