US Dollar traders will almost certainly track changes in yields and interest rate expectations, and a key question is whether domestic economic data can continue to impress and send rates and the USD to further peaks. Dollar momentum seems stretched, and economic data can only surpass expectations for so long. Yet the US Dollar remains in an uptrend until it isn’t, and we’ll need to see concrete signs of a turn to call for a meaningful turnaround.

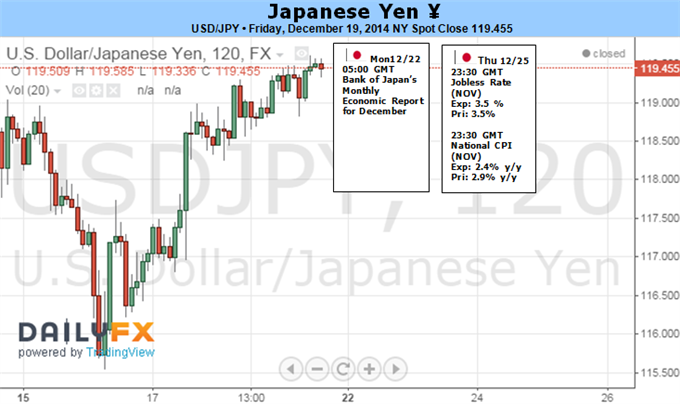

Japanese Yen Forecast – Year-End Flows May Drive Yen Recovery Amid Carry Trade Liquidation

The landscape probably won’t look as rosy in 2015.

While the precise timing of liftoff for the Fed policy rate is a matter

of debate, the commencement of stimulus withdrawal at some point in the

year ahead seems to be a given. The prospect of higher borrowing costs

may fuel liquidation of exposure reliant on cheap QE-based funding as

market participants lock in year-end performance ahead of tougher times

ahead.

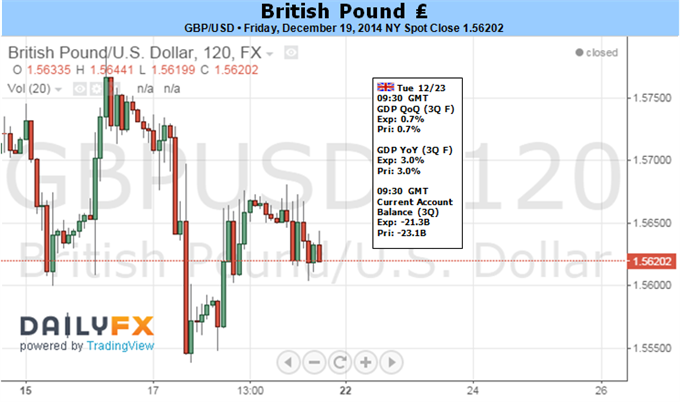

British Pound Forecast – British Pound may have set lasting low versus US Dollar

The clear divergence in growth and yield

expectations between the UK and other major economies leaves the GBP in

the position of strength. And though an obvious US Dollar uptrend makes

us reluctant to buy into GBPUSD weakness, we believe the UK currency

could trade higher through the coming week and perhaps month.