Break Hunter 28 MT4

- Experts

- Jimmy Musyoki Mwongela

- 버전: 1.0

- 활성화: 5

DESCRIPTION

Break Hunter 28 is an automated straddle strategy Expert Advisor designed to capture breakout movements by placing simultaneous Buy Stop and Sell Stop pending orders at a specified time each day. When one order is triggered by a price breakout, the opposite order is automatically cancelled, allowing you to ride the momentum in the direction of the breakout.

The EA features an aggressive trailing stop mechanism that locks in profits quickly, making it ideal for volatile market conditions and strong trending moves.

HOW IT WORKS

At your specified time (default 16:30 server time), the EA analyzes the current market price and places two pending orders:

- Buy Stop: Positioned above current price by your specified pip gap

- Sell Stop: Positioned below current price by the same pip gap

The current price sits exactly in the middle, creating a perfect straddle formation. When price breaks out in either direction and triggers one order, the opposite pending order is immediately deleted, leaving you with a single position in the direction of the breakout.

The trailing stop then activates once the position reaches a specified profit level, protecting your gains while allowing the trend to continue.

INPUT PARAMETERS AND THEIR EFFECTS

Pip Gap (Default: 200 pips)

This determines how far from current price your pending orders are placed. Larger gaps reduce false breakouts but may miss smaller moves. Smaller gaps increase trade frequency but risk whipsaw losses.

- For high volatility instruments (indices, crypto): Use 200-500 pips

- For medium volatility (major forex pairs): Use 100-300 pips

- For low volatility (exotic pairs, gold during quiet sessions): Use 50-150 pips

Stop Loss (Default: 100 pips)

Your maximum risk per trade. This should be proportional to your pip gap. A good ratio is 1:2 (stop loss half the size of pip gap).

Take Profit (Default: 200 pips)

Your profit target. Conservative traders may use 1:1 or 1:2 risk-reward ratios. Aggressive traders can use 1:3 or higher.

Trailing Stop (Default: 20 pips)

Once profit exceeds this value, the stop loss begins trailing. Smaller values protect profits faster but may exit prematurely. Larger values give more breathing room.

- Fast-moving markets: 20-30 pips

- Moderate markets: 30-50 pips

- Slow markets: 50-100 pips

Trailing Step (Default: 3 pips)

How frequently the trailing stop updates. Smaller values mean tighter, more responsive trailing. This is set very aggressively by default for maximum profit protection.

Placement Hour and Minute (Default: 16:30)

When the EA places daily orders. This should align with your strategy and instrument's active hours.

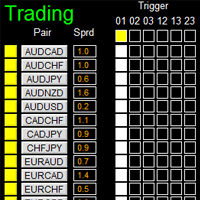

BEST INSTRUMENTS TO TRADE

HIGHLY RECOMMENDED:

US30 (Wall Street 30 / Dow Jones)

Excellent volatility during US session. High probability of 200+ point daily breakouts. Best results during US market open and economic news releases.

NAS100 (NASDAQ 100)

Extreme volatility provides large profit potential. Ideal for aggressive trailing stops. Avoid during low liquidity Asian session.

XAUUSD (Gold)

Strong trending behavior during breakouts. Responds well to geopolitical events and US dollar movements. Best during London and New York overlap.

GBPJPY, GBPUSD, EURUSD

Major forex pairs with sufficient daily range. GBPJPY offers highest volatility. These pairs work well with 150-300 pip gaps.

NOT RECOMMENDED:

Low volatility exotic pairs with insufficient daily range

Cryptocurrency pairs on some brokers (check swap costs and spreads)

Instruments with wide spreads that eat into profit potential

OPTIMAL TRADING TIMES

16:30 Server Time (Default)

This typically aligns with late European session or early US session depending on your broker's server timezone. This period often sees:

- Increased volatility as US markets open

- News releases that trigger breakouts

- Good follow-through momentum

Alternative Times to Consider:

00:00-02:00 Server Time

Captures Asian session breakouts. Best for JPY pairs and indices like Nikkei.

08:00-10:00 Server Time

London open provides strong momentum for EUR, GBP pairs and gold.

13:00-15:00 Server Time

US session open, ideal for US indices and USD pairs.

Important: Always check your broker's server timezone and adjust placement time accordingly to capture your preferred market session.

RESULTS VARIATION BY INSTRUMENT AND INPUTS

High Volatility + Large Pip Gap:

Fewer trades, higher win rate, larger average wins. More stable equity curve but potentially slower account growth.

High Volatility + Small Pip Gap:

More frequent trades, more whipsaws, requires tighter stops. Higher profit potential but increased drawdown risk.

Low Volatility + Large Pip Gap:

Very few trades. May go days without triggers. When trades occur, they tend to be high quality.

Low Volatility + Small Pip Gap:

Frequent small trades with mixed results. Not recommended as spread costs become significant relative to profit targets.

RISK MANAGEMENT RECOMMENDATIONS

Always ensure your lot size represents no more than 1-2 percent of account balance per trade. The EA validates lot sizes automatically but does not calculate position sizing based on account balance.

For a 10,000 USD account:

- Maximum risk per trade: 100-200 USD

- With 100 pip stop loss on EURUSD: Use 0.10-0.20 lots

- With 100 pip stop loss on US30: Use 0.01-0.02 lots (depending on broker contract size)

STRATEGY PERFORMANCE EXPECTATIONS

This straddle strategy performs best during:

- Trending markets with clear directional bias

- High-impact news events (NFP, interest rate decisions, GDP releases)

- Breakout from consolidation patterns

- Session overlaps with increased liquidity

The strategy underperforms during:

- Ranging, sideways markets

- Low liquidity periods (holidays, summer months)

- Extreme whipsaw conditions with false breakouts

VISUAL INTERFACE

The EA displays a purple dashboard in the upper left corner showing:

- EA name (Break Hunter 28)

- Today's Profit/Loss

- Current account balance

- Current account equity

- Developer information

This information is hardcoded and cannot be modified, ensuring proper attribution.

TECHNICAL FEATURES

- Automatic instrument detection (Forex, Gold, Indices, etc.)

- Dynamic pip value calculation for accurate order placement

- Lot size validation to meet broker requirements

- One-Cancels-Other (OCO) logic for automatic opposite order deletion

- Fast trailing stop with customizable parameters

- Daily reset mechanism for fresh order placement

- Compatible with netting and hedging account types

IMPORTANT NOTES

This EA requires adequate margin for two pending orders. While only one will be triggered, both must be supported by available margin when placed.

The EA trades only the symbol on which it is attached. For multi-symbol trading, attach the EA to multiple charts with appropriate settings for each instrument.

Server time varies by broker. Test in strategy tester or demo account to confirm your placement time captures desired market session.

Results are not guaranteed and past performance does not indicate future results. Always test thoroughly on demo account before live trading.

RECOMMENDED SETTINGS BY INSTRUMENT

US30 / NAS100:

Pip Gap: 200-400, Stop Loss: 100-200, Take Profit: 300-500, Trailing: 30-50

XAUUSD:

Pip Gap: 150-300, Stop Loss: 100-150, Take Profit: 200-400, Trailing: 20-30

EURUSD / GBPUSD:

Pip Gap: 100-200, Stop Loss: 50-100, Take Profit: 150-300, Trailing: 20-40

GBPJPY:

Pip Gap: 150-300, Stop Loss: 80-150, Take Profit: 200-400, Trailing: 30-50

These are starting points. Optimize based on your risk tolerance, broker spreads, and backtesting results.

SUPPORT AND OPTIMIZATION

For best results, backtest the EA on your specific broker and instrument for at least 3-6 months of historical data. Pay attention to drawdown periods and adjust pip gap and stops accordingly.

Monitor the first week of live trading closely on a demo account to ensure order placement timing aligns with your strategy goals.

Break Hunter 28 is designed for traders who understand breakout strategies and accept the inherent risks of aggressive trailing stops in exchange for maximized profit capture during strong trends.