The ascending triangle is formed when the market makes higher lows and the same level highs. These patterns are normally seen in an uptrend and viewed as a continuation pattern as the bulls gain more and more control running up to the top resistance line of the pattern. While you normally will see this pattern form in an uptrend if you do see it in a downtrend it should be paid attention to as it can act as a powerful reversal signal.

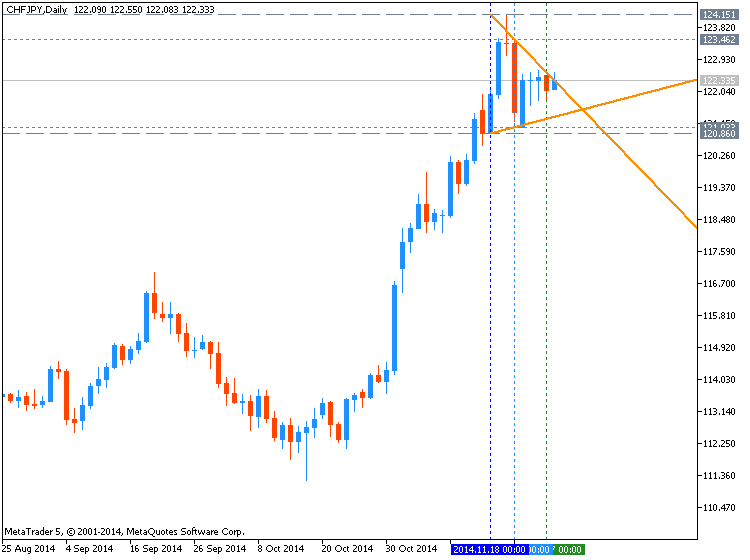

Ascending Triangle Example:

The Descending Triangle:

The descending triangle is formed when the market makes lower highs and

the same level lows. These patterns are normally seen in a downtrend

and viewed as a continuation pattern as the bears gain more and more

control running down to the bottom support line of the pattern. While

you normally will see this pattern form in a downtrend, if you do see it

in an uptrend it should be paid attention to as it can act as a

powerful reversal signal.

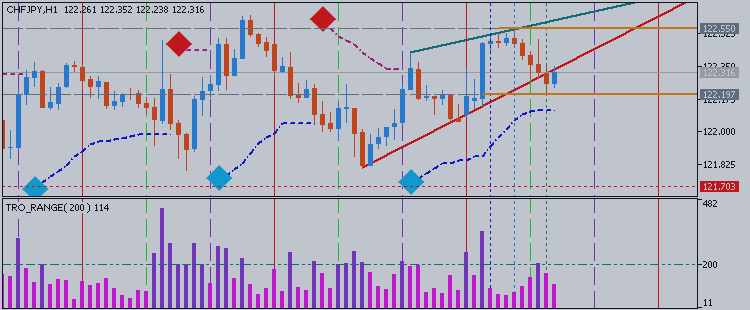

Descending Triangle Example:

The Symmetrical Triangle:

The symmetrical triangle is formed when the market makes lower highs and

higher lows and is commonly associated with directionless markets as

the contraction of the market range indicates that neither the bulls nor

the bears are in control. If this pattern forms in an uptrend then it

is considered a continuation pattern if the market breaks out to the

upside and a reversal pattern if the market breaks to the downside.

Similarly if the pattern forms in a downtrend it is considered a

continuation pattern if the market breaks out to the downside and a

reversal pattern if the market breaks to the upside.

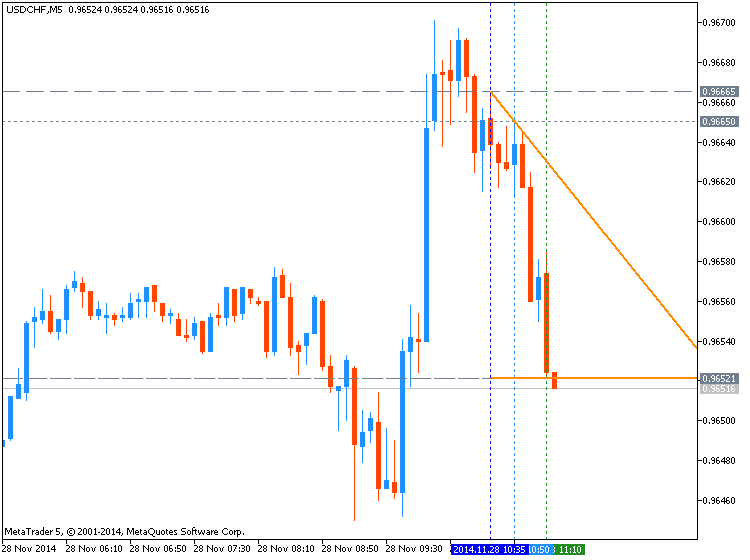

Symmetrical Triangle Example: