Trading News Events: GBP Jobless Claims Change - Wages to Expand an Annualized 2.2%

18 March 2015, 08:02

2

410

Another 30.0K decline in U.K. Jobless Claims paired with a hawkish Bank

of England (BoE) Minutes may spark a near-term rebound in GBP/USD should

the fundamental developments boost interest rate expectations.

Why Is This Event Important:

At the same time, Average Weekly Earnings are projected to increase an annualized 2.2% after climbing 2.1% in January, and a marked expansion in household earnings may encourage BoE Governor Mark Carney to normalize monetary policy sooner rather than later as the central bank anticipates a more sustainable recovery in the U.K economy.

However, the slowdown in building activity along with the pullback in business outputs may drag on hiring, and a dismal labor report may push Governor Carney to further delay the normalization cycle in an effort to encourage a stronger recovery.

How To Trade This Event Risk

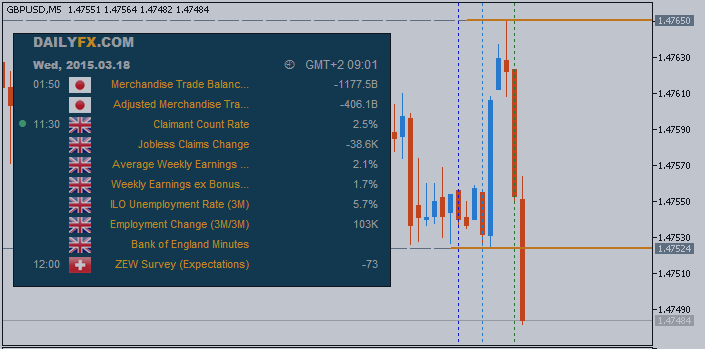

Bullish GBP Trade: Claims Slip 30.0K or More Accompanied by Stronger Wages

- Need green, five-minute candle following the print to consider a long GBP/USD trade

- If market reaction favors buying sterling, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

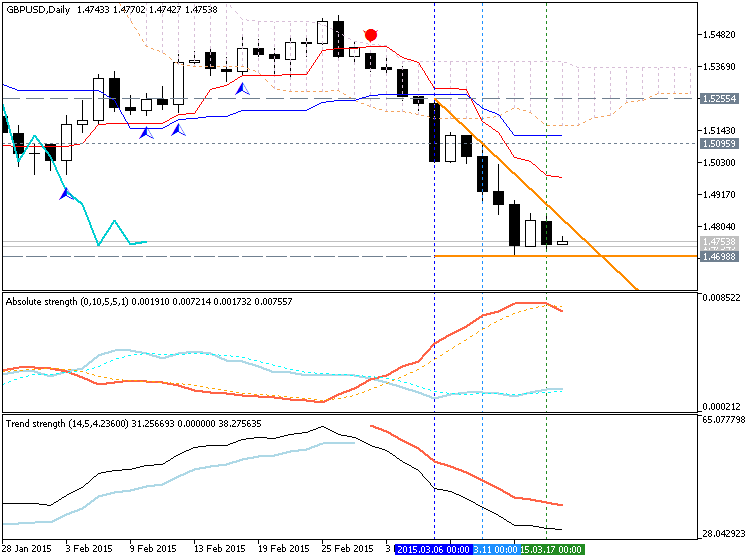

GBPUSD Daily Chart

- The near-term rebound in the RSI may pave the way for a larger rebound in GBP/USD as the oscillator comes off of oversold territory.

- Interim Resistance: 1.5000 pivot to 1.5020 (50% expansion)

- Interim Support: 1.4700 pivot to 1.4710 (78.6% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JAN 2015 |

02/18/2015 9:30 GMT | -25.0K | -38.6K | +62 | +73 |

U.K. Jobless Claims decline another 38.6K in January following the revised 35.8K contraction the month prior. The unemployment rate subsequently fell to 5.7% in three-months through November, reaching the lowest level since September 2008. In addition, private wages grew more-than-expected over the last quarter at an annualized rate of 2.1% amid forecasts for a 1.7% print. The ongoing improvement in the U.K. labor market may encourage the Bank of England (BoE) to retain a hawkish tone for monetary policy as the central bank anticipates stronger wage growth in 2015. The sterling gained ground following slew of positive prints, with GBP/USD breaking above the 1.5400 handle to end the day at 1.5444.