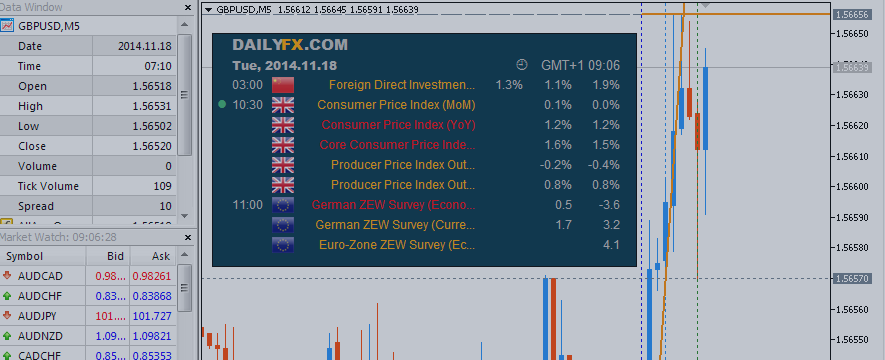

What’s Expected:

September 2014 U.K. Consumer Price Index

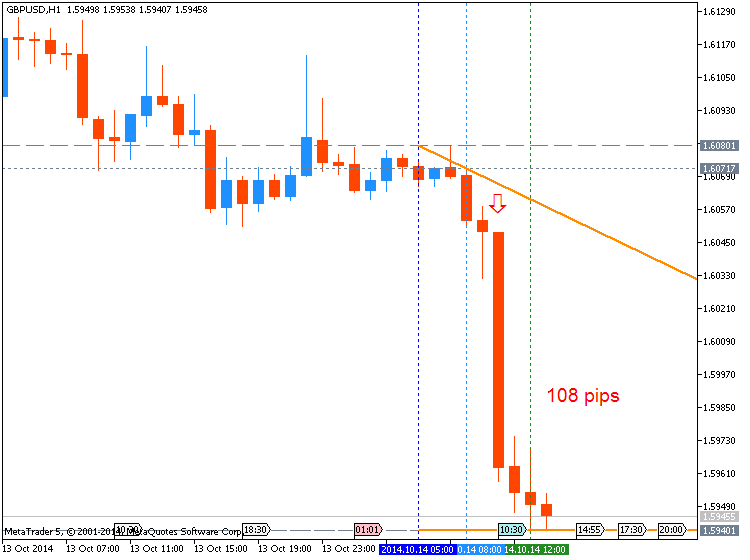

GBPUSD: 108 pips price movement by GBP - PPI news event :

Why Is This Event Important:

Despite the downward revision to the BoE’s growth & inflation forecast, sticky price growth in the U.K. may spur a greater dissent within the Monetary Policy Committee (MPC), and it seems as though Governor Mark Carney will continue to prepare household & businesses for higher borrowing-costs as the economic recovery becomes more broad-based.

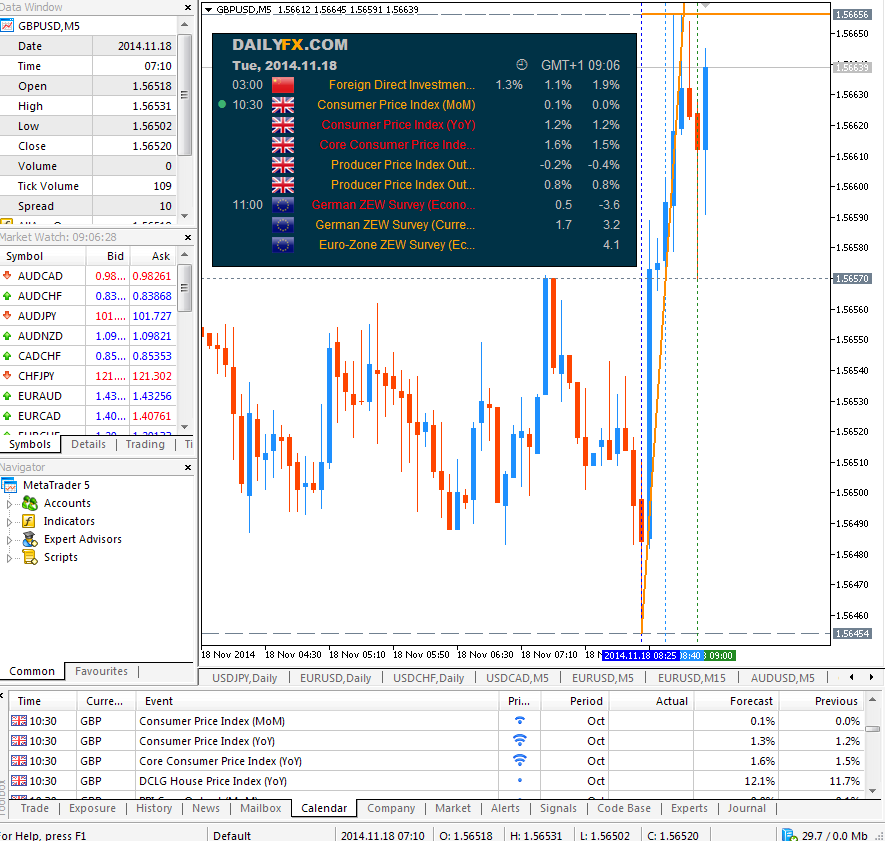

How To Trade This Event Risk

Bullish GBP Trade: U.K. Core Inflation Rebounds in October

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

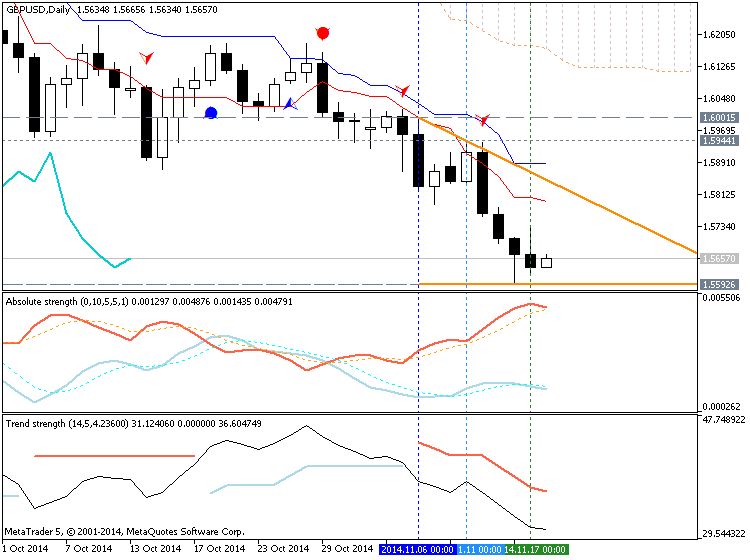

GBP/USD Daily

- GBP/USD remains vulnerable to further losses as the RSI appears to be sliding back into oversold territory.

- Interim Resistance: 1.6000 (50.0% retracement) to 1.6020 pivot

- Interim Support: 1.5540 (61.8% expansion) to 1.5550 (78.6% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 | 10/14/2014 8:30 GMT | 1.4% | 1.2% | -49 | -108 |

September 2014 U.K. Consumer Price Index

GBPUSD: 108 pips price movement by GBP - PPI news event :