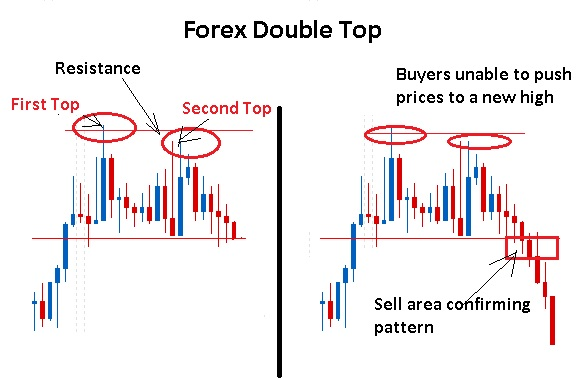

First lets look at the a common trading strategy for the double top. For confirmation that a double top has actually formed and that a reversal in the uptrend is at hand, a common strategy is to look for declining volume going into the second peak and rising volume on a break below the bottom of the trough which has formed between the two peaks (support).

Once

these things line up a common trading strategy is to enter the trade on

the break of support with a target which is equal to the distance

between the bottom of the trough and the top of the two peaks projected

downward from the bottom of the trough. The stop order is then placed

just above the last peak.

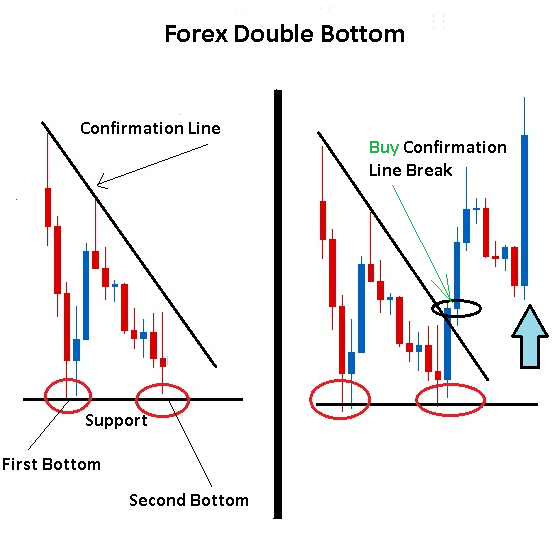

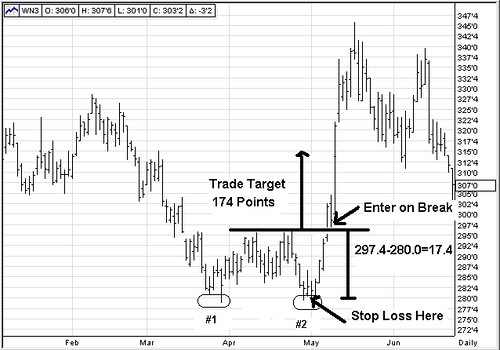

For double bottoms the process is a

mirror image of the above explanation. The strategy here is to look for

declining volume going into the second trough and rising volume on the

break of the peak which has formed between the two troughs (resistance).

Once you spot the double bottom the trade is entered on the break of

resistance with a target which is equal to the distance between the top

of the peak and the bottom of the two troughs projected upward. The stop

order is then placed just above the last trough.

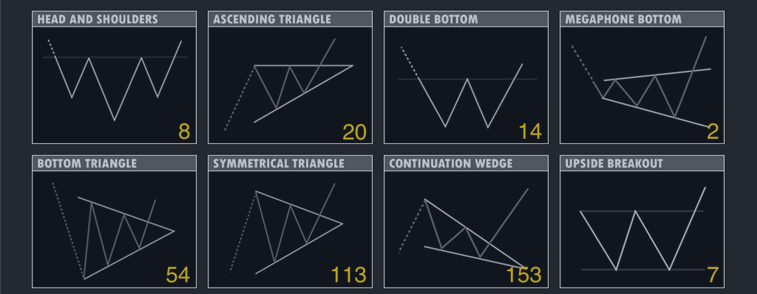

We should now have a good understanding of a common strategy used to trade double tops and double bottoms. In or next lessons we are going to look at another common chart pattern which is known as the head and shoulders pattern and a common trading strategy which is used to trade this chart pattern.