GEN Vertex Trading System

- Indicatori

- Gede Egi Narditya

- Versione: 1.2

- Aggiornato: 4 agosto 2025

- Attivazioni: 20

INDICATOR: GEN Vertex Trading System

Developer: gedeegi

General Description

GEN Vertex Trading System is a comprehensive trading system designed for MetaTrader 5 (MT5). This indicator combines two powerful market analysis methodologies into a single tool: a dynamic trend module (TurboTrend) and a market structure analysis module (Market Structure). Its purpose is to provide clear trend signals, identify key levels based on Smart Money Concepts (SMC), and present them in an intuitive visualization complete with an informative dashboard panel.

Key Features

- Dual Analysis System: Integrates two modules for holistic market analysis:

- TurboTrend Module: A volatility-based system to detect the main trend direction, providing entry signals and potential Take Profit signals.

- Market Structure Module: Automates the identification of key price action elements such as Swing Points, Break of Structure (BOS), Change of Character (CHoCH), as well as Supply and Demand zones.

- TurboTrend Signals:

- Candlestick Coloring: Provides green color for an uptrend, red for a downtrend, and gray for neutral/consolidation conditions.

- Entry Signals: Displays arrows on the chart for Bullish (buy) and Bearish (sell) signals when a trend change occurs.

- Take Profit Signals: Provides separate signals (box symbols) as an indication of a potential Take Profit area when the price reaches extreme deviation levels.

- Price Reaction Lines: Automatically marks the price level where a new trend signal appears, serving as dynamic support or resistance.

- Automatic Market Structure (SMC) Analysis:

- Swing High & Low Identification: Automatically detects and labels significant swing points on the chart.

- BOS & CHoCH Visualization: Draws Break of Structure (BOS) lines for trend continuation and Change of Character (CHoCH) for potential trend reversals.

- Supply & Demand Zones: Automatically draws Supply zones (from swing highs) and Demand zones (from swing lows), which serve as important areas for entries or targets.

- 0.5 Retracement Level: An option to display the 50% retracement level of the last swing move, helping to identify discount or premium zones.

- Interactive Dashboard Panel:

- Displays a summary of the status of key levels from both modules (Price Reaction Lines, Supply & Demand Zones).

- Shows the current price position relative to these levels.

- Can be minimized to save chart space.

- Comprehensive Notifications:

- Provides various types of notifications (Pop-up Alerts, Mobile Push, and Email) for all generated signals, ensuring traders do not miss opportunities.

Input Parameters

TurboTrend: Main Settings

- Length : The calculation period for the trend channel (a higher value results in slower but more confirmed signals).

- Multiplier : The multiplier for calculating the outer bands used for Take Profit signals.

- ColorUp / ColorDown : Sets the color for the candles and signals for uptrends/downtrends.

TurboTrend: Line Display Settings

- ShowLines : Enables/disables the display of the main trend channel lines.

- UpperLineColor / LowerLineColor : Sets the color for the upper and lower channel lines.

- LineStyle / LineWidth : Sets the style and width of the channel lines.

TurboTrend: Price Reaction Lines

- ShowBreakoutLine : Enables/disables the automatic horizontal lines when a signal appears.

- Bullish/BearishBreakoutLineColor : Sets the color for the Bullish and Bearish reaction lines.

- MaxRetestLines : The maximum number of reaction lines displayed on the chart.

Market Structure: General Settings

- swingSize : The number of candles to the left and right required to identify a swing pivot.

- bosConfType : The confirmation method for BOS/CHoCH (based on candle close or wick).

- choch / showSwing / showSwingZones : Options to display CHoCH labels, Swing points (H/L), and Supply/Demand zones.

- maxSwingZones : The maximum number of Supply/Demand zones to be displayed.

Other Settings

- Market Structure Colors: Color settings for all Market Structure elements (labels, lines, zones).

- 0.5 Retracement Level: Settings to display and customize the 0.5 retracement level.

- Performance: Option to limit the Market Structure calculation history to improve performance on long historical data.

- Dashboard Settings: Settings to display, position, and manage the dashboard on the chart.

- Notification Settings: Switches to enable various types of notifications (Alert, Push, Email).

Signal Logic

TurboTrend: The indicator uses a channel built from a Simple Moving Average (SMA) and Standard Deviation (StdDev), similar to Bollinger Bands.

- Entry Signal (Arrow): A Bullish signal appears when the price closes above the middle line of the channel after previously being below it. A Bearish signal appears when the price closes below the middle line after previously being above it.

- Take Profit Signal (Box): This signal serves as a warning that the trend may have reached a point of exhaustion. A Long TP signal appears if the price crosses below the upper outer band, and vice versa for a Short TP.

Market Structure:

- Swing Points: A high is identified as a swing high if it is surrounded by a number of candles (defined by swingSize ) with lower highs. Similar logic applies to a swing low.

- BOS/CHoCH: A BOS (Break of Structure) is confirmed when the price breaks a previous swing high in an uptrend, or a previous swing low in a downtrend. A CHoCH (Change of Character) is confirmed when the price breaks the minor structure opposing the main trend, signaling a potential reversal.

Usage

- Trend Confirmation: Use the candle colors from TurboTrend as a primary filter to determine if the market is bullish or bearish.

- Entry Areas: Look for TurboTrend arrow signals that appear in confluence with confirmation from the Market Structure. Example: A Bullish arrow signal that appears after the price bounces off a Demand zone or after a bullish BOS is a high-probability setup.

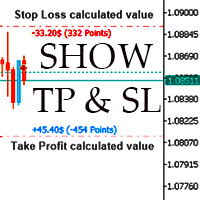

- Stop Loss & Take Profit Placement: Utilize the Supply/Demand zones and Price Reaction Lines as reference levels for placing a Stop Loss (outside the zone) or Take Profit (near the next zone).

- Contextual Analysis: Use the dashboard to quickly see where the price is in relation to important levels without having to scroll through the chart.