CryptoSlayer

- Experts

- VALU VENTURES LTD

- 버전: 3.3

- 업데이트됨: 16 10월 2025

- 활성화: 10

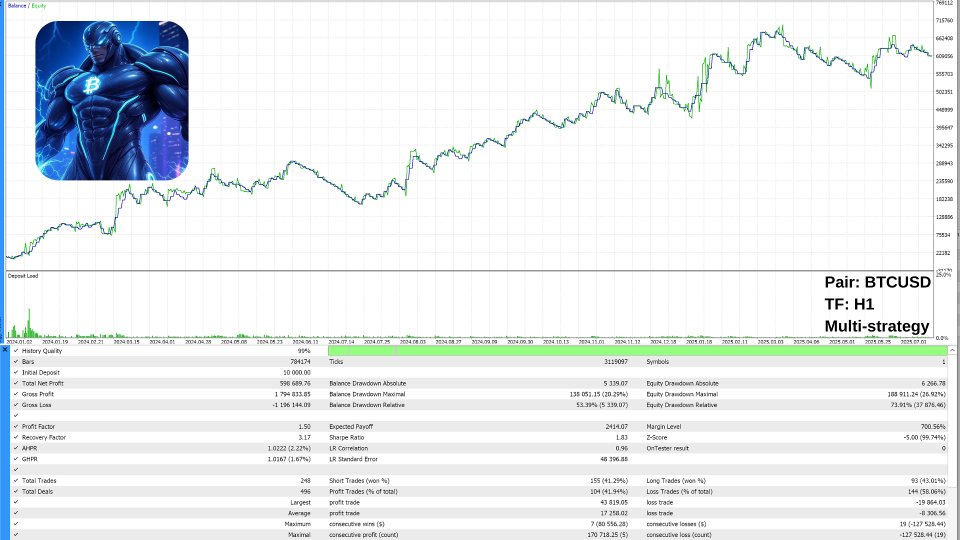

Crypto Slayer EA v2.3 - Multi-Strategy Crypto Trading System

Crypto Slayer EA v2.3 is a comprehensive trading system designed for cryptocurrency markets, featuring multiple integrated strategies and advanced risk management.

Trading Strategies

The system includes 25 trading strategies organized into three categories:

Technical Analysis Strategies:

-

MA Crossover

-

RSI Momentum

-

MACD Signal

-

Bollinger Bands

-

Market Structure

-

Multi-timeframe Analysis

-

Breakout Trading

-

ATR Position Sizing

-

Support/Resistance

-

Harmonic Patterns

-

Volume Profile

-

Fibonacci

-

Candlestick Patterns

-

Trend Lines

-

Round Numbers

-

Mean Reversion

-

Order Flow

-

Volatility Trading

Advanced Pattern Strategies:

-

Elliott Wave

-

Ichimoku System

-

Pattern Recognition

-

RSI Oversold/Overbought

-

Divergence Trading

Portfolio Management:

-

Universal risk controls

-

Dynamic position sizing

-

Kelly Criterion allocation

-

Portfolio-wide limits

Key Features

-

25 Independent Strategies: Each with individual controls and risk management

-

Universal Risk Management: Multiple sizing methods including Kelly Criterion and ATR-based

-

Smart Filter System: Volatility, spread, session, and momentum filters

-

Broker Compatibility: Auto-detects broker settings and crypto symbols

-

Backtesting Optimization: Enhanced accuracy with bar-close simulation

-

Portfolio Controls: Maximum positions, risk limits, emergency stops

-

Performance Tracking: Individual strategy analytics and reporting

Trading Approach

-

Multi-timeframe analysis (M5 to H4)

-

Session intelligence with major market session detection

-

Volatility-based position sizing

-

Enhanced stop-loss and take-profit logic

-

Real-time performance monitoring

Setup & Configuration

-

Ready to use with default settings

-

Individual Strategy Controls: Enable/disable any of the 25 strategies

-

Risk Customization: Set risk per strategy and portfolio-wide limits

-

Timeframe Selection: Choose optimal timeframes for each strategy

Risk Management

-

Individual strategy position limits

-

Portfolio-wide risk controls

-

Dynamic position sizing based on market conditions

-

Emergency stop-loss protection

-

Daily drawdown limits

Technical Specifications

-

Platform: MetaTrader 5

-

Markets: Cryptocurrencies (optimized for Bitcoin)

-

Account Types: Compatible with all MT5 account types

-

Minimum Deposit: Recommended according to risk settings

Ideal For

-

Traders seeking strategy diversification

-

Professionals wanting comprehensive crypto trading solutions

-

Investors looking for risk-distributed approach

Important Notice

Backtesting is recommended before live trading. Past performance does not guarantee future results. Trade responsibly and use proper risk management.