Whale Fibonacci Retracement Scalp

- Эксперты

- Mustafa Ozkurkcu

- Версия: 1.0

- Активации: 5

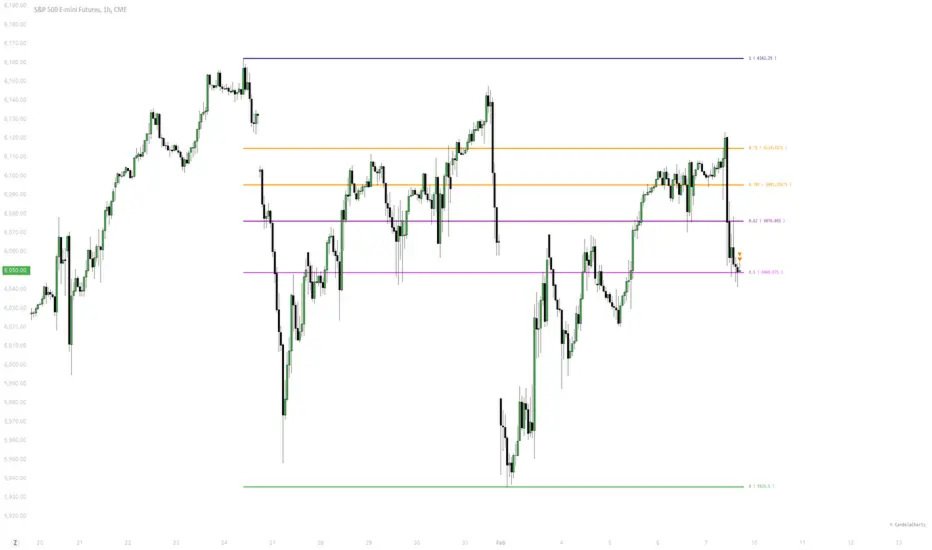

This Expert Advisor (EA) is designed to automate trading based on Fibonacci retracement levels that form after strong price movements. The main objective of the EA is to identify entry points during pullbacks within a trend. It executes trades based on a predefined risk-to-reward ratio, entering the market when the price action is confirmed by specific candlestick patterns.

How the EA Works

The EA automatically performs the following steps on every new bar:

-

Trend and Volatility Detection: First, it uses a Moving Average to determine the current trend. It also checks the Average True Range (ATR) to ensure there is enough market volatility for a valid trade setup. If the market is not active enough, the EA will not place a trade.

-

Finding Swing Points: It identifies the most recent high (swing high) and low (swing low) price points using either the ZigZag or Fractals indicators. These points are crucial for drawing the Fibonacci levels.

-

Fibonacci Level Calculation: Once the swing points are found, the EA calculates the key Fibonacci retracement levels, with a focus on 50% and 61.8%. These levels are treated as potential support or resistance zones where the price is likely to reverse.

-

Entry Signal and Confirmation:

-

A signal is generated when the price approaches a Fibonacci level.

-

This signal is then confirmed by candlestick patterns (such as Pin Bar, Hammer, or Engulfing patterns). This additional confirmation aims to increase the probability of a successful trade.

-

The EA also checks if the trade's direction aligns with the overall trend, as determined by the Moving Average.

-

-

Trade Management:

-

Upon a confirmed signal, a buy or sell order is automatically placed.

-

The lot size is dynamically calculated based on a user-defined risk percentage of the account balance.

-

A Stop Loss is set at a safe distance below or above the swing point.

-

A Take Profit is automatically set based on the specified risk-to-reward ratio (e.g., 1:2).

-

Input Parameters Explained

You can customize the strategy using the following parameters:

Trade Settings

-

InpLotSize: The fixed trade volume if you're not using automatic lot sizing.

-

InpUseAutoLotSize: Toggles the automatic lot size calculation on or off. It's recommended to keep this on.

-

InpRiskPercentage: The percentage of your account balance you want to risk per trade. A value of 2.0 means you risk 2% of your balance on each trade.

-

InpMaxLotPerTrade: The maximum lot size allowed for any single trade.

-

InpRiskRewardRatio: Defines the ratio of the Take Profit to the Stop Loss (e.g., 2.0 for a 1:2 ratio).

-

InpMagicNumber: A unique ID that helps the EA identify and manage its own trades.

Strategy Parameters

-

InpLookBackBars: The number of historical bars the EA looks back to find swing points.

-

InpRetraceTolerance: The tolerance (in points) for how close the price must be to a Fibonacci level to trigger a signal.

-

InpTimeframe: The timeframe on which the EA will operate (e.g., M30, H1, D1).

Filters and Indicators

-

InpUseFractalsZigZag: Uses the Fractals indicator to find swing points.

-

InpUseZigZag: Uses the ZigZag indicator to find swing points.

-

InpMinATRValue: The minimum ATR value required for a trade to be placed. This prevents trading in flat, low-volatility markets.

-

InpMAPeriod: The period for the Moving Average trend filter.

-

InpMAMethod: The type of Moving Average to be used (e.g., EMA, SMA).

-

InpUseExtendedFibs: Enables the use of additional Fibonacci levels, such as 38.2% and 78.6%.

-

InpUseFibonacciExtensionsForTP: Enables the use of Fibonacci extension levels for setting the Take Profit.

Risk Disclaimer

Important Warning: This strategy is a scalping strategy and may involve a high degree of risk. Trading in financial markets, including using automated systems like this one, carries the risk of losing some or all of your capital. Past performance is not a guarantee of future results.

-

Market Conditions: The strategy may perform better in specific market conditions, such as trending markets. Unexpected outcomes can occur in ranging or excessively volatile markets.

-

Broker Conditions: Slippage, spread widening, and "Volume limit reached" errors from the broker can negatively affect the strategy's performance.

-

Risk Management: It is crucial to set your risk management parameters, such as InpRiskPercentage and InpMaxLotPerTrade , carefully to control potential losses.

-

Demo Account Testing: It is highly recommended to test this EA on a demo account for an extended period across different market conditions before using it on a live account.

The purpose of this EA is to automate the trading process, but it's essential that you understand the underlying logic and potential risks of the strategy.