Forex Correlations - Your Trading Edge

To be an effective trader, it is important to understand how different currency pairs move in relation to each other so traders can better understand their exposure. Some currency pairs move in tandem with each other, while others may be polar opposites. Learning about currency correlation helps traders manage their portfolios more appropriately. Regardless of your trading strategy and whether you are looking to diversify your positions or find alternate pairs to leverage your view, it is very important to keep in mind the correlation between various currency pairs and their shifting trends.

Correlations Do Change

It is clear then that

correlations do change, which makes following the shift in correlations

even more important. Sentiment and global economic factors are very

dynamic and can even change on a daily basis or even hourly basis. Strong correlations today

might not be in line with the longer-term correlation between two

currency pairs.

Forex Correlations - Trading

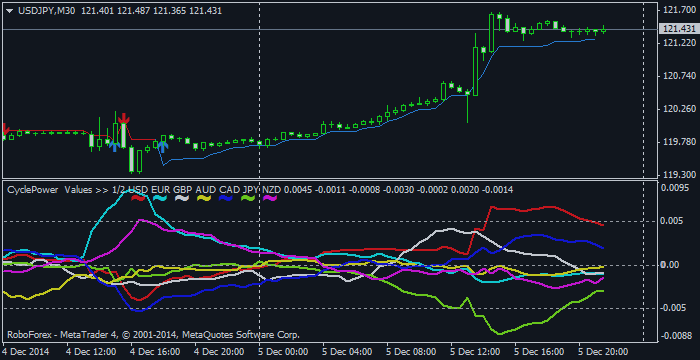

Looking at the USDJPY30M chart, I have plotted a dynamic Forex correlation indicator. We are able to quickly conclude that the best currency pair to trade on Friday morning was indeed USDJPY30M chart. As you can see USD (red line) was stronger and raising and was above JPY (green line) which was falling. Hence, we would go long USDJPY30M and stayed put till the close of session as the price was above the custom built indicator plotted on the price chart.

Happy Trading - Get Your Trading Edge

Closure Update. - USDJPY 30 - On Monday, few hrs Forex correlation indicator crosses over along custom built indicator plotted giving a sell signal on the price chart.