Market Perspective Structure Indicator MT4

- Göstergeler

- Mykola Khandus

- Sürüm: 1.1

- Güncellendi: 17 Ekim 2025

- Etkinleştirmeler: 20

Overview

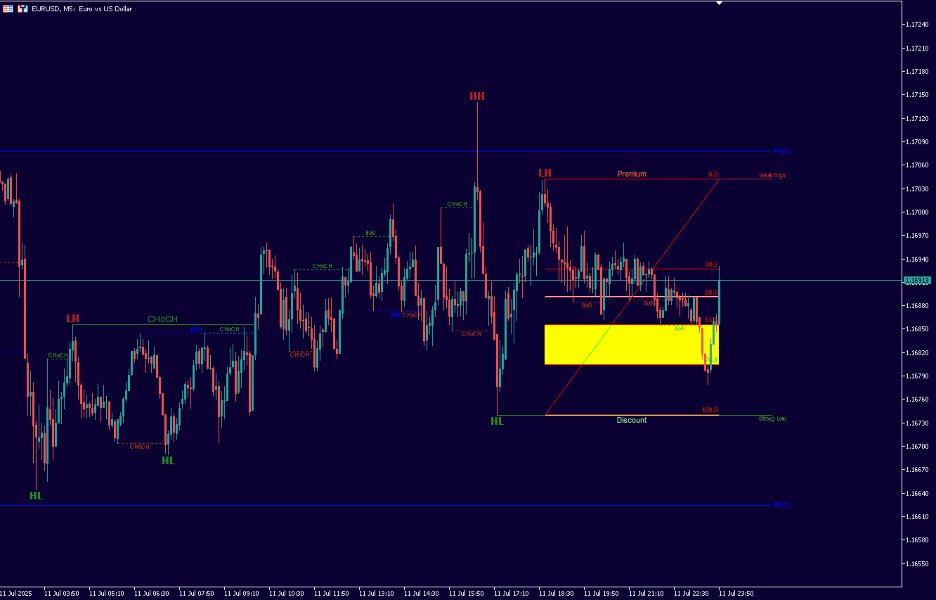

The Market Perspective Structure Indicator is an indicator designed to provide traders with a detailed analysis of market structure across multiple timeframes. It identifies and visualizes key price action elements, including swing highs and lows, Break of Structure (BOS), Change of Character (CHOCH), internal structures, equal highs/lows, premium/discount levels, previous levels from higher timeframes, and trading session zones. With extensive customization options, this indicator is adaptable to various trading strategies and preferences.

Key Features

Market Structure Analysis

- Swing Highs and Lows: Identifies significant swing points based on a user-defined swing length.

- Swing Labels: Option to display labels for swing highs and lows with customizable sizes.

- Color Customization: Allows users to set distinct colors for swing highs (e.g., red) and lows (e.g., green).

Extremas

- Displays upper and lower extremas (significant price points) with customizable labels, colors, line styles, and widths.

Break of Structure (BOS)

- Highlights bullish and bearish BOS events, indicating when price breaks out of an established structure to continue the current trend.

- Customizable display options, including colors, line styles, widths, and label sizes.

Change of Character (CHOCH)

-

Identifies bullish and bearish Change of Character (CHOCH) events, signaling potential trend reversals:

- Bullish CHOCH: Occurs in a bearish trend when the price breaks above a recent lower high, indicating a potential shift to a bullish trend.

- Bearish CHOCH: Occurs in a bullish trend when the price breaks below a recent higher low, indicating a potential shift to a bearish trend.

- Customizable display options for colors, line styles, widths, and label sizes.

Internal Structure

- Provides a finer-grained view of market structure using a shorter swing length.

- Includes BOS and CHOCH for internal structures, displayed with distinct styles (e.g., dotted lines) and smaller label sizes.

Equal Highs/Lows

- Identifies equal highs and lows based on a specified swing size.

- Supports error calculation using Average True Range (ATR) or average candle range for flexibility.

- Options to extend equality lines across the chart and delete broken equalities.

- Customizable display type (e.g., lines), color, line style, width, and label size.

Premium/Discount Levels

- Displays premium (above a swing high) and discount (below a swing low) levels.

- Supports different display types, such as lines.

- Includes Fibonacci retracement levels and Order Target Equality (OTE) zones for additional analysis.

- Customizable colors, line styles, and widths for premium and discount lines.

Previous Levels

- Shows previous swing highs and lows from higher timeframes (e.g., monthly, weekly, daily, 12-hour, 8-hour).

- Allows users to enable or disable levels for up to five different timeframes.

- Customizable colors, line styles, widths, and label sizes for each timeframe.

Trading Sessions

- Visualizes major trading sessions (Tokyo, London, New York) and two custom sessions.

- Each session can be enabled or disabled, with customizable labels, start/end times, colors, and fill options.

- Helps traders identify periods of high market activity.