Scalping Magic Cube M5

- Indicadores

- Andrey Kozak

- Versión: 1.0

- Activaciones: 20

Scalping Magic Cube es una herramienta inteligente multinivel de nueva generación diseñada para determinar con precisión la dirección del movimiento del mercado e identificar posibles puntos de cambio de tendencia.

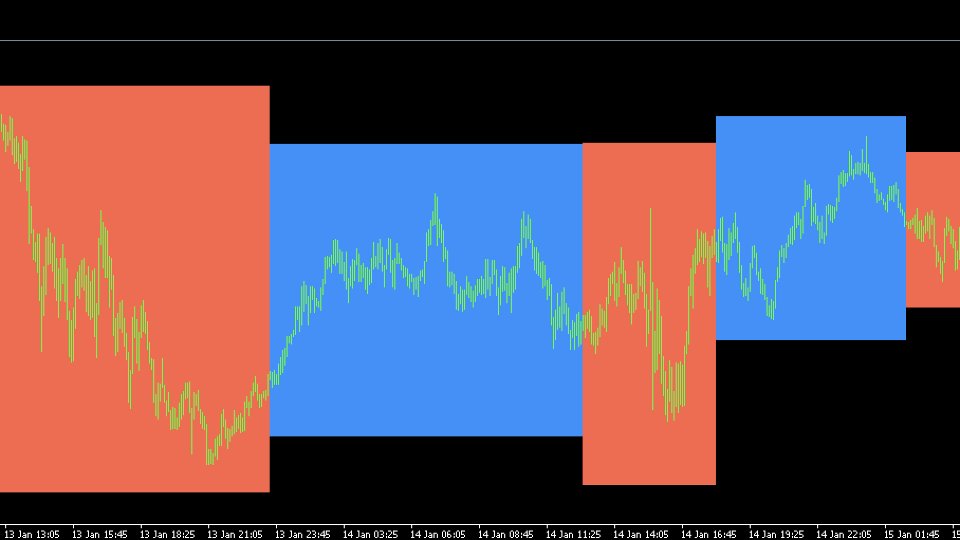

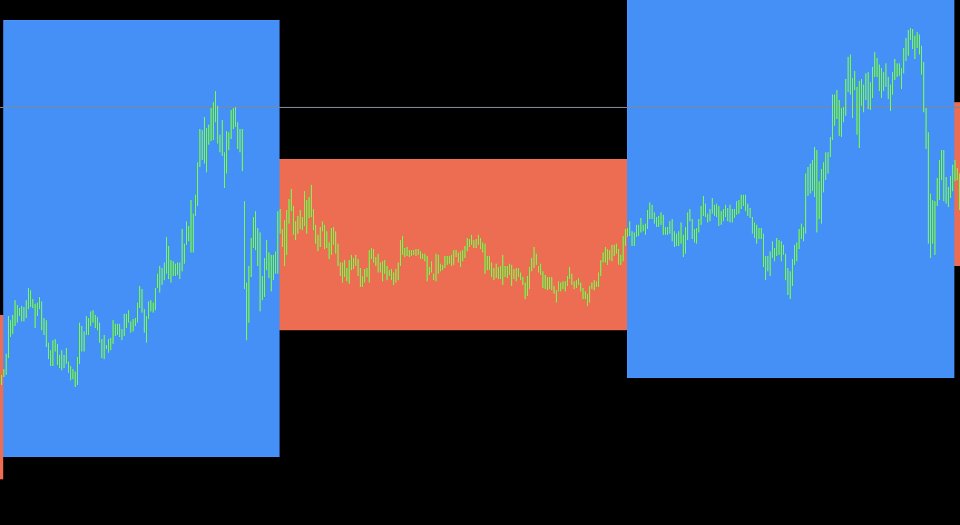

El indicador se basa en un complejo sistema de análisis que combina elementos de regresión lineal, medias móviles adaptativas, filtros dinámicos y modelos de evaluación de la fuerza de los impulsos. A diferencia de los métodos clásicos que reaccionan al precio con retraso, Scalping Magic Cube forma zonas de tendencia estables y las muestra como rectángulos de color con una proyección de regresión adicional.

Este enfoque permite al operador no sólo registrar visualmente las fases activas del mercado, sino también obtener una visión holística del estado actual del precio, la velocidad del movimiento y la dirección de la tendencia dominante.

Estrategia de trabajo con el indicador

Definición de la tendencia

En el gráfico se forman rectángulos de colores: azul - tramos ascendentes del movimiento, rojo - descendentes.

Filtrado de señales

La transición de una zona a otra se produce sólo después de la confirmación de la nueva configuración del mercado. Esto le permite evitar la mayoría de las señales falsas que se producen durante las fluctuaciones a corto plazo.

Trabajar en la zona

Mientras el precio se encuentre dentro de la zona formada, se recomienda abrir posiciones en la dirección de esta zona. Para acompañar las operaciones, puede utilizar el canal de retroceso como punto de referencia adicional.

Cambio de tendencia

Cuando se forma una nueva zona del color opuesto, se recomienda al operador cerrar las posiciones anteriores y considerar la posibilidad de entrar en la dirección del nuevo movimiento.

Marcos temporales de aplicación

En M1-M5: operaciones rápidas en la dirección de la tendencia dominante, recogida de beneficios al alcanzar los límites del canal.

En M15-M30: trabajo en el formato de mantenimiento hasta el final de la zona de tendencia con la posibilidad de utilizar filtros adicionales.

Ventajas del indicador

- Adaptabilidad y resistencia a las condiciones cambiantes del mercado.

- Filtración de la mayor parte del ruido del mercado gracias a un filtrado complejo.

- Clara separación visual de las fases de movimiento del mercado.

- Sin redibujado de señales.

- Versatilidad: el indicador es adecuado tanto para el scalping como para la negociación intradía.

Parámetros del indicador

- FastMAPeriod - período de la media móvil exponencial rápida.

- SlowMAPeriod - periodo de la media móvil exponencial lenta.

- ADXPeriod - periodo ADX utilizado para evaluar la fuerza de la tendencia.

- ADXGate - valor ADX mínimo para reconocer un movimiento como tendencia.

- LRLenn - profundidad de cálculo de la regresión lineal.

- MinSlopeATR - pendiente mínima del movimiento normalizada por ATR.

- ConfirmBars - número de barras que confirman un cambio de tendencia.

- LockBars - número mínimo de barras después de una inversión antes de que un nuevo cambio de dirección sea posible.

- InitScanBars - número de barras históricas para la inicialización del indicador.

- ShowChannel - mostrar u ocultar el canal de regresión.

- MaxChannelBars - número máximo de barras para construir un canal.