Adaptive Trend

- Эксперты

- Le Trung Kien Hoang

- Версия: 1.0

- Активации: 10

The Adaptive Trend EA is engineered to address a common trading challenge: using the right tool for the right market condition. Instead of relying on a fixed method, this EA dynamically adapts its core logic based on the strength of the current trend. The goal is to improve signal accuracy and reduce trades taken in unfavorable market environments.

Core Feature: The Adaptive Moving Average

This is the heart of the system. The EA constantly monitors the ADX indicator to gauge trend strength:

-

In Ranging Markets (Low ADX): The EA automatically uses a Simple Moving Average (SMA). The smoothing effect of the SMA helps to filter out market noise and avoid entries on false breakouts.

-

In Strong Trending Markets (High ADX): The system switches to an Exponential Moving Average (EMA). The EMA reacts faster to price changes, allowing for earlier trend entries and better tracking of strong moves.

Multi-Layered Entry Logic

Every trade signal must pass through a strict, multi-condition filter to ensure high quality:

-

Trend Filter (ADX): Trades are only considered when the ADX is above a specified threshold, confirming that a sufficiently strong trend is in place.

-

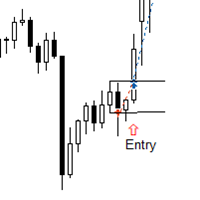

Signal Confirmation (EMA Crossover & MA): A buy or sell signal is confirmed by the crossover of the fast and slow EMAs, while the price must also be positioned correctly relative to the adaptive MA.

-

Momentum Filter (RSI): The signal must occur within a healthy RSI range (avoiding overbought/oversold conditions) to ensure there is room for the price to move in the intended direction.

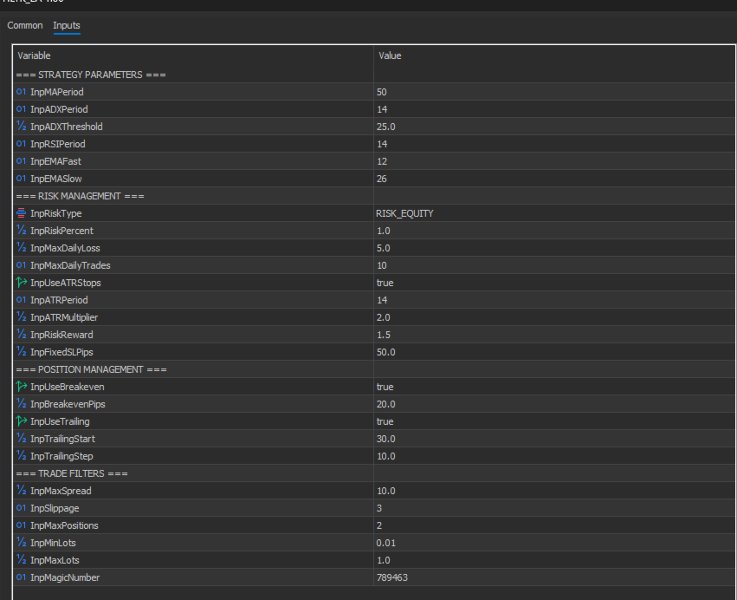

Comprehensive Risk and Position Management

Capital protection is a key priority. The EA is equipped with a full suite of professional management tools:

-

Automatic Lot Sizing: Automatically calculates the trade volume based on your defined risk percentage (calculated on Balance, Equity, or Free Margin).

-

Flexible Stop Loss: Offers two distinct options:

-

ATR Stop Loss: Dynamically adjusts the stop loss distance based on current market volatility.

-

Fixed Pip Stop Loss: Uses a predefined stop loss in pips set by the user.

-

-

Account Protection: Set a maximum daily loss limit and a maximum number of daily trades to maintain discipline and control risk.

-

Profit Optimization: Integrated Breakeven and Trailing Stop functions work to secure profits and let winning trades run automatically.

The Adaptive Trend EA is a tool built on transparent trading logic and strict risk management principles. Important: Please note that this is a support tool, not a "money-printing machine," and it cannot replace the analysis, experience, and discretion of a human trader. We strongly recommend thorough testing on a demo account to evaluate its performance and suitability for your trading style.