Gann Square of Nine

- Indicatori

- Mahmoud Ahmed Abdou Ali

- Versione: 2.0

Here is the full technical and strategic description for the Gann Square of 9 indicator.

Full Name

Gann Square of 9 - Intraday Levels (v2.0)

Overview

This is a mathematical Support & Resistance indicator based on W.D. Gann's "Square of 9" theory. Unlike moving averages which lag behind price, this indicator is predictive. It calculates static price levels at the very beginning of the trading day (based on the Daily Open) and projects them forward.

These levels act as a "road map" for the day, showing where price is likely to pause, reverse, or accelerate.

The Math (How it Works)

Gann believed that price and time are related geometrically. The algorithm uses the Square Root principle to find the next significant rotation levels.

-

Baseline: It takes today's Open Price.

-

Normalization: It converts the price into a "Gann Number" (adjusting for decimal points, e.g., turning 1.2000 into 12000).

-

Rotation Calculation:

-

It takes the Square Root of the price.

-

It adds or subtracts specific increments corresponding to degrees on a circle:

-

0.125 = 45°

-

0.250 = 90° (Quarter Circle)

-

0.500 = 180° (Half Circle - Major Pivot)

-

1.000 = 360° (Full Circle - Major Cycle End)

-

-

It squares the result back to get the projected price level.

-

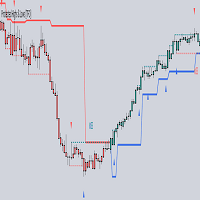

Visual Guide

🔵 Blue Lines (Resistance / Targets)

These levels are calculated above the Daily Open.

-

Use: If the market opens and moves UP, these are your Take Profit targets.

-

Breakout: If a candle closes strongly above a Blue line (especially the 90° or 180° line), it usually signals a continuation to the next level.

🔴 Red Lines (Support / Buy Zones)

These levels are calculated below the Daily Open.

-

Use: If the market moves DOWN, look for price to bounce at these levels.

-

Breakdown: If price breaks a Red line, it opens the door to the next lower level.

Key Levels to Watch

Not all lines are equal. In Institutional trading, specific degrees are more important:

-

90° (Level 2): The first major test. If price breaks this, the trend for the day is often established.

-

180° (Level 4): The "Line of Balance." Often the maximum range for a normal trading day.

-

360° (Level 7): The "Cycle Completion." If price hits this in one day, it is an extreme move (limit up/down) and a reversal is highly likely.