Technical Analysis for US Dollar, Crude Oil, S&P 500 and Gold - Crude Oil Range Holds, Gold Snaps Monthly Uptrend

US DOLLAR TECHNICAL ANALYSIS

Prices may be preparing to decline

after prices put in a bearish Evening Star candlestick pattern.

Negative RSI divergence bolsters the case for a downside scenario.

Near-term support is at 11734, the intersection of the 14.6% Fibonacci

retracement and a rising trend line, with a break below that on a daily

closing basis exposing the 23.6% level at 11648.

S&P 500 TECHNICAL ANALYSIS

Prices declined as expected

after putting in a bearish Evening Star candlestick pattern. A daily

close below the 1998.00-30 area marked by a rising trend line and the

38.2% Fibonacci retracement exposes the 50% level at 1955.80.

GOLD TECHNICAL ANALYSIS

Prices turned sharply lower,

overturning the monthly uptrend. A daily close below the 38.2% Fibonacci

retracement at 1253.77 exposes the 50% level at 1237.18. Alternatively,

a push above the 23.6% Fib at 1274.30 targets trend line

support-turned-resistance at 1299.63.

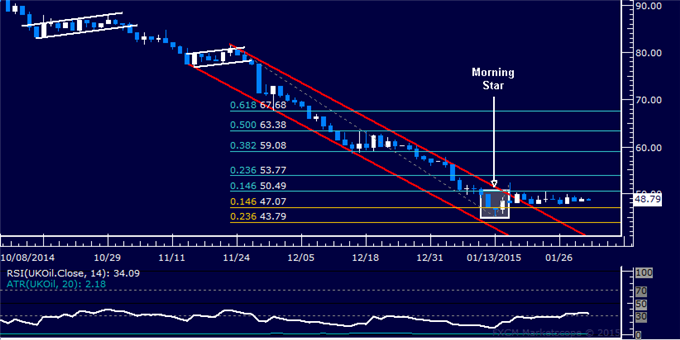

CRUDE OIL TECHNICAL ANALYSIS

Prices are stalling having

attempted to recover as expected. A daily close above the 14.6%

Fibonacci retracement at 50.49 exposes the 23.6% level at 53.77.

Alternatively, a reversal below the 14.6% Fib expansion at 47.07 targets

the 23.6% threshold at 43.79.