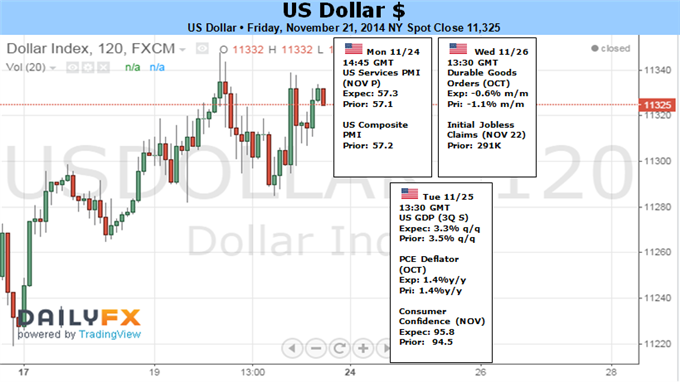

Fundamental Weekly Forecasts for US Dollar, GBPUSD, GOLD, USDJPY and AUDUSD

From a fundamental perspective, the Dollar’s interest rate backdrop seems to be mired in debate over the timing of the inevitable first hike. Technically, many of its pairings have extended to multi-month or multi-year highs with large boundaries looming just ahead. And, perhaps most condemning for momentum is the ‘market conditions’ consideration of a seasonal liquidity drain for the financial markets for the US-based Thanksgiving holiday. Despite all of these factors, however, the Greenback is more likely to extend its stretch of volatility – and perhaps even extend its drive – as the market appreciates its ‘relative’ appeal.

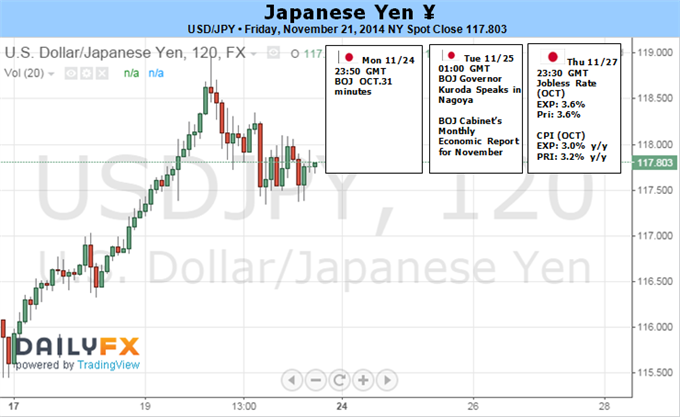

Japanese Yen Forecast- Japanese Recession, General Election May Yield Victories for “Abenomics”

The Yen largely acted as if nothing happened, with prices continuing to drift higher against the US Dollar

at the same measured pace seen over the last three weeks. For its part,

Japan’s benchmark Nikkei 225 stock index oscillated in a narrow range

having set a seven-year high.

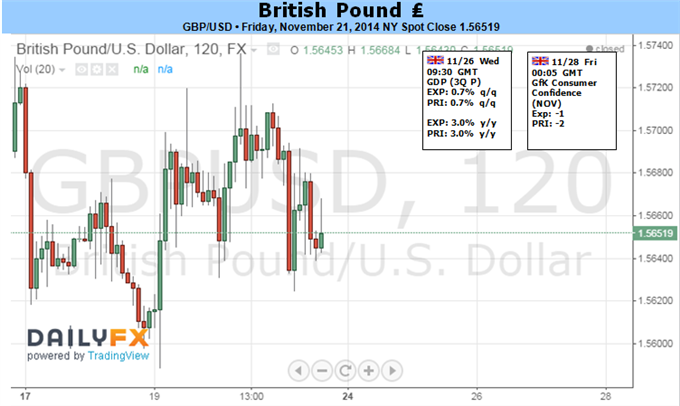

British Pound Forecast- GBP/USD Outside Day Reversal; Bigger Resistance Slightly Higher

The preliminary 3Q U.S. Gross Domestic Product (GDP)

report may serve as another fundamental catalyst to drive GBP/USD

higher as market participants anticipate a downward revision in the

growth rate, while the core Personal Consumption Expenditure, the Fed’s

preferred gauge for inflation, is expected to grow an annualized 1.4%

after expanding 2.0% during the three-months through June.

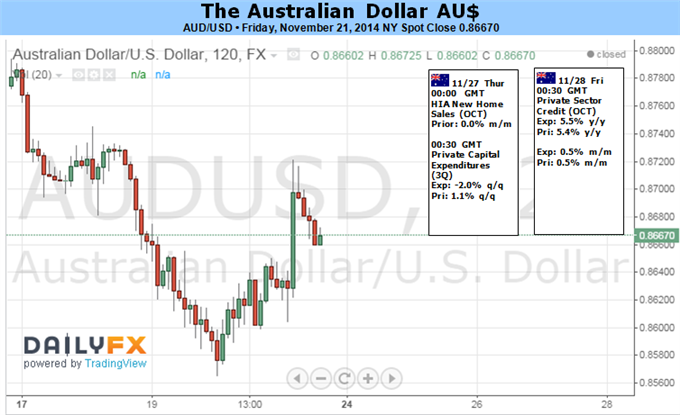

Australian Dollar Forecast- AUD/USD Suffers Intraday Volatility Yet Remains Above 2014 Low

Downside risks for AUD/USD are centered on the 2014

lows near 0.8540, which if broken may set the pair up for a run on the

July 2010 trough near 0.8320

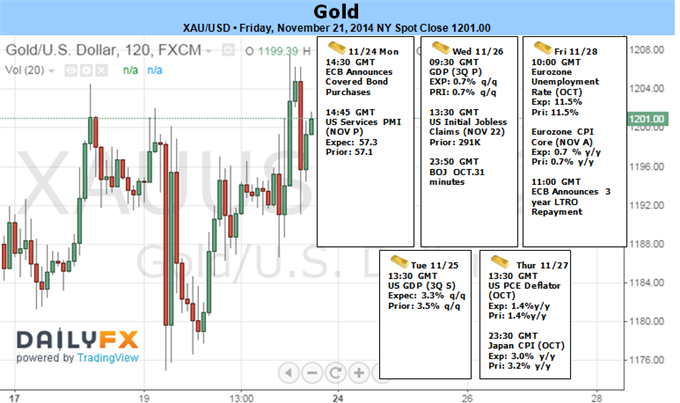

GOLD Forecast- Gold Rallies on PBOC, ECB Surprise Easing -1207 Key Resistance

From a technical standpoint gold continues to trade

within the confines of a well-defined Andrew’s pitchfork formation off

the November low with this week’s rally taking prices into key near-term

resistance at $1206/07.