Price Pattern Analysis for US Dollar, S&P 500 , Gold and Grude Oil - Crude Oil Rebound Stumbles, Gold Prices Treading Water

US DOLLAR TECHNICAL ANALYSIS

Prices edged higher for a fourth

consecutive day, with buyers seemingly on pace to set a new year-to-date

high. Near-term resistance is at 11374, the 38.2% Fibonacci expansion,

with a break above that on a daily closing basis exposing the 50% level

at 11422.

S&P 500 TECHNICAL ANALYSIS

Prices continue to march higher

after clearing resistance at 2051.00, the 23.6% Fibonacci expansion,

with buyers aiming to challenge the 38.2% level at 2081.20. A further

push beyond that targets the 50% Fib at 2105.60.

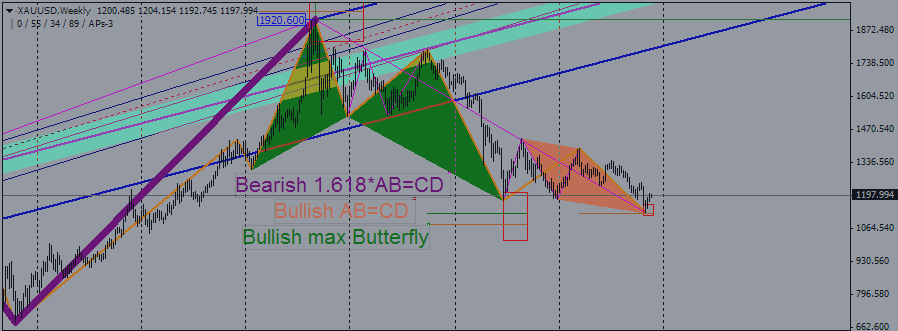

GOLD TECHNICAL ANALYSIS

Prices are edging upward en route

toward resistance at 1212.23, the 38.2% Fibonacci retracement. A daily

close above this barrier exposes a falling trend line at 1226.78.

CRUDE OIL TECHNICAL ANALYSIS

Prices stumbled after trying to

bounce as expected following the formation of a bullish Piercing Line

candlestick pattern. A daily close below the 23.6% Fibonacci expansion

at 78.95 exposes the 38.2% level at 77.32.