Weekly Digest for Fundamentals: US Dollar, GBPUSD, AUDUSD and GOLD

3 November 2014, 06:11

0

257

US Dollar Forecast

GBPUSD Pound Forecast

AUDUSD Forecast

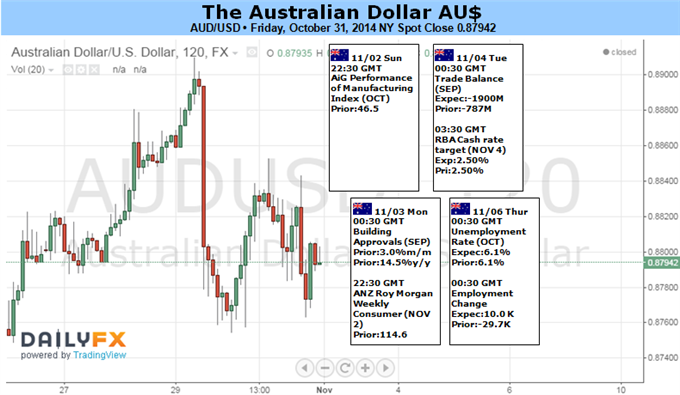

The Aussie is bracing for a medley of economic releases that may catalyze intraday swings, yet scope for follow-through may be limited amid steadfast RBA bets. Until we see consistent signs of improvement in the local labour market the Reserve Bank is likely to retain its highly accommodative stance over the near-term. Yet further rate cuts remain off the cards for the time-being, given the need to manage risks posed by speculative lending in the housing market. A lack of fresh insights into policy makers’ thinking is likely to leave the AUD to take its cues from elsewhere.

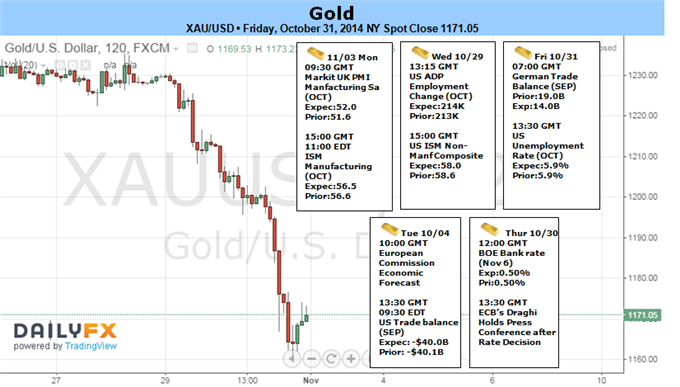

Gold (XAUUSD) Forecast

Gold prices plummeted this week with the precious metal off by more than 5.2% to trade at $1166 ahead of the New York close on Friday. Looking ahead to next week investors will be closely eyeing the US data flow with ISM, Factor Orders, and the highly anticipated Non-Farm Payrolls report on tap. Although the focus for Fed officials has seemingly shifted more so towards the inflation side, traders will be looking to confirm the central bank’s assertion of a substantiated recovery in the labor markets with consensus estimates calling for a print of 234K as unemployment holds at 5.9%. Look for stronger than expected US data points to continue fueling the dollar rally at the expense of gold. However, although our broader focus remains weighted to the short-side of the trade, near-term an upcoming technical feature around $1160 may offer some support for gold as we head into November trade.

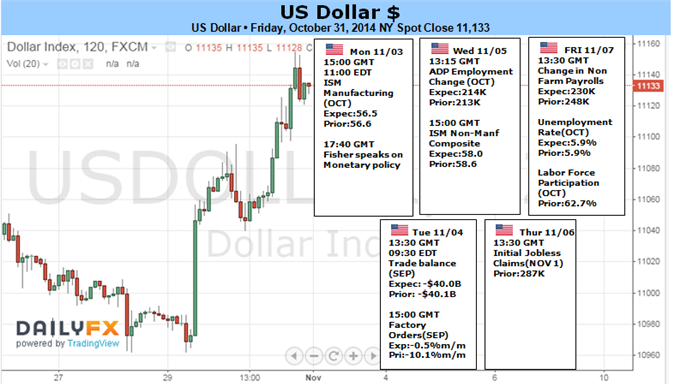

US Dollar to Advance as Upbeat Payrolls Data Fuels Fed Rate Hike Bet. Softer ISM Data May Be Offset by “Fed-Speak” Pointing to Steady Outlook

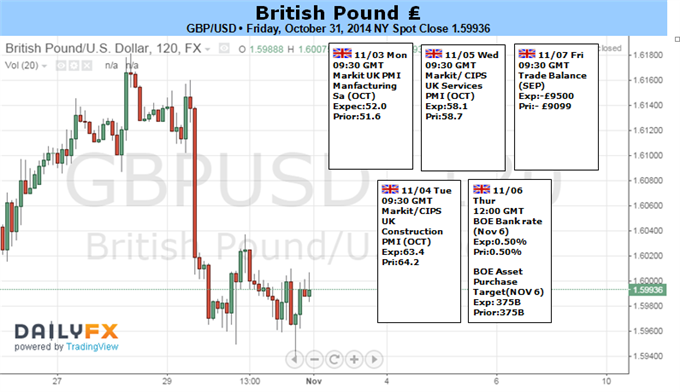

GBPUSD Pound Forecast

Bank of England Rate Decision threatens volatility on surprises.

The British pound finished the week notably lower versus the resurgent

US Dollar, but a busy week of economic event risk ahead suggests the

GBP/USD may see big moves and could very well stage a reversal.

AUDUSD Forecast

The Aussie is bracing for a medley of economic releases that may catalyze intraday swings, yet scope for follow-through may be limited amid steadfast RBA bets. Until we see consistent signs of improvement in the local labour market the Reserve Bank is likely to retain its highly accommodative stance over the near-term. Yet further rate cuts remain off the cards for the time-being, given the need to manage risks posed by speculative lending in the housing market. A lack of fresh insights into policy makers’ thinking is likely to leave the AUD to take its cues from elsewhere.

Gold (XAUUSD) Forecast

Gold prices plummeted this week with the precious metal off by more than 5.2% to trade at $1166 ahead of the New York close on Friday. Looking ahead to next week investors will be closely eyeing the US data flow with ISM, Factor Orders, and the highly anticipated Non-Farm Payrolls report on tap. Although the focus for Fed officials has seemingly shifted more so towards the inflation side, traders will be looking to confirm the central bank’s assertion of a substantiated recovery in the labor markets with consensus estimates calling for a print of 234K as unemployment holds at 5.9%. Look for stronger than expected US data points to continue fueling the dollar rally at the expense of gold. However, although our broader focus remains weighted to the short-side of the trade, near-term an upcoming technical feature around $1160 may offer some support for gold as we head into November trade.