Gartley Projections D

- Indicatori

- Oleksandr Medviediev

- Versione: 3.55

- Aggiornato: 8 dicembre 2025

- Attivazioni: 20

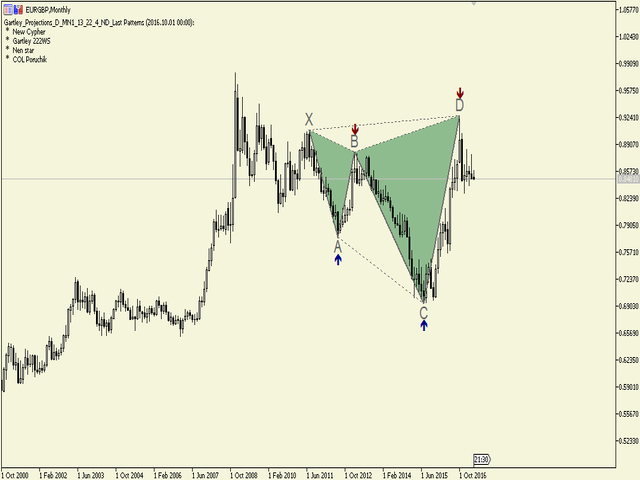

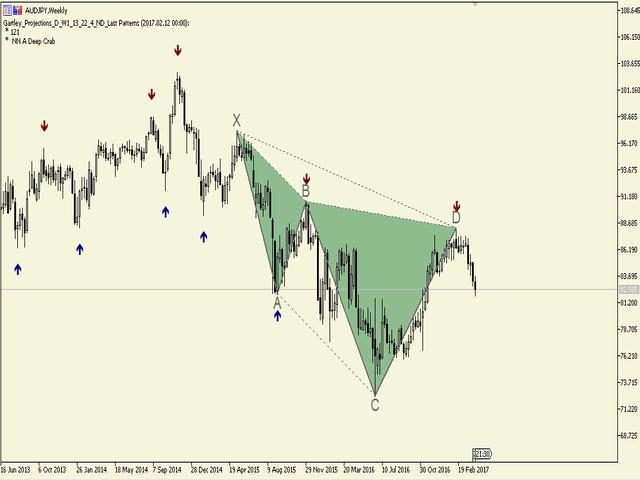

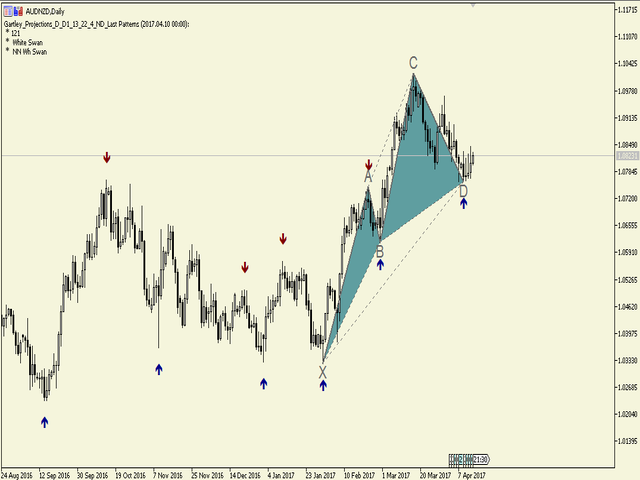

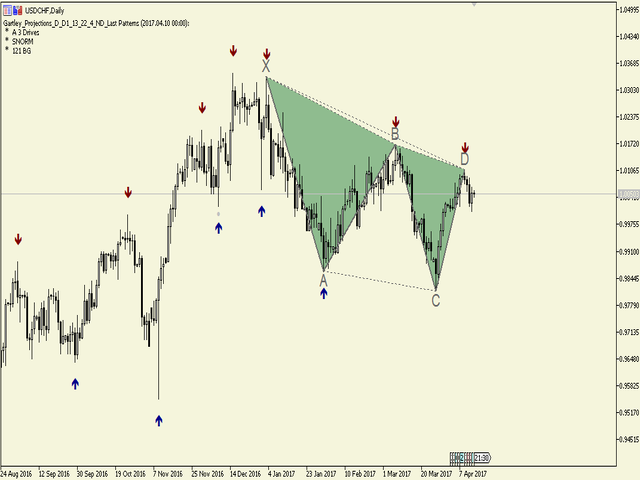

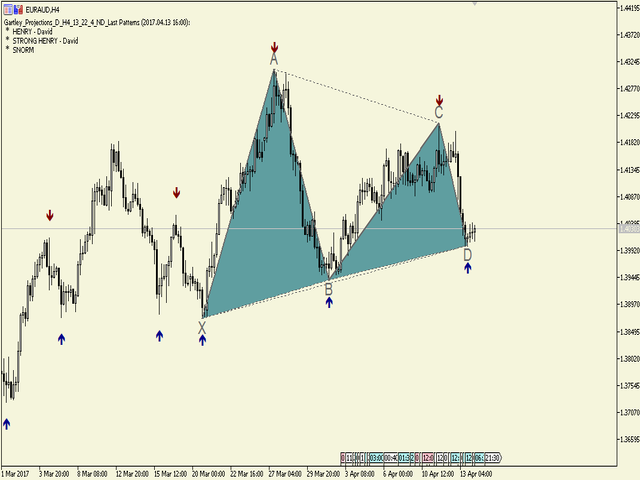

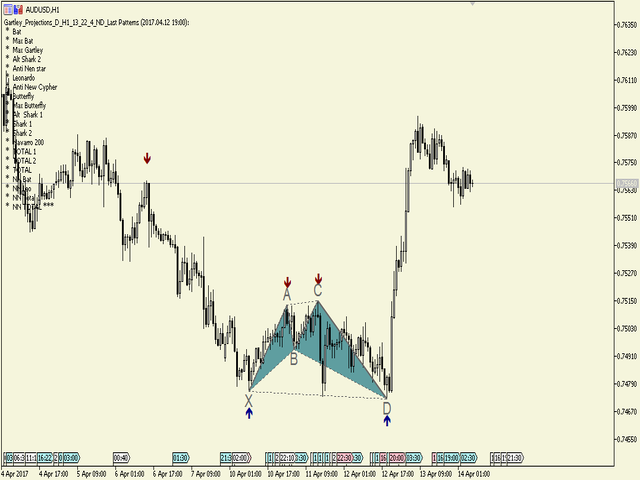

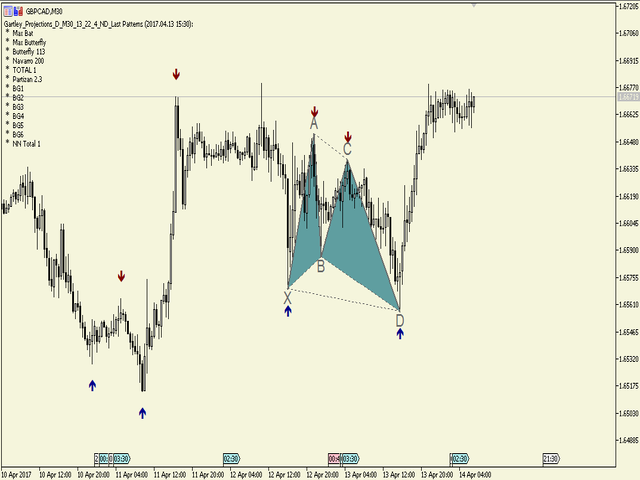

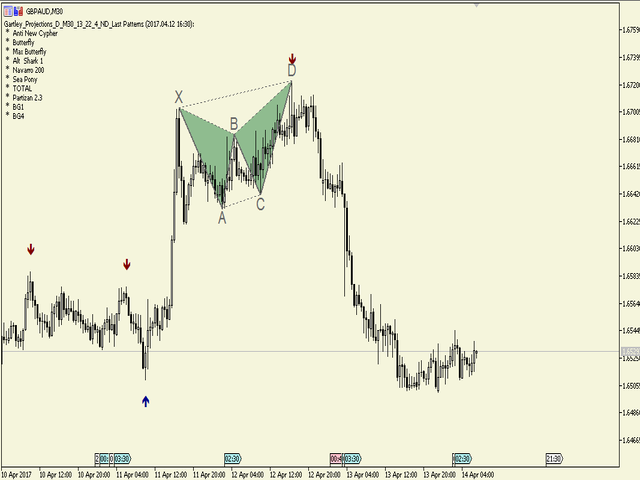

The indicator identifies the harmonic patterns (XABCD) according to developments of H.M.Gartley ("Profits in the Stock Market", 1935г).

It projects D-point as a point in the perspective projection (specify ProjectionD_Mode = true in the settings).

Does not redraw. When a bar of the working timeframe closes, if the identified pattern point has not moved during Patterns_Fractal_Bars bars, an arrow appears on the chart (in the direction of the expected price movement). From this moment on, the arrow permanently remains on the chart.

NOTE: 2-3 and more arrows in a row - this is changing market conditions, NOT redraw.

The total number of patterns is 85 (including Gartley-222 and Gartley-222WS, the full list is available at the link to drive.google in the Comments section). Only the latest identified pattern is filled with a solid color among all identified patterns.

Parameters

- DrawPatterns (true/false) - draw a pattern with a solid color

- ProjectionD_Mode (true/false) - mode for defining the D-point as a projection in perspective

- Patterns_Fractal_Bars - the number of the working timeframe bars, during which the latest identified pattern point must remain fixed for it to be considered a formed fractal (an arrow appears on the chart)

- Patterns_Deviation - allowed percentage deviation from the reference values of side proportions in a pattern (allowed value range)

- Patterns_XA_MinLength_Bars - the minimum allowed number of bars on the initial segment XA

- Patterns_XA_MinHeight_Points - the minimum allowed size of the initial segment XA in points

- ZigZag_Depth - parameter of the ZigZag indicator

- ZigZag_Deviation - parameter of the ZigZag indicator

- ZigZag_Backstep - parameter of the ZigZag indicator

- ShowInfo (true/false) - display the list of identified patterns at the left side of the chart

- PrintInfo (true/false) - print the information to the log

For clarity and better practical use, I prefer to split all harmonic patterns into 12 groups:

-

Golden-Ratio – classic Fibonacci symmetry

-

Moderate-Retracement – shallow B-point pullbacks

-

Deep-Retracement – deep B-point retracements

-

Extreme-Extension – stretched BD/XB extensions

-

Reciprocal-Structure – mirror-symmetric AC legs

-

Shark-Family – specific 0.752 / 1.373 AC ratios

-

Anti-Patterns – inverse-logic harmonic structures

-

Extreme-Expansion – oversized XB or XD legs

-

Special-Symmetry – BD ≈ XD proportional symmetry

-

Balanced-Complex – multi-condition blended ratios

-

BG-Series – XB=0.507, XD=1.00 proprietary set

-

Swan-Patterns – Black/White Swan extreme models

Also a verry good indicator