USDCNH is a great carry trading pair. Selling this pair will net both a positive swap figure as well as ride the down trend. The daily time frame shows the down trend beginning on May 28, 2014, but is expected to continue. With the strong economic growth in China, the yuan is appreciating. However, this is for the on-shore yuan. USDCNH is the benchmark of the offshore yuan. While there is a discrepancy between the two, the overall trend is in sync. In fact, it is quite evenly matched from the data pulled from Google Finance.

While USDCNH is slightly more volatile than its CNY counterpart, it is still a good representation of the Yuan. Despite the recent uptick, this pair looks to resume its overall downtrend once again.

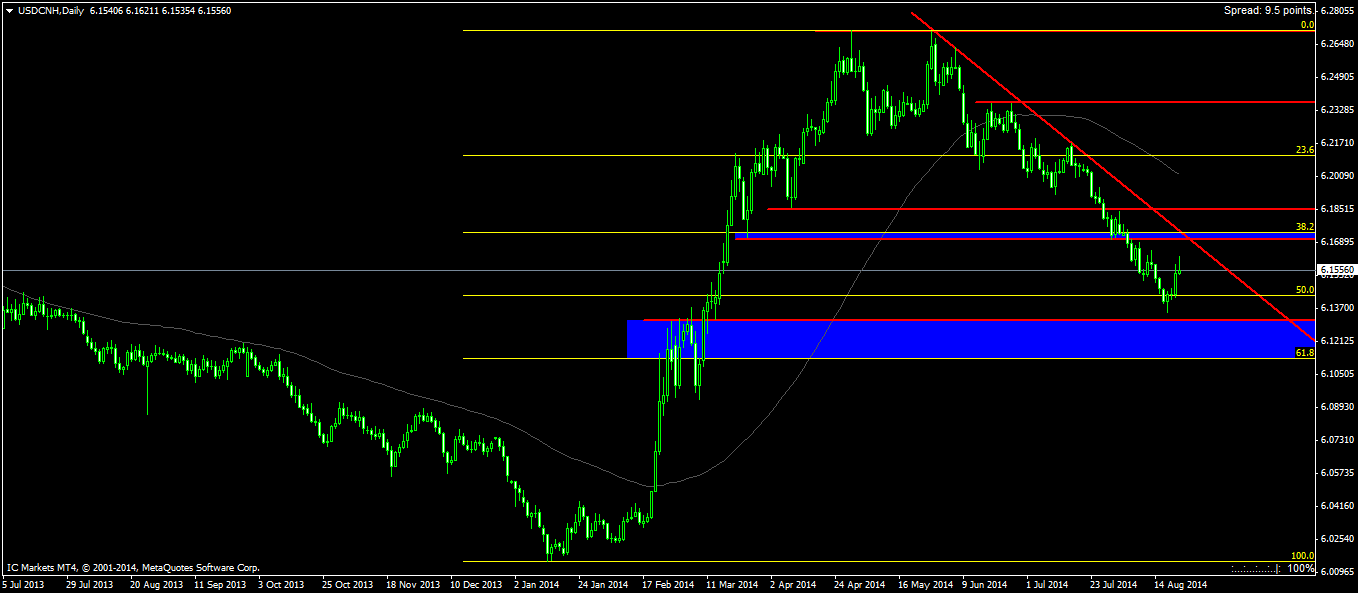

Taking a look at the daily chart, yesterday's close showed a very long upper tail yet a very small body. This is the first indication that buying pressure is wearing off. With this pair still under the moving average and lower fractal movements, a down trend is established and will most likely resume.

Taking a look at the daily chart, yesterday's close showed a very long upper tail yet a very small body. This is the first indication that buying pressure is wearing off. With this pair still under the moving average and lower fractal movements, a down trend is established and will most likely resume.

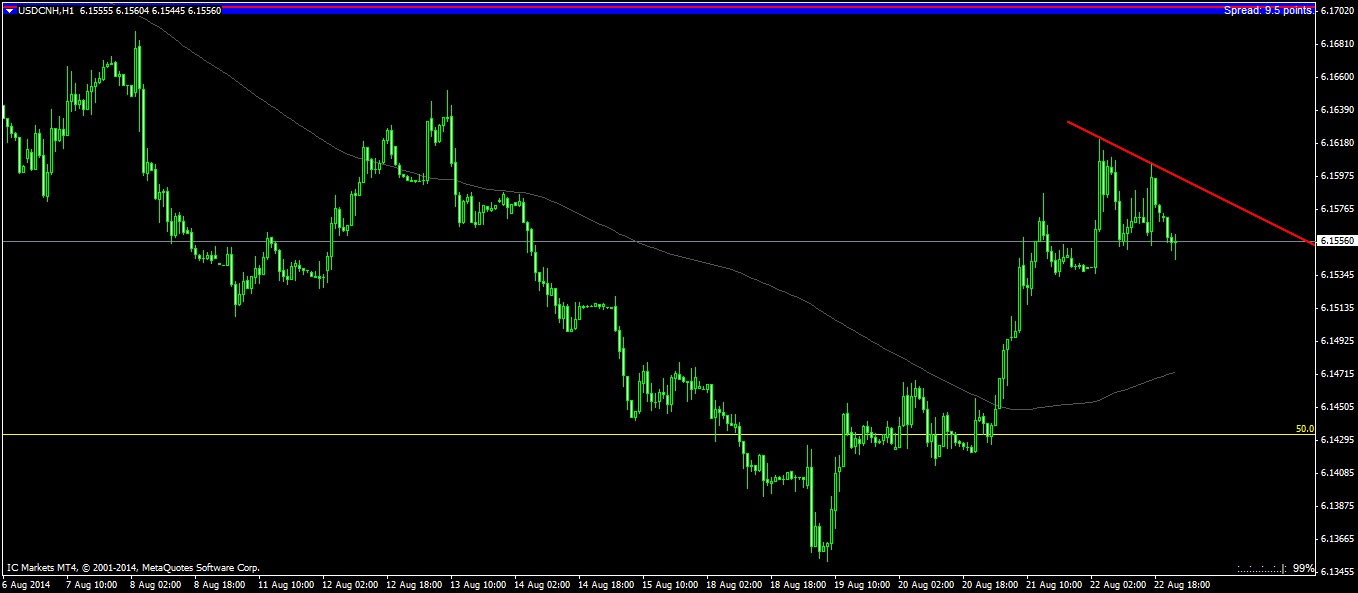

The second indication that the downtrend is resuming is the hourly close. This is a rather reliable set. A lower high following a higher high shows an early set of buyers closing out their longs, which causes the initial short. More traders enter, but failed to push the price higher resulting in a lower high close. Following that is a sell-off because no buyers are left to buy.

The second indication that the downtrend is resuming is the hourly close. This is a rather reliable set. A lower high following a higher high shows an early set of buyers closing out their longs, which causes the initial short. More traders enter, but failed to push the price higher resulting in a lower high close. Following that is a sell-off because no buyers are left to buy.

The recommended trade is to go short upon Monday's open and ride this pair out until the next pull back. In the meantime, positive rollover charges should be accumulated. If your broker is not giving you positive rollovers for this pair, there is something wrong with the liquidity preference your broker is using. If your broker is giving positive rollovers, the actual amount may differ depending on the rates they have received. In any case, this is a very good trade setup as it provides more than one way to profit even despite the trend.