Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.08 15:27

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Bullish

-

Lack of easing by ECB sparks Euro reversal versus Australian Dollar and Japanese Yen.

- Euro catches a bid on mixed US NFP report, clear $1.3600 versus US Dollar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.09 16:58

EUR/USD weekly outlook: February 10 - 14The euro rose against the dollar on Friday after data showed that the U.S. economy added fewer-than-expected jobs last month, but the data did little to alter expectations that the Federal Reserve will continue to scale back its stimulus program.

Monday, February 10

In the euro zone, France is to release data on industrial production.

Tuesday, February 11

Federal Reserve Chair Janet Yellen is to testify on the bank’s semiannual monetary policy report before the House Financial Services Committee, in Washington.

Wednesday, February 12

The euro zone is to release data on industrial production.

ECB President Mario Draghi is to speak at an event in Brussels.

Thursday, February 13

The ECB is to publish its monthly bulletin.

The U.S. is to produce data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. The nation is also to release the weekly report on initial jobless claims.

Federal Reserve Chair Janet Yellen is to testify on the bank’s semiannual monetary policy report before the House Financial Services Committee, in Washington.

Friday, February 14

The euro zone is to release preliminary data on fourth quarter gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth. Germany, France and Italy are also to release preliminary estimates on fourth quarter growth.

The U.S. is to wrap up the week with the closely watched preliminary reading of the University of Michigan consumer sentiment index. The U.S. is also to release data on import prices and industrial production.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.11 16:32

2013-02-11 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

Due to testify on the Semiannual Monetary Policy Report before the House Financial Services Committee, in Washington DC

==========

Europe Stocks Rise as Yellen Says Jobs Recovery Not Over

European stocks rose, with the Stoxx Europe 600 Index climbing for a fifth day, as Federal Reserve Chairman Janet Yellen said more work is needed to restore the labor market to health.

==========

Fed chair Janet Yellen promises 'continuity,' further stimuls reduction

U.S. Federal Reserve Chair Janet Yellen says that if the economy keeps improving, the U.S. central bank will take "further measured steps" to reduce the support it's providing through monthly bond purchases.

In her first public comments since taking over the top Fed job last week, Yellen said Tuesday that she expects a "great deal of continuity" with her predecessor, Ben Bernanke. She signalled that she supports his view that the economy is strengthening enough to withstand a pullback in stimulus but that interest rates should stay low to fuel further growth.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 28 pips price movement by USD - Fed Chair Yellen Speech news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.13 06:11

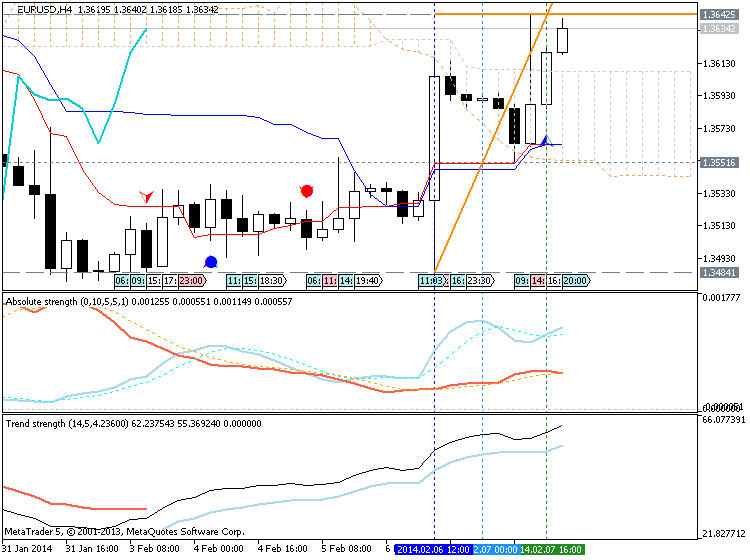

EURUSD Technical Analysis (based on dailyfx article)

EURUSD found a top just shy of a trendline confluence. The market is in a range (within a range within a range). Support is estimated at 1.3527/55 and resistance is seen at 1.3637 now. Stronger resistance is probably 1.3745.

Bigger picture, the response in late December from the trendline that extends off of the 2008 and 2011 highs does suggest that the market may have made an important top BUT the failed breakdown in late January / early February hints at a bottoming process. Play the range.

LEVELS: 1.3480 1.35271.3576 | 1.3637 1.3672 1.3699

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_17235.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_38840.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_2085.png

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.13 15:10

2013-02-13 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]- past data is 0.2%

- forecast data is 0.0%

- actual data is -0.4% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Retail Sales Show Unexpected Drop In January

With auto sales showing another notable decrease, the Commerce Department released a report on Thursday showing an unexpected drop in U.S. retail sales in the month of January.

The report said retail sales dropped by 0.4 percent in January following a revised 0.1 percent decrease in December. Economists had expected sales to come in unchanged compared to the 0.2 percent increase originally reported for the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 20 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.14 07:35

2013-02-14 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - CPI]- past data is 2.5%

- forecast data is 2.4%

- actual data is 2.5% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China CPI Climbs 2.5% On Year In January

Consumer prices in China were up 2.5 percent on year in January, the National Bureau of Statistics said on Friday.

That was unchanged from the December reading, and it exceeded forecasts for 2.4 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 7 pips price movement by CNY - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.14 07:15

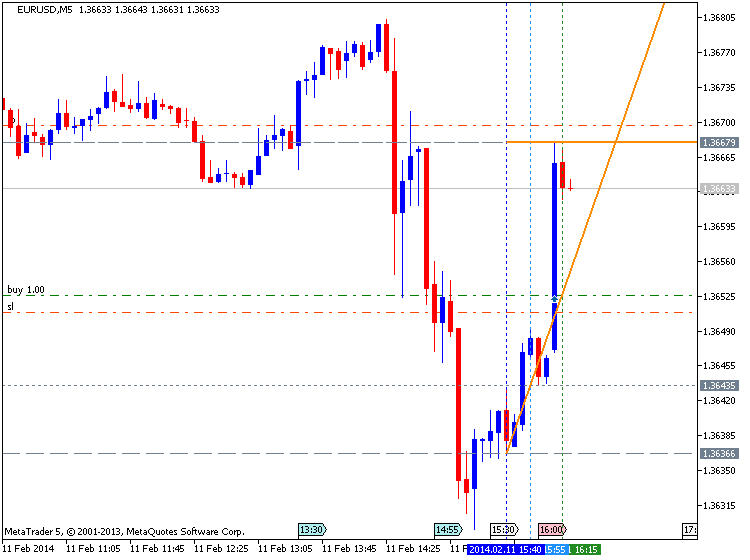

Trading the News: German Gross Domestic Product (based on dailyfx article)Germany’s Gross Domestic Product (GDP) figure may undermine the recent rebound in the EURUSD as Europe’s largest economy is expected to grow yet another 0.3% during the last three-months of 2013.

What’s Expected:

Time of release: 02/14/2014 7:00 GMT, 2:00 EST

Primary Pair Impact: EURUSD

Expected: 0.3%

Previous: 0.3%

Forecast: 0.1% to 0.3%

Why Is This Event Important:

A disappointing growth report may put increased pressure on the European Central Bank (ECB) to further embark on its easing cycle amid the threat for disinflation, and the single currency may continue to carve a series of lower highs paired with lower lows amid the protracted recovery in the monetary union.

How To Trade This Event Risk

Bearish Euro Trade: German 4Q GDP Misses Market Forecast

- Need red, five-minute candle following the report to favor a bearish Euro trade

- If reaction favors short Euro trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to consider a long EURUSD trade

- Implement same strategy as the bearish Euro trade, just in the opposite direction

Potential Price Targets For The Release

- At Risk for Range-Bound Prices Ahead of ECB March 6 Meeting

- Relative Strength Index Clears Bearish Trend

- Interim Resistance: 1.3800 (100.0 expansion) to 1.3830 (61.8 retracement)

- Interim Support: 1.3450 (38.2% retracement) to 1.3460 (50.0% expansion)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 26 pips price movement by EUR German GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.14 11:41

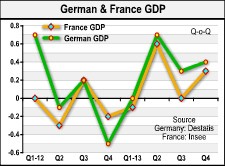

German, France Q4 GDP Growth Exceeds Expectations

German and French economic growth at the end of 2013 exceeded expectations, underpinned by investment and foreign demand, official figures revealed Friday. The data bodes well for the larger euro currency bloc that is struggling to see a stable expansion.

According to preliminary data from the Federal Statistical Office, German economic growth accelerated marginally to 0.4 percent in the fourth quarter from a quarter ago. The growth exceeded expectations for 0.3 percent growth.

Elsewhere, the French economy expanded 0.3 percent sequentially in the fourth quarter after stagnating in the third quarter. The growth figure was marginally above the 0.3 percent forecast by economists. The third quarter GDP figure was upgraded from 0.1 percent fall.

The report revealed that positive contributions to German GDP were came mainly from foreign trade. The increase in exports of goods and services was substantially higher than that of imports.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.14 15:37

2013-02-14 14:15 GMT (or 15:15 MQ MT5 time) | [USD - Industrial Production]- past data is 0.3%

- forecast data is 0.3%

- actual data is -0.3% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Industrial Production Shows Unexpected Drop In January

With severe weather curtailing manufacturing production in some regions of the country, the Federal Reserve released a report on Friday showing that U.S. industrial production unexpectedly decreased in the month of January.

The report said industrial production fell by 0.3 percent in January after rising by 0.3 percent in December. The pullback came as a surprise to economists, who had expected production to increase by another 0.3 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 12 pips price movement by USD - Industrial Production news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line of Ichimoku indicator came in very close way to historical price for future possible breakout on D1 timeframe. D1 price is located in Ichimoku cloud/kumo trying to break Sinkou Span A line (one of the border of kumo) for bullish reversal.

By the way, there is already bullish reversal was happened on H4 timeframe and H4 price is above the cloud with primary bullish market condition. And we can see the primary bullish (ranging but bullish) on W1 timeframe too.

If the price will break 1.3688 resistance on D1 close bar together with breaking upper Ichimoku cloud border (Sinkou Span A) and with Chinkou Span line crossing the price on close bar so we may see good breakout on D1 timeframe (good to open buy trade).If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-02-10 07:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Industrial Production]

2013-02-11 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2013-02-12 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - Trade Balance]

2013-02-12 15:30 GMT (or 16:30 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2013-02-13 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German CPI]

2013-02-13 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - ECB Monthly Bulletin]

2013-02-13 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2013-02-13 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2013-02-14 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - CPI]

2013-02-14 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - PPI]

2013-02-14 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German GDP]

2013-02-14 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]

2013-02-14 14:55 GMT (or 15:55 MQ MT5 time) | [USD - University of Michigan Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart