Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD and GOLD: Gold prices streak this week with the precious metal rallying 2.51%

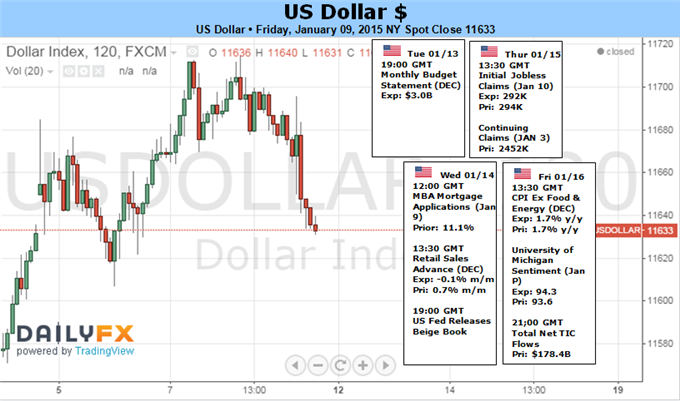

US Dollar Forecast - NFPs and FOMC minutes last week offered measures of balance, but net they draw the first Fed hike closer

Conditions are generally improving to the point where rate hikes will become likely. yet, there is still ambiguity in the timing of that turn to tightening

– whether the “mid-2015” vow means June/July or Fed Funds futures are

correct in pricing in the fourth quarter. In that uncertainty, the

Dollar is bid because its yield is on track to still rise before most

counterparts while speculators seeking return can ignore the rising cost

of their exposure for a little time longer. Yet, as we close in on the

expected range, one side will likely crumple.

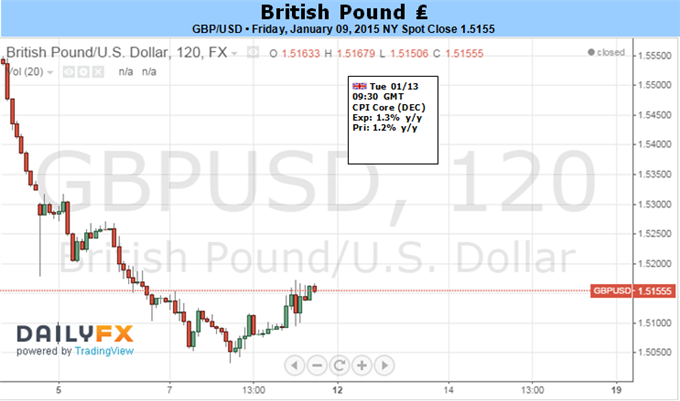

British Pound Forecast - Interest Rate Expectations Drop, Sterling Hobbled

With the BoE scheduled to testify on the Financial

Stability report next week, we may see Mark Carney and Co. retain an

upbeat tone for the region as the committee sees lower energy costs

boosting private-sector consumption. As a result, the BoE may adopt a

more hawkish tone for monetary policy as it anticipates a stronger

recover in 2015.

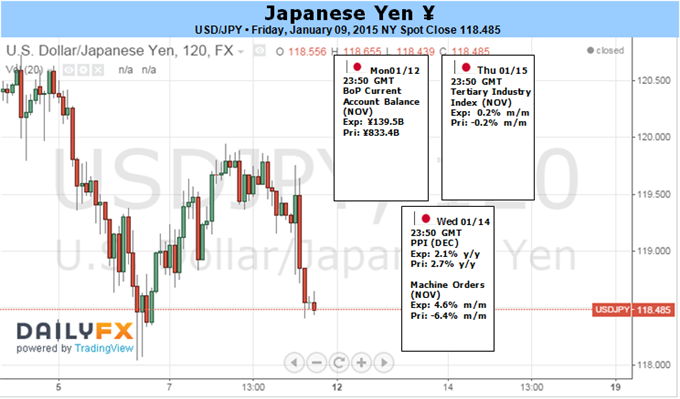

Japanese Yen Forecast - The Japanese Yen snapped a multi-week losing streak for the US Dollar as it rallied noticeably off of recent lows

A strong correlation between the Japanese Yen and the Nikkei 225/US S&P 500

tells us the next big USDJPY move could coincide with equity market

turmoil. An important drop in the S&P Volatility Index (VIX) shows

that few fear any such tumbles, but market conditions can and do change

quite quickly.

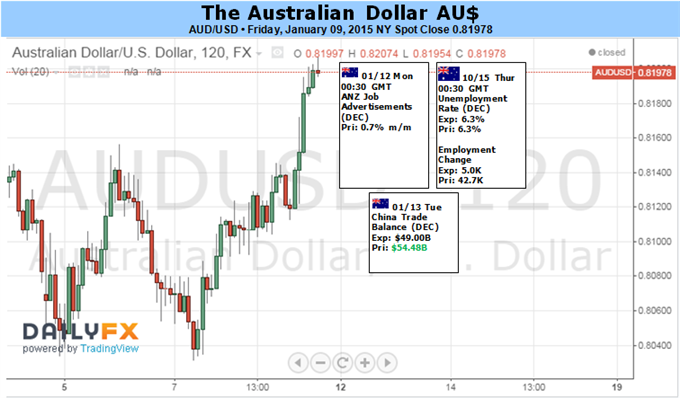

Australian Dollar Forecast - Aussie Dollar to Rise if Jobs Data Cools RBA Rate Hike Speculation

US retail sales, inflation and consumer confidence

figures as well as the Fed’s Beige Book survey of regional economic

conditions are all due to cross the wires in the coming days. The growth

side of the equation looks mixed considering the Fed’s assessment is

likely to take a balanced view and sentiment is seen firming while

retail activity is expected to slow. Though this casts a cloud of

uncertainty over sentiment trends, the FX picture looks clearer as soft

price growth undercuts Fed rate hike bets, sending AUDUSD higher.

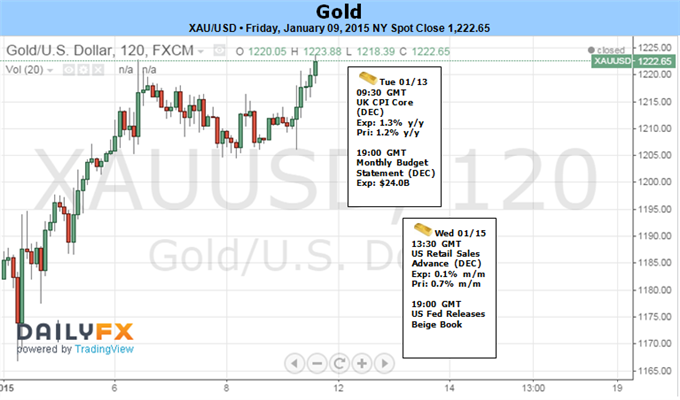

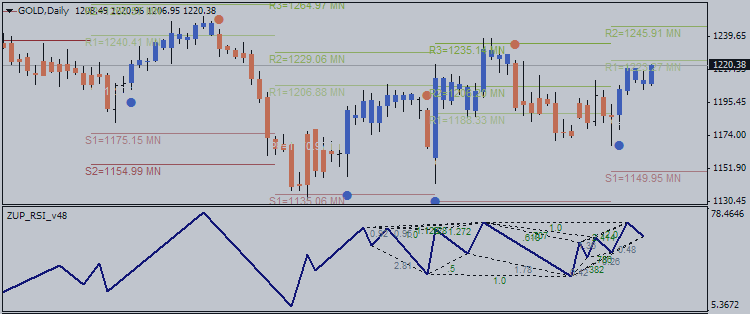

Gold Forecast - Gold Could Find Support at 1187 Now

From a technical standpoint, gold continued to trade

within the confines of a well-defined Andrew’s pitchfork off the March

high with Friday’s advance challenging the upper median-line parallel.

Interim support rests at $1206 (2013 low-day close) and is backed by the

lower median-line parallel of a near-term pitchfork off the November

lows, currently around $1171/80. We’ll reserve this region as our

bullish invalidation level with the medium-term outlook weighted to the

topside while above $1171. A breach above resistance targets objectives

at $1230 and critical resistance at $1236/37.