Asset Back Securities - High-frequency trading activity in EU equity markets.

"The person who minds nobody's business but his own is probably a millionaire." - Anonymous

This article provides initial empirical evidence on HFT activity on EU equity markets. HFT firms account for one - quarter of traded volumes (60% for investment banks) and around 60% of all order messages. HFT activity is significantly higher on MTFs than on RMs. Moreover, HFT firms are members of more trading platforms than other types of participant, which may indicate that they are more likely to perform cross-venue arbitrage. HFT activity is positively correlated with fragmentation, volumes, tick sizes and prices and negatively with volatility. These results remain valid when using an instrumental variable approach, with the exception of fragmentation, implying that those variables are likely to be drivers of HFT activity, although further analysis is needed to ensure the robustness of these conclusions. Looking ahead, further analysis is needed to — improve the identification of HFT using the indirect approach, — assess the actual contribution of HFT to liquidity, and — analyse potential risks and benefits linked to HFT activity. In particular, ESMA is investigating the topic of ‘ghost liquidity’, whereby liquidity in the order book vanishes before transactions can be executed on the opposite side, and its relationship with HFT activity.

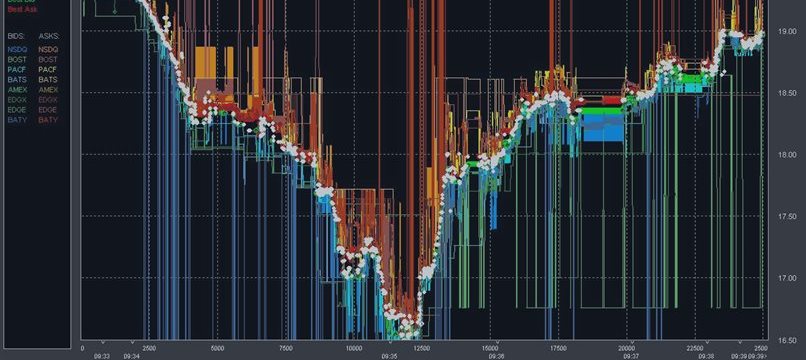

It would be great if we would have Tick Charts to trade on. Anyone care to share some information about it?

- Thank you.

(http://www.math.nyu.edu/faculty/avellane/QuantCongressUSA2011AlgoTradingLAST.pdf)