Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 8433

- Derecelendirme:

- Yayınlandı:

- Güncellendi:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

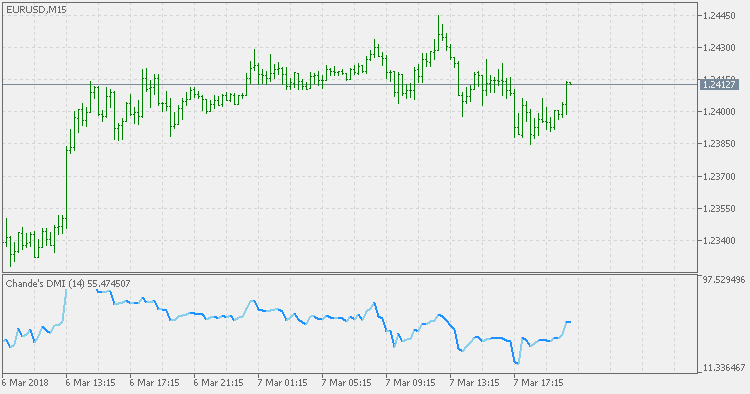

The Dynamic Momentum Index (DMI) is a variable term RSI. When default values are used, the RSI term varies from 3 to 30. The variable time period makes the RSI more responsive to short-term moves. The more volatile the price is, the shorter the time period is. It is interpreted in the same way as the RSI, but provides signals earlier.

The Dynamic Momentum Index was developed by Tushar S. Chande and Stanley Kroll and is described in their 1994 book "The New Technical Trader".

This version is the same as the original described in the "The New Technical Trader".

ZigZag separate

ZigZag separate

ZigZag separate is a MetaTrader 5 version of one indicator that was floating around the net as a wonder indicator for MetaTrader 4.

Fractal Adaptive MACD

Fractal Adaptive MACD

Fractal Adaptive Moving Average Technical Indicator (FRAMA) was developed by John Ehlers. This indicator is constructed based on the algorithm of the Exponential Moving Average, in which the smoothing factor is calculated based on the current fractal dimension of the price series. The advantage of FRAMA is the possibility to follow strong trend movements and to sufficiently slow down at the moments of price consolidation.

3 MAs Market

3 MAs Market

Indicator that shows the current estimated state of the market based on a correlation of 3 Moving Averages.

McGinley Dynamic Indicator

McGinley Dynamic Indicator

The McGinley Dynamic indicator was developed by John McGinley and outlined in the Market Technicians Association's "Journal Of Technical Analysis" in 1991. The purpose of this indicator is to address flaws found in conventional moving averages, such as price separation and whipsaws. The result is a remarkable indicator that follows the average price of an instrument while adapting to current market speeds.