Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 12996

- Derecelendirme:

- Yayınlandı:

- Güncellendi:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

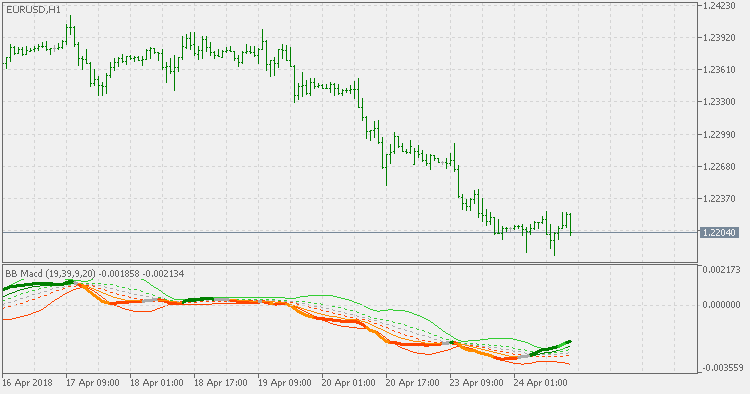

BB MACD is a MACD (Moving Average Convergence Divergence) indicator variation with an addition of Bollinger Bands, which helps in detecting trend change points and measuring current trend's strength.

The indicator is separated into three parts:

- The "line" part which is the colored MACD value.

- The "channel" part which is the Bollinger Bands drawn that way to make it easier to spot the changes of MACD within the channel.

- The "early levels" part which is the Bollinger Bands using smaller deviations multiplication for early assessment of MACD trend change.

Weekly Fibo Levels

Weekly Fibo Levels

Calculation is based on current week open and previous week range.

Heiken Ashi Smoothed Oscillator

Heiken Ashi Smoothed Oscillator

Instead of using the "regular" Heiken Ashi for oscillator calculations, this version is using the smoothed Heiken Ashi. That makes the number of false signals fall dramatically, and, when pre-smoothing is applied to Heiken Ashi, the lag is in acceptable bounds.

Fractal dimension - Ehlers

Fractal dimension - Ehlers

By it's nature, fractal dimension index indicator is not directional. Instead it is showing if there is a trend or not. If the value of the FDI is less than the target threshold, then there is no trend (the market is ranging). If the value is above that threshold then the market is trending.

Fractal dimension index (Sevcik/Matulich)

Fractal dimension index (Sevcik/Matulich)

Mandelbrot describes the Fractal Dimension Index (FDI) as a way to measure "how convoluted and irregular" something is. The FDI can be used as a stock market indicator. The closer prices move in a one-dimensional straight line, the closer the FDI moves to 1.0. The more closely prices resemble a two-dimensional plane, the closer the FDI moves to 2.0.