Technical Price Pattern Analysis for US Dollar, Gold, Crude Oil and S&P 500 - Crude Oil at Risk of Deeper Losses, Gold Prices Aim Higher

US DOLLAR TECHNICAL ANALYSIS

Prices have flat-lined after

hitting a five-year high, with negative RSI divergence warning a

downturn may be ahead. Near-term resistance is at 11577, the 38.2%

Fibonacci expansion, with a break above that on a daily closing basis

exposing the 50% level at 11648.

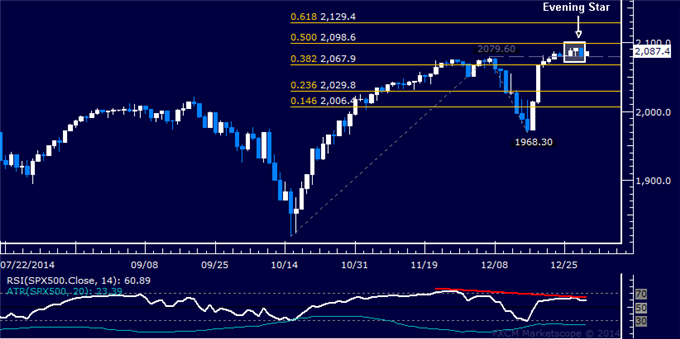

S&P 500 TECHNICAL ANALYSIS

Prices have produced a bearish

Evening Star candlestick pattern, hinting a move lower is ahead.

Negative RSI divergence reinforces the case for a downside scenario. A

daily close below the 2067.90-79.60 area marked by the December 5 high

and the 38.2% Fibonacci expansion exposes the 23.6% level at 2029.80.

Alternatively, a push above the 50% Fibat 2098.60 targets the 61.8%

expansion at 2129.40.

GOLD TECHNICAL ANALYSIS

Prices pushed higher anew after a brief

respite, clearing resistance marked by the 23.6% Fibonacci expansion at

1196.08. Buyers now aim to challenge the 38.2% level at 1211.85, with a

break above that on a daily closing basis exposing the 50% Fib at

1224.59. Alternatively, a reversal back below 1196.08 targets the

December 22 lowat 1170.59.

CRUDE OIL TECHNICAL ANALYSIS

Prices are aiming to extend losses

after breaking support at 58.20, the 23.6% Fibonacci expansion. Sellers

now aim to challenge the 38.2% level at 54.83, with a further push

beneath that targeting the 50% Fib at 52.10. Alternatively, a reversal

back above 58.20 aims for the December 18 high at 63.65.