Weekly Trend - Divergence with EURUSD and USDCHF; Reversal Coming?

27 June 2014, 22:03

0

254

- EURUSD and USDCHF divergence

- GBPUSD momentum considerations

- USDJPY tests important support

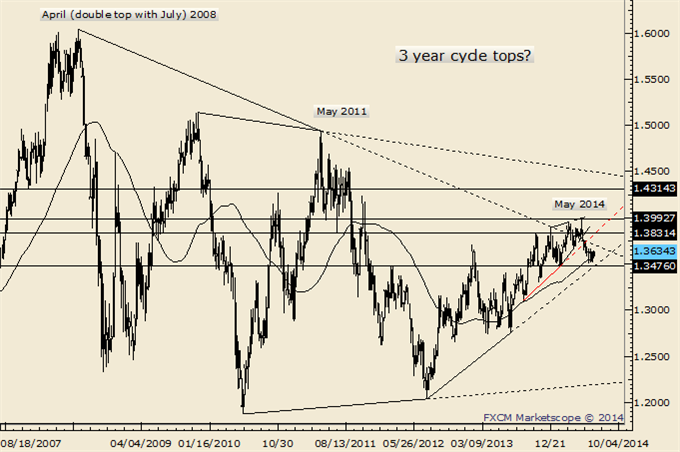

- “Long term, a failed breakout and top would keep with the pattern of 3 year cycle tops. 1.3750 is an important reference point (year open).”

- “EURUSD resolved a triangle with a terminal thrust and reversal on

the June ECB meeting. Several developments suggest that EURUSD is headed

higher for at least several weeks. The reversal occurred from just

above the 2014 low and near the 52 week average (which exhibits a

positive slope but momentum has been trending down since August)…The

implication from volume is that this low isn’t as strong as the November

and July lows (the doing of smaller traders…think volume /

transactions). There are 3 points to watch for resistance moving

forward…1.3750/60, 1.3800, and 1.3840.”

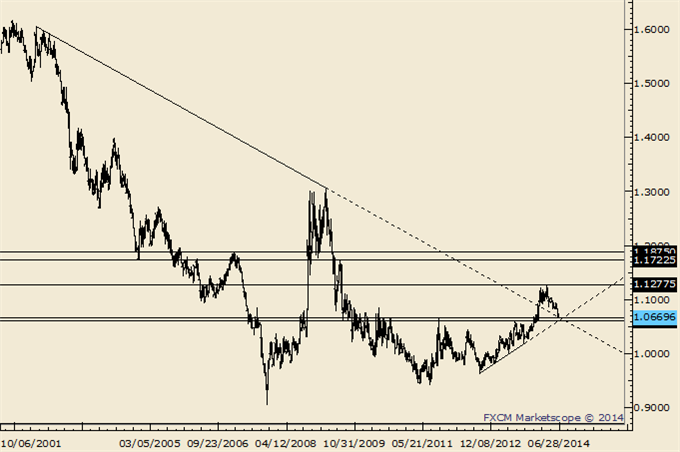

- EURUSD has headed higher but the first cited resistance (1.3750) has yet to be reached. In fact, EURUSD remains below the post ECB high. 1.3670/85 is a level that should inspire a reaction (selling). How the market reacts at that level will help in assessing the next move.

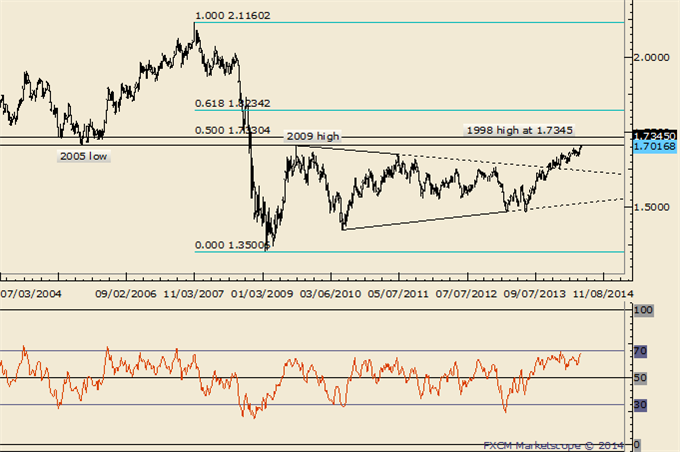

- GBPUSD recently traded at its best level since October 2008. The level is also home to the 2005 low. The next big confluence is from the 1998 high and 50% retracement of the decline from the 2007 high at 1.7330/45.

- The momentum profile at multiple degrees of trend warns that the market may not make it to 1.7330/45 though. Daily RSI is divergent with the new price high (compare this June high with the May high) and RSI at the most recent peak is below 70. Weekly RSI also exhibits slight divergence and the indicator is still below 70.

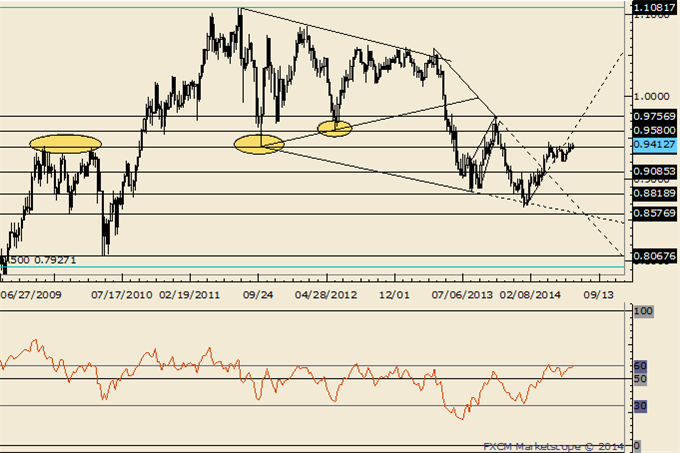

- The combination of the .9400 figure and weekly RSI failing near 60 indicates a lot of overhead to punch through. Since the 2011 top, each RSI failure near 60 has led to a top or topping process (range for several weeks then a breakdown...that may be the case now).

- “Don’t forget about the line that extends off of the 1996 and 2007 highs. That line crosses through the 2008, 2011, and highs as well. In 2011 (record free float high), the rate surged through the line in late July before topping on August 1st.” NZDUSD sold off for 5 weeks, found low near the 50% retracement of the year’s range and has surged back to this seemingly magnetic line.

- Market conditions (volatility) is much different than it was in 2011 but the record free float high did occur in ‘blow-off’ fashion throughout July (the high was August 1st). If history were to rhyme, then know that the rally from the 2000 low would consist of 2 equal waves at .9203. Below .8650 probably means the rate topped for at least .8500.

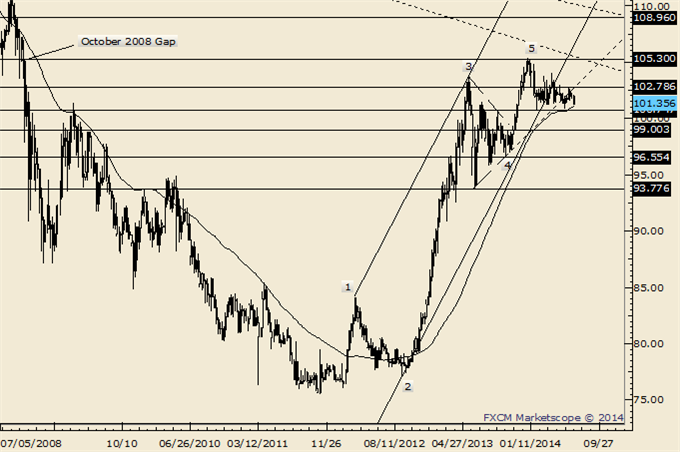

- “USDJPY has bounced from the line that extends off of the February and 3/14 lows. The rally from the February low channels in a corrective manner and makes 104.12 important from a bigger picture bearish perspective.”

- “There is an Elliott case to be made for a return to the 4thwave of one less degree. The range spans 93.78 to 96.55. Of course, the path to get to that level is far from clear.” USDJPY is testing support from 101.35. 101.16 is also a reaction level. A larger breakdown is possible as long as price is below 102.80.

- USDCAD has fallen apart which ironically means it is probably going to find some sort of low soon. The rate is nearing important price levels.

- The 2011 high at 1.0657 and current year open at 1.0634 are possible supports. The line that extends off of the 2012 and September 2013 lows is at about 1.0607 next week. This level is in line with the July 2013 high at 1.0608.

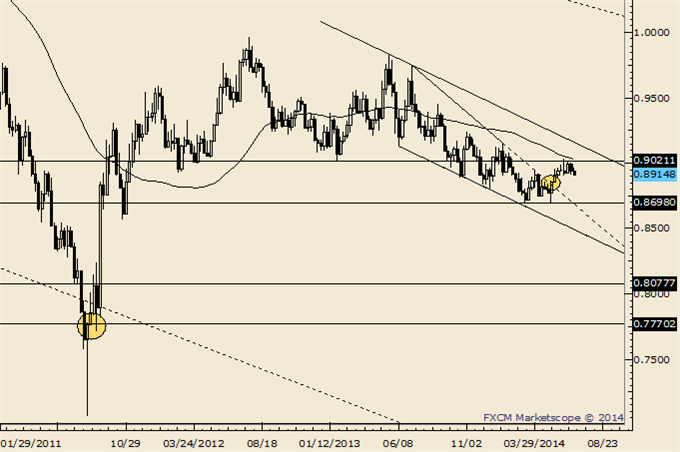

- “USDCHF found top this week from just above the February 2013 low at .9020. The reversal probably caps USDCHF for at least a few weeks. Supports are seen at .8860 and .8800. In summary, the rate is probably capped for a few weeks before another rally attempt.”

- Near term developments warn of a turn towards USD strength, probably next week. USDCHF has slipped to a new low for June yet EURUSD is below its June high of 1.3676. These subtle divergences have pinpointed several important turns recently including the May turn when EURUSD exceeded its March high yet USDCHF stayed above its March low.