Three line candle scanner with RSI filter

- 指标

- Jan Flodin

- 版本: 1.5

- 更新: 11 二月 2024

- 激活: 10

此多品种和多时间框架指标扫描以下烛台模式(请参阅屏幕截图以了解模式说明):

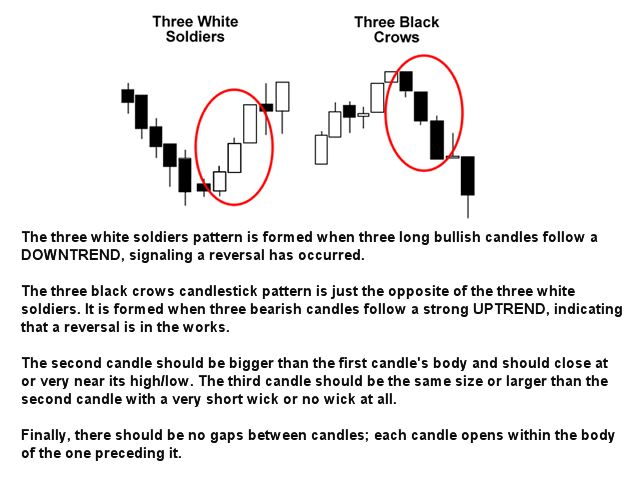

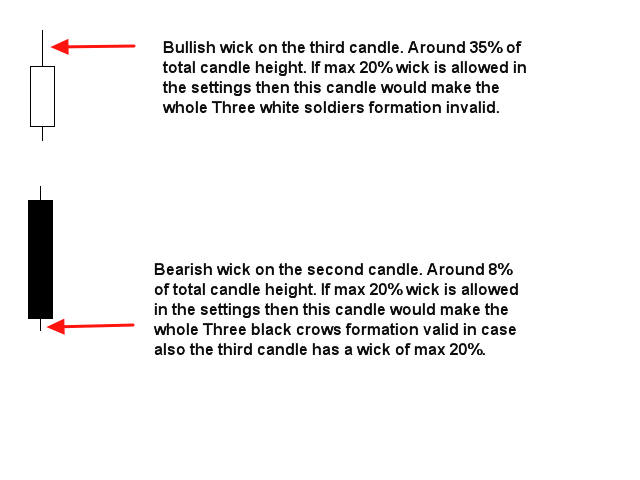

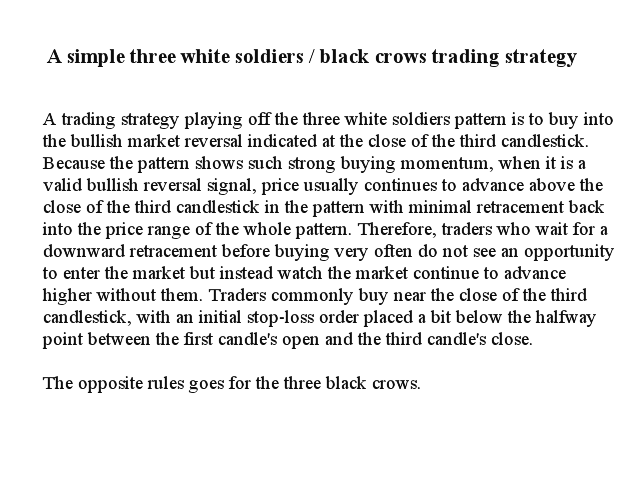

- 三白兵(反转>延续形态)

- 三只黑乌鸦(反转>延续形态)

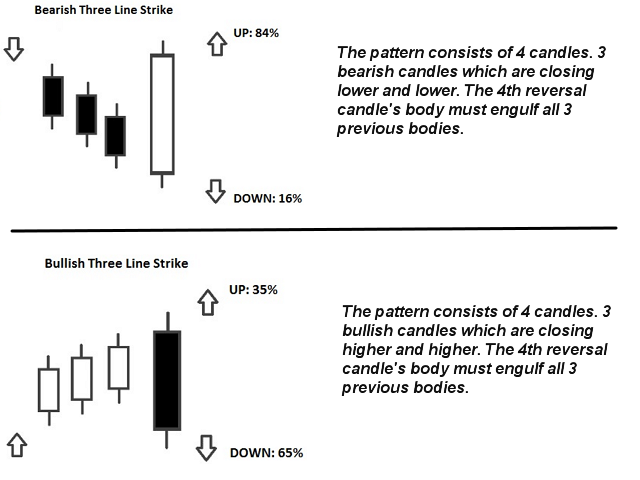

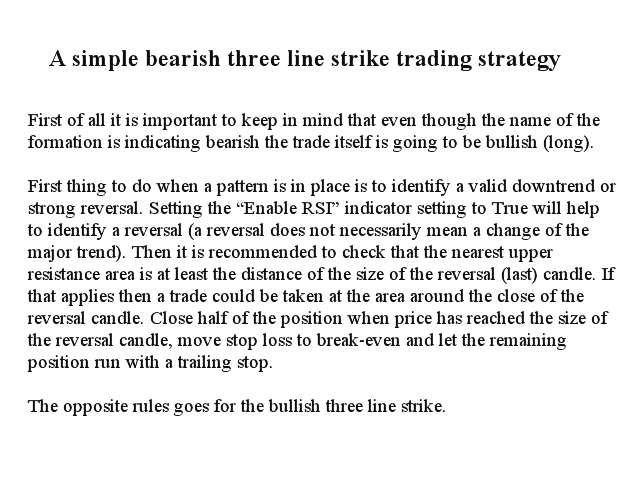

- 看涨和看跌三线罢工(反转形态)

当指标设置中的严格选项启用时,模式不会经常出现在更高的时间范围内。但是当他们这样做时,这是一个非常高概率的设置。根据 Thomas Bulkowski(国际知名作家和烛台模式的领先专家)的说法,三线罢工在所有烛台模式中的整体表现排名最高。结合您自己的规则和技术,该指标将允许您创建(或增强)您自己的强大系统。

特征

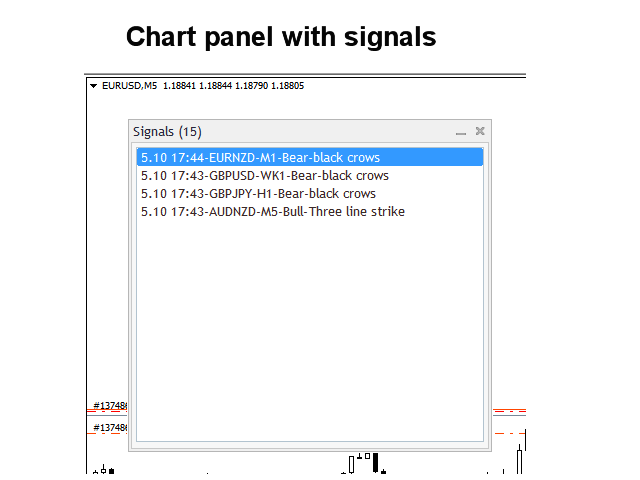

- 可以同时监控您的市场报价窗口中可见的所有交易品种。仅将指标应用于一张图表并立即监控整个市场。

- 可以监控从 M1 到 MN 的每个时间范围,并在识别出模式时向您发送实时警报。支持所有 Metatrader 原生警报类型。

- 可以使用 RSI 作为趋势过滤器,以便正确识别潜在的逆转。

- 该指示器包括一个交互式面板。当单击一个项目时,将打开一个带有相关代码和时间范围的新图表。

输入参数

请在此处找到输入参数的说明和解释。

请注意,由于具有多时间框架功能,该指标不会在任何图表上绘制线条和箭头或买卖建议。

我建议您将指标放在干净(空)图表上,不要在其上放置任何其他可能干扰扫描仪的指标或智能交易系统。

用户没有留下任何评级信息