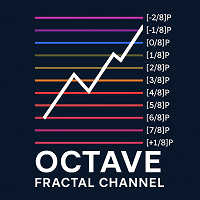

Octave Fractal Channel

- Indicateurs

- Sergei Semenov

- Version: 1.0

- Activations: 5

Octave Fractal Channel — Dynamic Gann-Based Support/Resistance Levels with Auto-Scaling.

This indicator plots a dynamic channel based on the fractal structure of price movement. Channel levels adapt to the current symbol and timeframe, making it suitable for use across various financial instruments — from currency pairs to cryptocurrencies and indices.

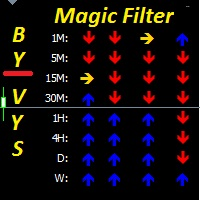

The indicator can be used in combination with other technical tools, such as the RSI oscillator, to provide additional signal filtering.

How to use

-

Level [6/8] may be considered a potential reversal zone downward. If price reaches this level and RSI begins rising after falling below 30, it may indicate a possible upward move.

-

Level [2/8] may be considered a potential reversal zone upward. If price reaches this level and RSI begins declining after exceeding 70, it may suggest a possible downward move.

-

Level [4/8] represents the central line of the channel. Price often consolidates near this zone. Opening positions close to this level is not recommended without additional confirmation.

-

Levels [0/8] and [8/8] mark the outer boundaries of the channel. These can be used to set stop-loss levels or as supplementary confirmation of trend direction.

To improve signal reliability, consider combining with:

- RSI behavior (period 14),

- Trading volume,

- Classic candlestick patterns (e.g., pin bars or engulfing patterns).

Repeated testing of levels [2/8] or [6/8] followed by a bounce may serve as an additional analytical signal.

This indicator does not guarantee signal accuracy and is not a standalone trading strategy. Additional analysis is recommended before making trading decisions.