Most investment houses see EUROUSD next year at the level of 1,16-1,18. Can the pair drops even lower?

How to find technical analysts of Citi- can.

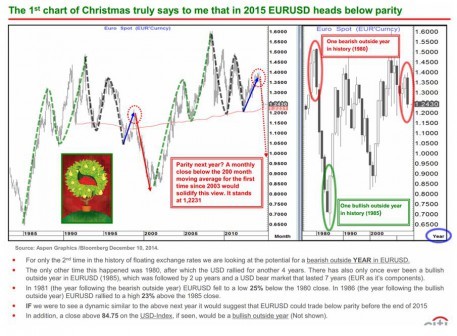

A strong argument in favor of this view, they believe that this year for the second time in history there annual bearish candle absorption EUROUSD.

Candle absorption - a candle, which completely covers the previous candle.

The first such candle appeared in 1980, and USD rally then continued for 4 years.

Also happened in the history of only one bullish candle absorption (in 1985), followed by two years of strong growth, and then the bear market lasted 7 years.

The next 1981 after the bearish candle absorption in 1980 EUROUSD fell by almost 25%, and in 1986 (the year following bullish candle absorption) EUROUSD grew 23%.

Assuming that this trend could be repeated, then EUROUSD throughout the year can be traded below parity.

The question arises: from a fundamental point of view, is that possible?

In my opinion, it is possible under two conditions.

The first condition: inflation in the euro area will continue to decline. It is very likely, since the new wave of deflation from another weakening of the Japanese yen and lower oil prices will reach Europe only in January and February.

The second condition: the Federal Reserve in 2015 at least once will raise the rate.

In my view, too, it is possible. Based on the fact that the data of US economic growth in recent years in the fourth and first quarters worse than in the second and third quarters, most likely that the growth of USD happen around mid-summer. McAuley NICHOLAS LUDANOV