The MACD indicator is one of the most widely and commonly used indicators available. MACD indicator is a momentum oscillator with some trend following characteristics. MACD is one of the most popular indicators used in technical analysis. It is used to generate signals using crossovers.

MACD indicator plots the divergence and convergence of moving averages. It is constructed using moving average analysis. Moving Average Convergence/Divergence is a trend-following indicator. It indicates the correlation between two moving averages.

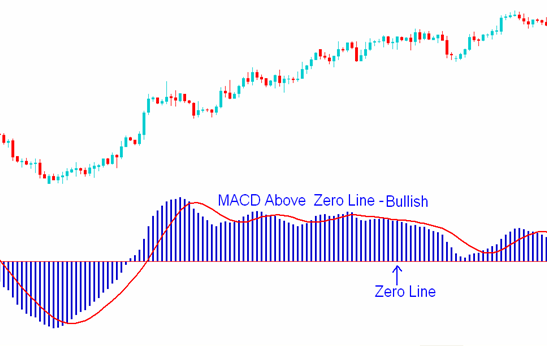

This indicator has a zero center line; values above zero line are bullish while those below zero are bearish. In an uptrend the shorter MACD line rises faster that the longer MACD line this creates a gap.

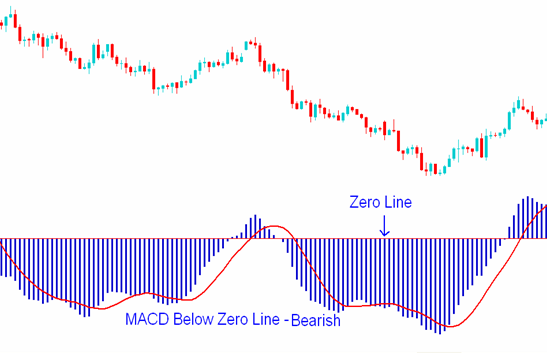

In a downtrend the shorter MACD line falls faster than the longer MACD line this creates a gap.

When the trend is about to reverse the MACD lines start to move closer to each other, thus closing the gap.