- FX Volatility is at historically low levels

- Range trading strategies tend to work well in low volatility environments

- JW Ranger Strategy can help you time entries on range bound currency pairs

Prices typically don’t move fast, but levels of support and resistance tend to hold.

Therefore, if you have found your strategy not producing the amount of wins as expected, it could be that your strategy is a trend loving strategy and the market simply isn’t trending.

Today, I wanted to share with you a strategy that was presented in 2011 and how you can apply it to a range bound environment.

JW Ranger Strategy

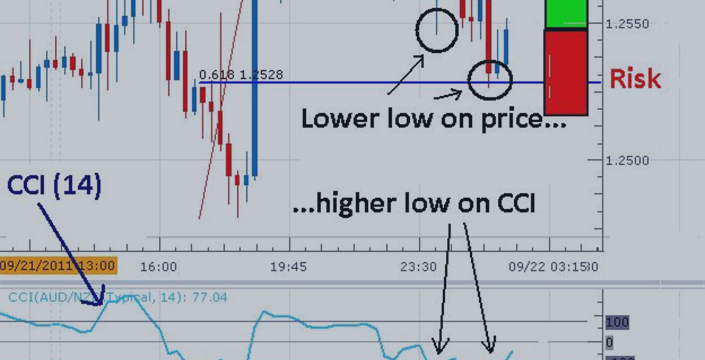

The JW Ranger Strategy uses divergence readings on the Commodity Channel

Index (CCI) oscillatorrelative as prices move into a support or

resistance zone. In essence, we are looking for slowing momentum in

price (divergence) coupled with price entering a supply or demand zone

which can act as a reason to reverse short term prices.

Divergence into support and resistance is the critical element of the

entry trigger on this strategy. The suggested time frame of the trading

chart is 15 minute to 1 hour, with my preference being the 1 hour

intraday chart.

If you would like to incorporate a portion of your own analysis, that is quite ok because, remember, the critical element is divergence into support or resistance.

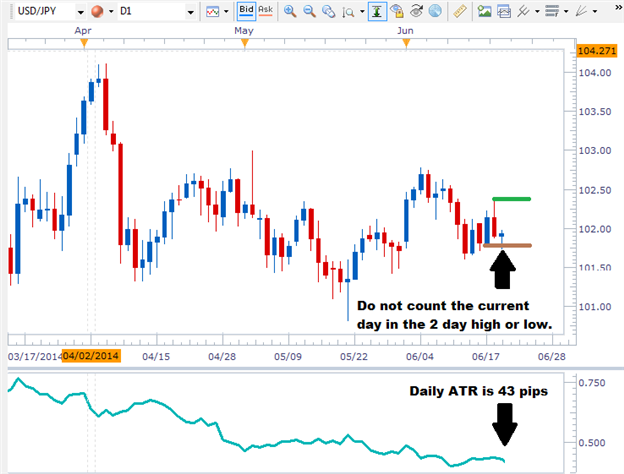

If you are not sure how to identify support and resistance levels, one simple method is to use a 2 day high or low.

On a daily chart, identify the highest high and the lowest low for the past two days, not including the current day.

For example, if today is Thursday, then look for the highest high for

Tuesday and Wednesday and note that price on your 1 hour chart. Then,

look for the lowest low for Tuesday and Wednesday and note that price on

your 1 hour chart.

Note, the current price on the current day, may already be outside that range noted on the 1 hour chart. That is ok; continue to look for entry signals below.

- Once your highest high and lowest low are notated on the 1 hour chart,

then add the CCI oscillator with a 14 period input value onto the chart.

- Once prices have passed above the high level noted, or once prices have passed below the low level noted on the 1 hour chart, then wait for the divergence signal to appear.

-

Once divergence appears, then we have our entry signal.

The stop loss is set at 50% of the daily ATR value. From the daily

chart, you’ll notice the daily ATR is 43 pips. So the stop loss would be

half of 22 pips in this case.

The take profit level is set at 50% of the daily ATR value. The take profit level would be the same as the stop loss at 22 pips.

This establishes a 1:1 risk to reward ratio.

With the recent tight range on the USDJPY, it would be a good candidate

to trade this strategy. Other currency pairs that are trading in small

ranges can be instruments to trade this strategy on as well.