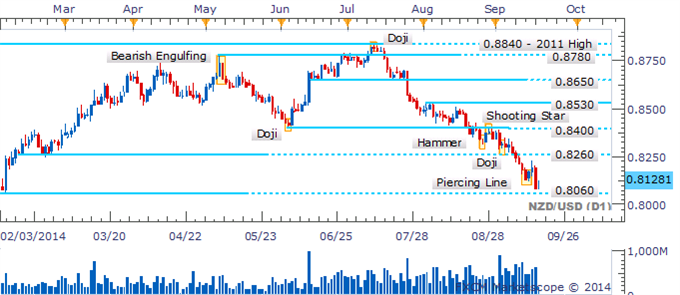

Technical Analysis for NZDUSD - Pending Short, Daily Close Below 0.8060 To Open Aug ’13 Lows

19 September 2014, 06:11

0

187

NZDUSD has resumed its journey lower in recent trade, which in turn has

negated a Piercing Line pattern on the daily. As noted in recent

reports the potential for a sustained recovery was questionable against

the backdrop of a core downtrend. A daily close below the 0.8060 hurdle

could open some significant room before buying interest is renewed at

the August 2013 low near 0.7750. Whereas, a climb above the 0.8260

hurdle would likely be required to mark a small base for the pair.

A Harami pattern alongside a push beyond intraday resistance (now

support) at 0.8120 hints at further gains over the session. Yet within

the context afforded by the daily, selling into rallies remains

preferred.