Multi Timeframe Analysis

- Indicatori

- Teerathad Booranawisedkul

- Versione: 2.0

- Aggiornato: 7 febbraio 2026

- Attivazioni: 10

FREE 7-DAY TRIAL

After your trial ends, continue using this essential trading tool for only $30 one-time payment.

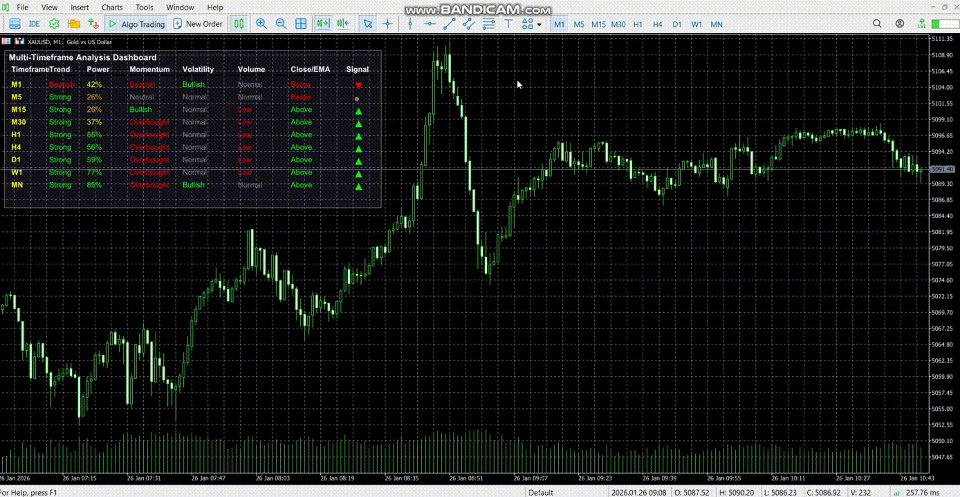

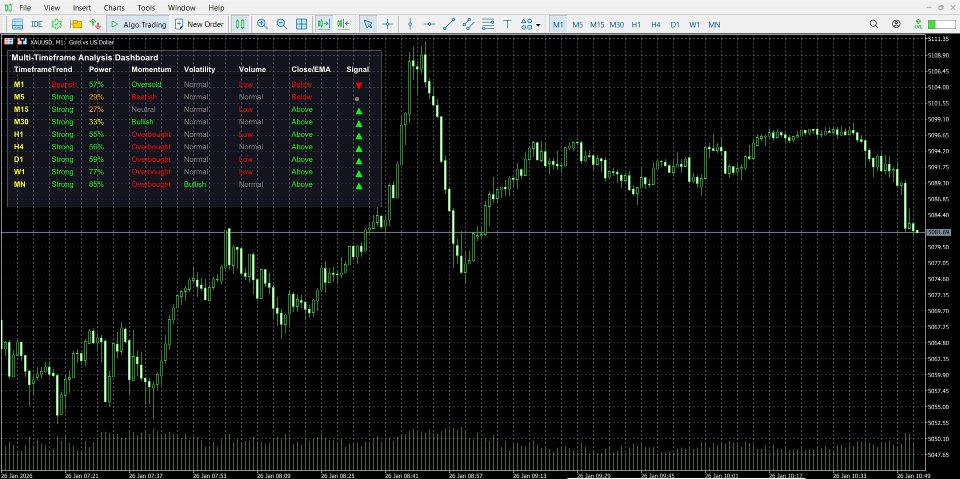

Multi-Timeframe Dashboard Indicator

A comprehensive multi-timeframe analysis tool that displays market conditions across 9 timeframes simultaneously on a single dashboard panel.

Timeframes Analyzed

M1, M5, M15, M30, H1, H4, D1, W1, MN

Toggle visibility for each timeframe individually

Analysis Metrics

Trend - EMA crossover status (Strong/Weak/Bearish/Neutral)

Power - ADX strength percentage

Momentum - RSI-based momentum (Bullish/Bearish/Overbought/Oversold/Neutral)

Volatility - ATR comparison against 10-period average

Volume - Current volume vs average volume status

Close/EMA - Price position relative to fast EMA (Above/Below)

Signal - Combined signal with directional arrows (BUY / SELL / NEUTRAL)

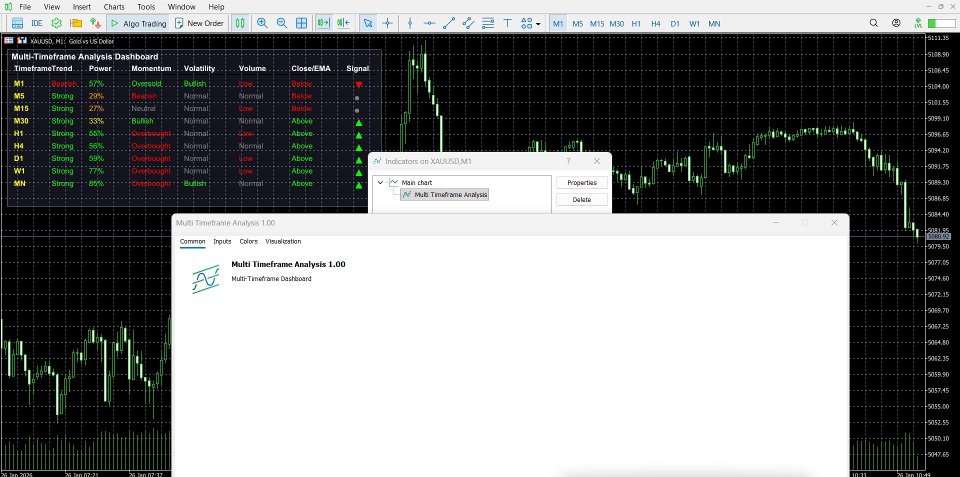

Configuration

Adjustable indicator periods:

RSI Period (default: 14)

ADX Period (default: 14)

ATR Period (default: 14)

Fast EMA (default: 20)

Slow EMA (default: 50)

Display settings:

Corner position (4 options)

X/Y offset

Background and text colors

Bullish/Bearish/Neutral colors

Timeframe selection:

Enable/disable any timeframe

Panel auto-adjusts height based on visible timeframes

Usage

The indicator automatically calculates and displays all metrics for selected timeframes. Each row shows complete market analysis for one timeframe. Signals combine trend, momentum, and price position to generate BUY/SELL/NEUTRAL recommendations.

Color coding:

Green = Bullish conditions

Red = Bearish conditions

Gray = Neutral conditions

Yellow = Timeframe label

Gradient = Power/strength levels