Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 09:58

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Market participants may pay increased attention to the key developments coming out of the U.S. as another slew of Fed officials (New York Fed President William Dudley, Philadelphia Fed President Patrick Harker, Fed Governor Daniel Tarullo) are scheduled to speak throughout the first full-week of April, while U.S. Non-Farm Payrolls (NFP) are projected to increase another 175L in March. Recent comments from Fed Vice-ChairStanley Fischer suggests the central bank remains on course to implement three or four rate-hikes in 2017 despite the uncertainty surrounding fiscal policy, and a batch of hawkish central bank rhetoric paired with a further improvement in the labor market dynamics may heighten the appeal of the greenback as it puts increased pressure on the FOMC to raise the federal funds rate sooner rather than later."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.07 08:28

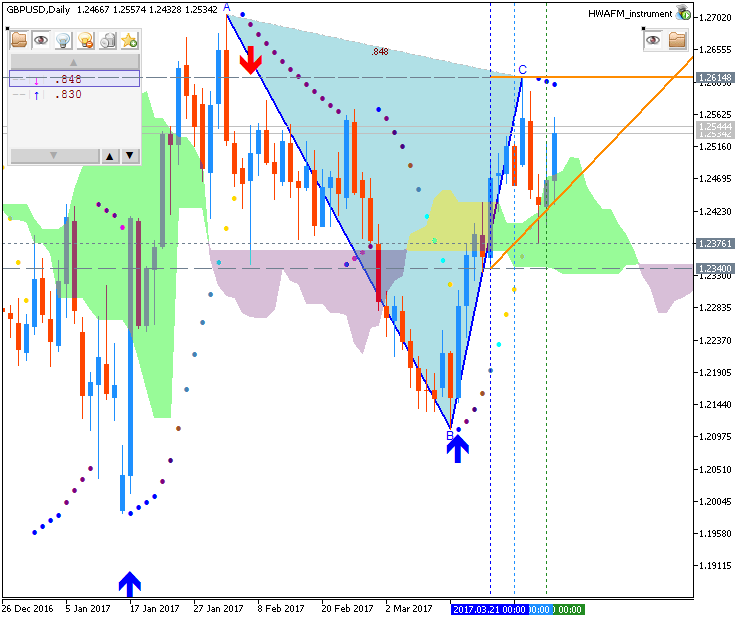

GBP/USD - inside the ranging area for the bearish to be resumed or for the bullish reversal to be started (based on the article)

Daily price is below 200-day SMA and above 100-day SMA for the bullish ranging market condition. The price is within 1.2614/1.2421 support/resistance levels waiting for the bearish trend to be resumed or for the bullish reversal to be started.

- "Bulls of GBP/USD will be encouraged by a well-defined pennant formation on the daily chart (see below), a continuation pattern that points to further strength after the pair’s climb from 1.2113 on March 14 to 1.2613 on March 27. If the formation works as it should in theory, a break to the upside above 1.2465 in a few days’ time could lead to an advance equivalent to the height of the “flagpole” – that five-big-figure advance between March 14 and March 27 – taking it to 1.2965."

- "Moreover, there is plenty of support for the exchange rate at its current level. It has already held twice this week at the trendline support from that recent low on March 14, while the 50-day and 100-day moving averages both lie just below the current 1.2470 at close to 1.24."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 12:43

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Market participants may put increased emphasis on the fresh rhetoric coming out of the FOMC with Chair Janet Yellen scheduled speak next week, and the greenback may stage a larger advance over the days ahead should the central bank head show a greater willingness to implement higher borrowing-costs over the coming months."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.11 11:52

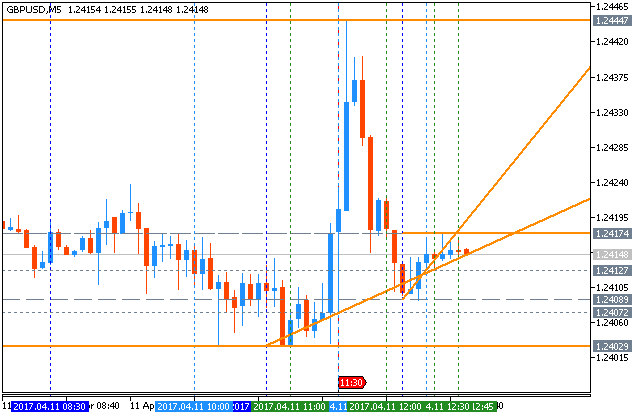

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and range price movement

2017-04-11 09:30 GMT | [GBP - CPI]

- past data is 2.3%

- forecast data is 2.2%

- actual data is 2.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The Consumer Prices Index including owner occupiers’ housing costs (CPIH, not a National Statistic) 12-month inflation rate was 2.3% in March 2017, unchanged from February."

- "The Consumer Prices Index (CPI) 12-month rate was also 2.3% in March 2017, unchanged from February."

==========

GBP/USD M5: range price movement by U.K. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.11 19:26

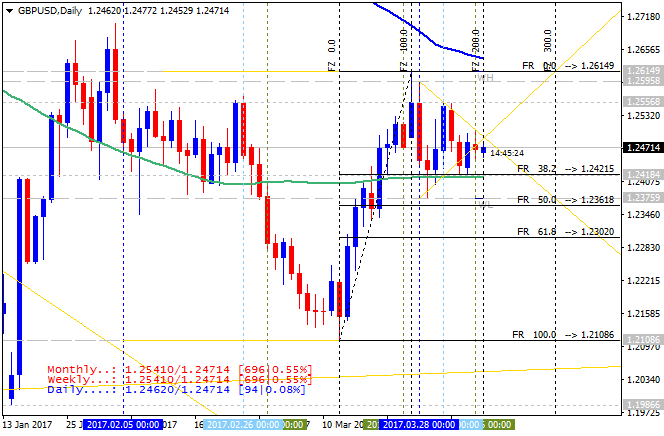

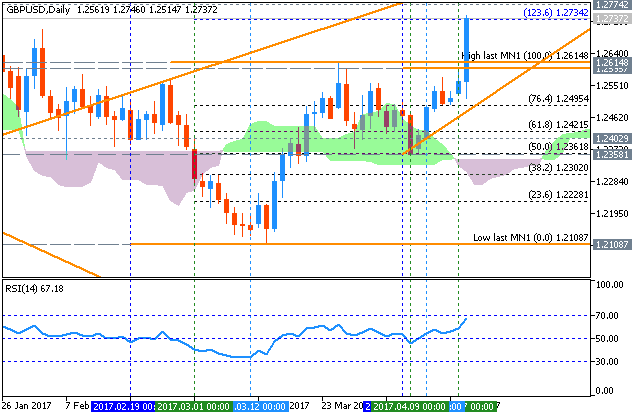

GBP/USD Technical Analysis: bullish ranging near bearish reversal level (based on the article)

Daily price is located near and above Ichimoku cloud for the ranging within the following support/resistance levels:

- 1.2358 support level located in the beginning of the bearish reversal to be started, and

- 1.2557 resistance level located in the bullish trend to be resumed.

"Cable responded to the 50% retracement of the March advance at 1.2362 this week with the rebound now approaching initial resistance targets. The broader focus remains weighted to the topside while above 1.23 / the lower parallel (blue) with a breach above the monthly open needed to validate a more meaningful reversal targeting confluence resistance at the 200-day moving average at ~1.2630s & key resistance at 1.2675-1.2706."

Forum on trading, automated trading systems and testing trading strategies

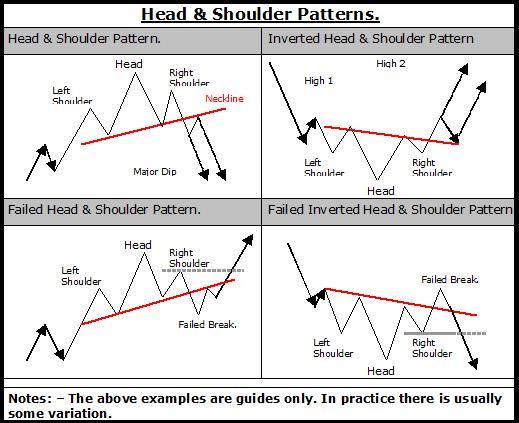

HEAD & SHOLDER BOTTOM GB PUSD

upul siriwardhana, 2017.04.17 16:15

Hii.

There is a complex head & shoulder bottom pattern(2 shoulders left & 2 shoulders right) appears on GBPUSD daily chart. If the resistance level break out on heavy volume downward trend turn to upward near 1.3123 level.is it possible or not?

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.18 16:01

GBP/USD: daily bullish breakout ahead of a snap general election announced (based on the article)

Daily price is located above Ichimoku cloud in the bullish area of the chart: the price is breaking ascending triangle pattern together with 1.2614 resistance level to above for the bullish trend to be continuing with 1.2737/1.2774 nearest bullish target to re-enter.

- "British Prime Minister Theresa May on Tuesday announced a snap general election for June 8."

- "In a surprise statement at 10 Downing Street, May said the U.K. needed stability, certainty and strong leadership after the June 2016 referendum. Her government has delivered that, she claimed."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.20 09:09

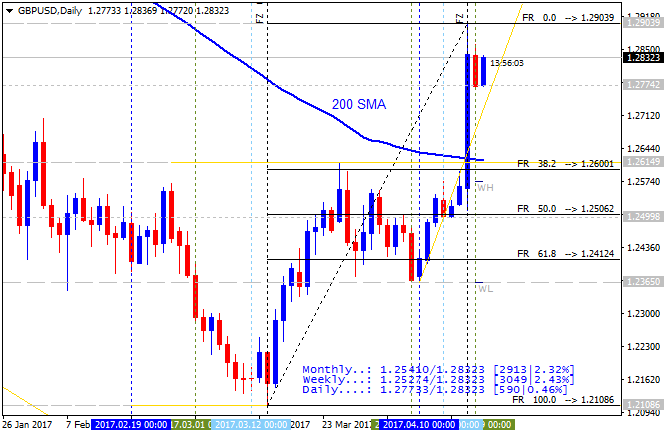

GBP/USD - daily price broke 200-day SMA for the bullish (based on the article)

Daily price broke 200 SMA to above to be reversed to the primary bullish market condition. The price is testing 1.2903 resistance level to above for the bullish trend to be condition, otherwise - ranging waiting for direction.

- "Prime Minister Theresa May announced that general elections would be held early, on June 8th of this year. The move was largely applauded as cogent political strategy in the effort of gaining a Conservative super majority to push through Brexit negotiations. And this very much may be the case; but given the volatility seen in global elections over the past year, it would seem that a bit of reservation should be due before any long-term prognostications are built based on early polling numbers. "

- "The immediate impact to the British Pound was a quick run of strength that finally sent price action above the 1.2775-level. Prices continued to run in a rather aggressive fashion, all the way up to 1.2903 before sellers came-in. This led many outlets to claim that PM May’s announcement was a ‘game-changer’; and again, this very much may be the case but for traders putting money on the line, this is a leap-of-faith that shouldn’t yet be initiated until more information presents itself. "

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

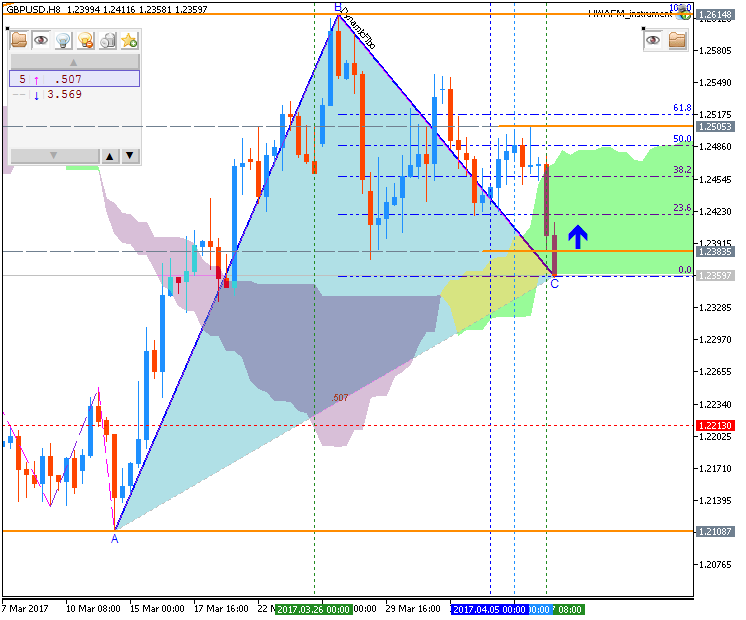

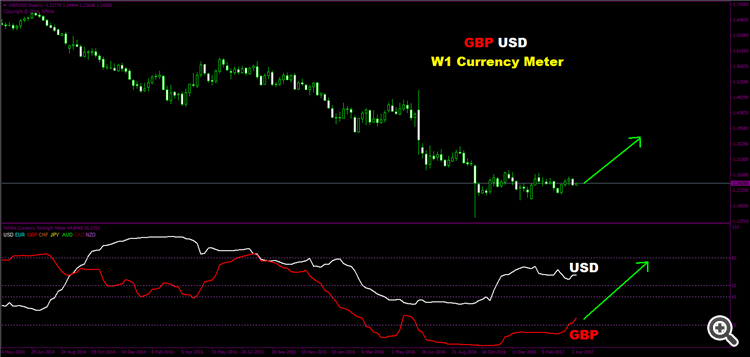

GBP/USD April-June 2017 Forecast: ranging below Ichimoku cloud for direction

W1 price is below Ichimoku cloud for the bearish ranging market condition within the following support/resistance levels:

- 1.2569 resistance level located near and below Ichimoku cloud in the beginning of the secondary rally to be started, and

- 1.2108 support level located below the cloud in the bearish area of the chart.

Chinkou Span line is located below the price indicating the bearish ranging, Trend Strength indicator is estimating the rally in the near future, and Absolute Strength indicator is evaluating the trend as a ranging as well. Non-lagging Tenkan-sen/Kijun-sen signal is for secondary rally within the bearish trend to be started for now and in very near future for example.Trend:

W1 - ranging bearish