XMaster XHMaster formula MT4 Indicator No Repaint

- インディケータ

- Mehnoosh Karimi

- バージョン: 3.2

- アップデート済み: 1 12月 2025

XMaster XHMaster Formula MT4 Indicator – No Repaint Strategy

The XMaster / XHMaster Formula Indicator for MetaTrader 4 (MT4) is one of the most popular non-repaint tools used in Forex trading. According to sources like XS.com and TradingFinder, the indicator is designed to detect market direction, momentum strength, and potential reversal areas with high accuracy.

This MT4 version blends multiple technical elements—such as EMA-based trend analysis, MACD momentum, RSI and Stochastic oscillators, and volatility filters—to generate clean buy and sell signals that remain stable after the candle closes.

Indicator Classification

| Feature | Description |

| Category | Trend – Momentum – Reversal |

| Platform | MetaTrader 4 (MT4) |

| Skill Level | Beginner to Advanced |

| Indicator Type | Leading – Entry/Exit Signals |

| Time Frame | M1–H4 and higher |

| Trading Style | Scalping – Day Trading – Swing Trading |

| Markets | Forex, Gold, Crypto, Indices |

How the XMaster Formula MT4 Works

Based on the information from TradingFinder and the no-repaint script version on TradingView, the MT4 indicator uses two core analytical layers:

1. Standard Mode

- Uses fast and slow EMAs (e.g., EMA 10 & EMA 38) to calculate normalized momentum between 0–100.

- Buy Signal: Value crosses upward above the bullish threshold and indicator color turns green.

- Sell Signal: Value crosses downward below the bearish threshold and color turns red.

- Designed for simple, high-clarity trend detection.

2. Advanced Mode

Built from multi-indicator confluence techniques mentioned in TradingView’s No-Repaint version:

- MACD: Confirms positive or negative momentum.

- RSI: Oversold (<30) supports buy setups; overbought (>70) supports sell setups.

- Stochastic: Helps identify extreme turning points.

- Parabolic SAR: Confirms trend direction and reduces false signals.

A valid signal appears only when the majority of these components align.

Visual Signal System

- Green Arrow / Line: Bullish continuation or reversal zone.

- Red Arrow / Line: Bearish reversal or trend continuation.

- No Repaint: Signals stay fixed after the candle closes — confirmed by both XS.com and TradingFinder as a major advantage of this indicator.

This stability makes the MT4 version especially effective on volatile pairs like XAUUSD or GBP pairs.

How to Install the XMaster Formula on MT4

- Download the MT4 file (.ex4 or .mq4).

- Open MT4 → File → Open Data Folder.

- Navigate to MQL4 → Indicators.

- Paste the indicator file into the folder.

- Restart MT4 or refresh the Navigator panel.

- Drag the indicator onto your chart and customize sensitivity, colors, or thresholds based on your strategy.

Trading with XMaster MT4

Buy Setup

- Green signal appears.

- Indicator rising from lower levels (momentum strengthening).

- Price forms a bullish confirmation candle.

- Stop-loss placed below the signal candle or recent swing low.

Sell Setup

- Red signal appears.

- Indicator dropping from overbought or upper levels.

- Bearish price candle confirms the shift.

- Stop-loss above the signal candle or nearest swing high.

Strengths and Limitations

Strengths

- Non-repaint signals (verified by XS and TradingFinder).

- Works across all timeframes and assets.

- Easy visual interpretation suitable even for beginners.

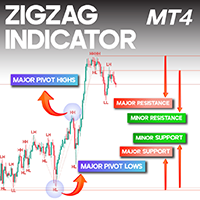

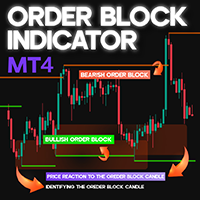

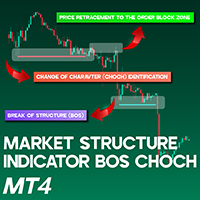

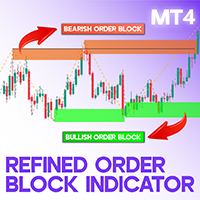

- Can be used with trendlines, support/resistance, or supply/demand for improved accuracy.

Limitations

- May produce false signals during sideways markets.

- Works best when combined with market structure, liquidity zones, or secondary confirmation tools.

- Trend-based calculations can lag in extremely volatile conditions.

Summary

The XMaster XHMaster Formula MT4 Indicator is a powerful, non-repaint trend and reversal tool widely used by Forex traders. Built on EMA trend logic and supported by momentum oscillators, it provides clear and reliable buy/sell signals. With its simple visuals and high accuracy, the MT4 version is ideal for scalping, intraday trading, and swing strategies. When paired with proper risk management and technical confirmation, it can significantly enhance trade decision-making.