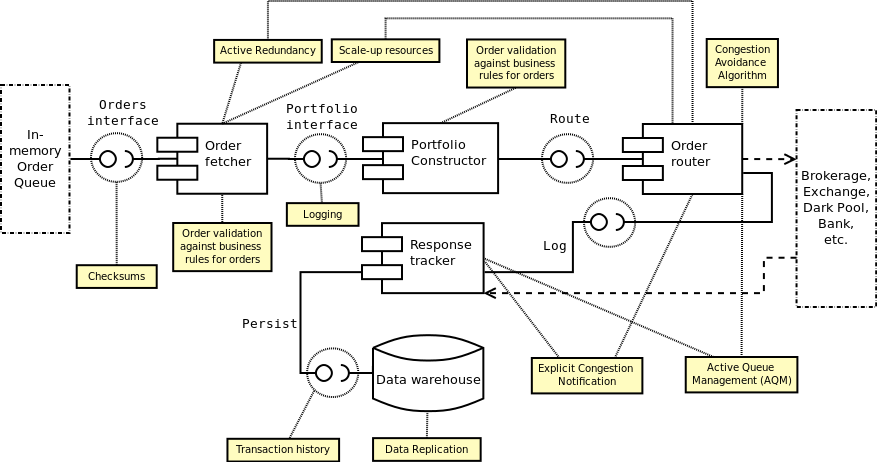

WEEKLY DIGEST 2015, February 15 - 22 for Neural Networks in Trading: Order processing layer component diagram

24 February 2015, 15:11

0

850

WEEKLY DIGEST 2015, February 01 - 08 for Neural

Networks in Trading: Do NN need “compound” features, and How do I

normalize data for stock prediction?

mql5 blogs

"Some have tried not using price data at all, and instead using indicators based on that data. For example, you could have an input that switches between 0, 0.5, and 1.0 depending on whether the market's close is below, within, or above its Bollinger band. Oscillators with a fixed range are also popular for ANN inputs precisely because they are so easy to normalize.

Also, remember that you have to do something with the ANN output, which is just as difficult as figuring out what the ANN inputs should be. What sort of training algorithm are you going to use? If you have the output correspond to predicted price movements, then you still need to develop a trading strategy based on that. If you have the ANN's output actually be a trading signal, you also need to figure out how you're going to train it.".

the article promoting the NN software

the blog of a quant at Old Mutual

"Clustering is the process of partitioning a set of heterogeneous (different) objects into subsets of homogeneous (similar) objects. At the heart of cluster analysis is the assumption that given any two objects you can quantify the similarity or dissimilarity between those objects. In continuous search spaces we usually think of similarity in terms of distance."

mql5 blogs

"Some have tried not using price data at all, and instead using indicators based on that data. For example, you could have an input that switches between 0, 0.5, and 1.0 depending on whether the market's close is below, within, or above its Bollinger band. Oscillators with a fixed range are also popular for ANN inputs precisely because they are so easy to normalize.

Also, remember that you have to do something with the ANN output, which is just as difficult as figuring out what the ANN inputs should be. What sort of training algorithm are you going to use? If you have the output correspond to predicted price movements, then you still need to develop a trading strategy based on that. If you have the ANN's output actually be a trading signal, you also need to figure out how you're going to train it.".

============

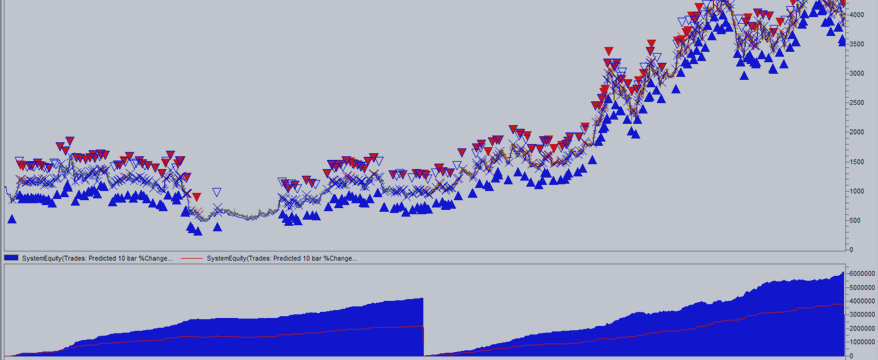

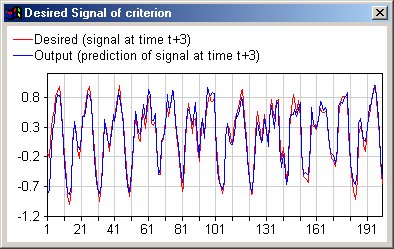

Neuro Solutions Software Neural Network Software Datathe article promoting the NN software

============

Order processing layer component diagram - Stuart Gordon Reidthe blog of a quant at Old Mutual

"Clustering is the process of partitioning a set of heterogeneous (different) objects into subsets of homogeneous (similar) objects. At the heart of cluster analysis is the assumption that given any two objects you can quantify the similarity or dissimilarity between those objects. In continuous search spaces we usually think of similarity in terms of distance."