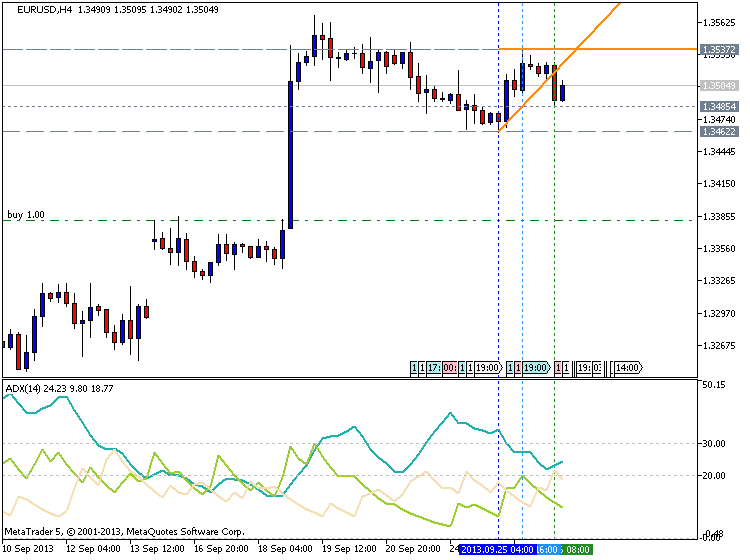

ADX indicator is used to determine the strength of the trend:

- +DI- Positive Directional indicator

- –DI - Negative Directional Indicator

You do need to know that:

- The +DI Line is representative of how strong or weak the uptrend in the market is.

- The –DI line is representative of how strong or weak the downtrend in the market is.

- As the ADX line is comprised of both the +DI Line and the –DI Line, it does not indicate whether the trend is up or down, but simply the strength of the overall trend in the market.

As the ADX Line is Non Directional, it does not tell you whether the market is in an uptrend or a downtrend (you must look to price or the +DI/-DI Lines for this) but simply how strong or weak the trend in the financial instrument you are analyzing is. When the ADX line is above 40 and rising this is indicative of a strong trend, and when the ADX line is below 20 and falling this is indicative of a ranging market.