Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.03.31 07:16

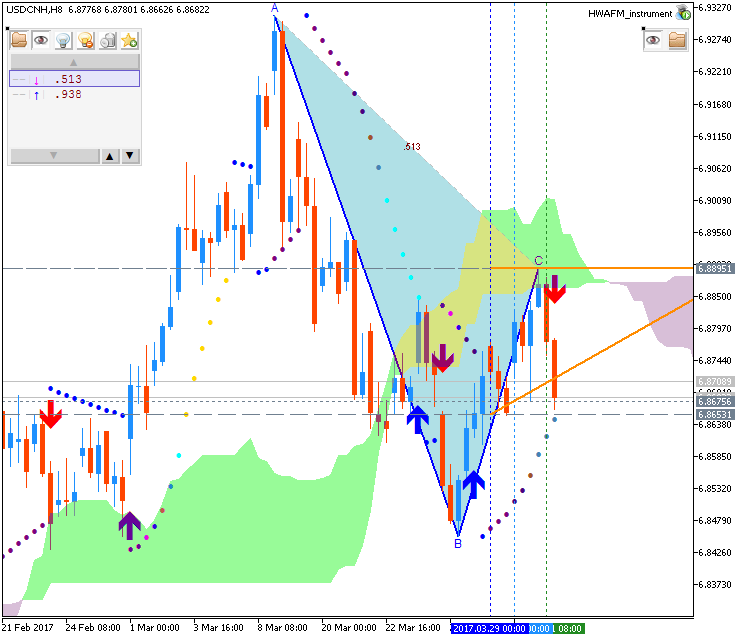

USD/CNH Intra-Day Fundamentals: China Manufacturing PMI and range price movement

2017-03-31 02:00 GMT | [CNY - Manufacturing PMI]

- past data is 51.6

- forecast data is 51.7

- actual data is 51.8 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From rttnews article:

- "The manufacturing sector in China continued to expand in March, and at an accelerated pace, the National Bureau of Statistics said on Friday with a manufacturing PMI score of 51.8."

==========

USD/CNH M5: range price movement by China Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 10:02

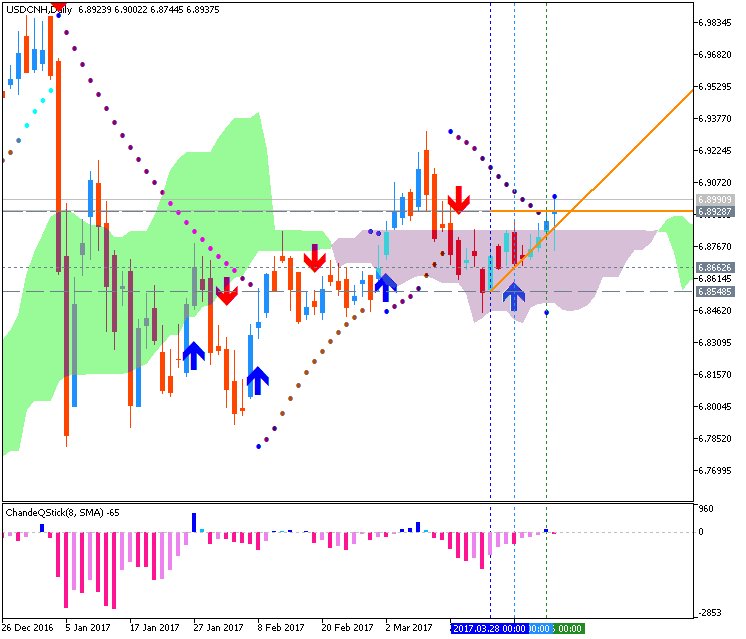

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "This Thursday, a couple of hours following the announcement of the US-China summit, Trump tweeted that “the meeting next week with China will be a very difficult one”. “We can no longer have massive trade deficits and job losses”. Also, President Trump has been considering to launch a border adjustment tax, which from China’s point of view, it is “controversial”. At the summit, if Trump takes a hardline on China over its trade practices, it may dampen the outlook of China’s exports and imports condition over the following periods, adding bearish momentums to the Yuan. In addition to this top theme, China will release March Caixin PMI prints. The official Manufacturing PMI in March increased to 51.8 from 51.6 in the month prior and beat a forecast of 51.7. Compared to the official gauge, the Caixin PMI measures smaller-sized companies that are usually more sensitive to economic cycles. As a result, if these smaller manufacturing firms have not shown sustainable improvements, it indicates that the economy may still face some major challenges. Based on the data that has already been released, this is likely to be the case, and in turn, will not provide much support to Yuan rates."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.07 17:41

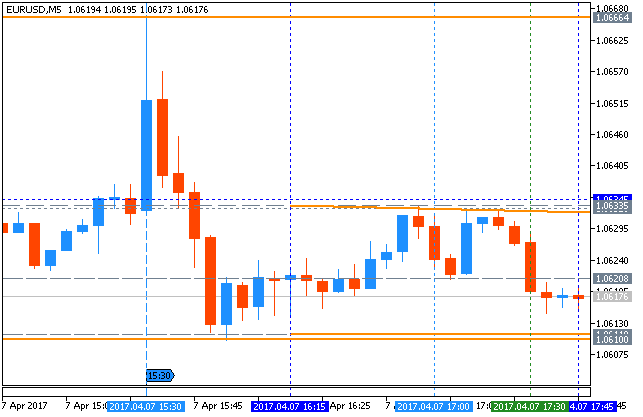

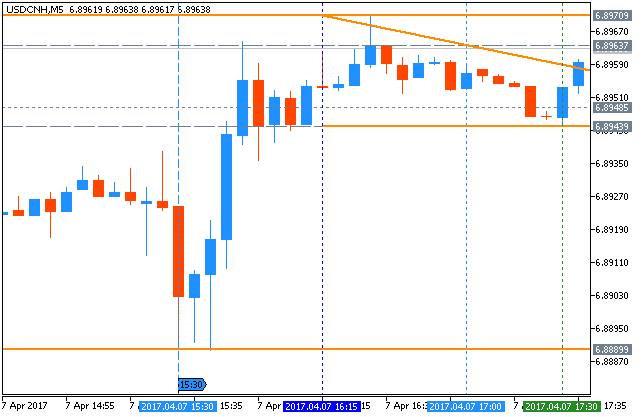

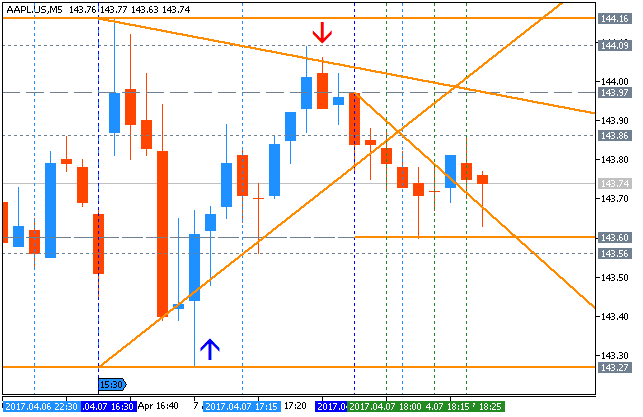

Intra-Day Fundamentals - EUR/USD, USD/CNH, Apple shares and McDonald's shares: Non-Farm Payrolls

2017-04-07 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 219K

- forecast data is 174K

- actual data is 98K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

- "The unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services and in mining, while retail trade lost jobs."

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

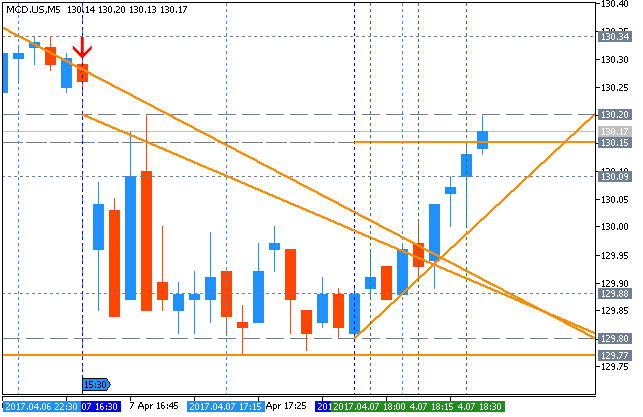

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

Apple M5: range price movement by Non-Farm Payrolls news events

==========

McDonald's M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 12:47

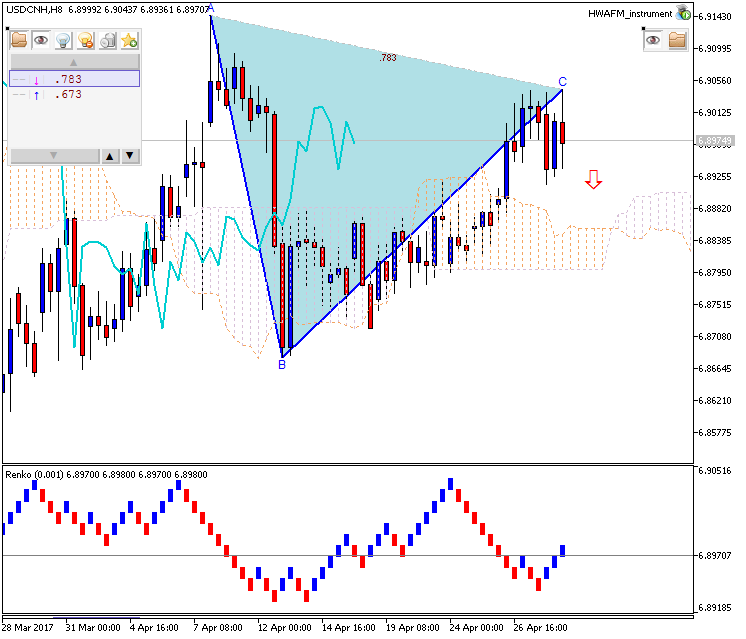

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "Among all the event risks, exports and imports reads could have a greater direct impact to the Dollar/Yuan than others. China has been shifting from an export-driven economy to domestic-consumption-driven. However, this will need to take a long process; so far, Chinese producers still largely rely on international demand. In the U.S.-China leaders meeting, Trump told that the U.S. has “made progress” in the relationship with China and “lots of very potentially bad problems will be going away”. The bilateral trade issue is considered to be one of those “bad problems”. For China, avoiding major conflict with its U.S. counterpart will give it more time to upgrade the manufacturing industries that still heavily depend on exports, and in turn, will help to stabilize the economic growth when a slowdown is already seen."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.12 07:47

USD/CNH Intra-Day Fundamentals: China Consumer Price Index and 26 pips range price movement

2017-04-12 02:30 GMT | [CNY - CPI]

- past data is 0.8%

- forecast data is 1.1%

- actual data is 0.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

From rttnews article:

- "Consumer prices in China were up 0.9 percent on year in March, the National Bureau of Statistics said on Wednesday."

- "That was shy of expectations for 1.0 percent, but it was still up from 0.8 percent in February."

==========

USD/CNH M5: 26 pips range price movement by China Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.17 07:43

USD/CNH Intra-Day Fundamentals: China Gross Domestic Product and range price movement

2017-04-17 03:00 GMT | [CNY - GDP]

- past data is 6.8%

- forecast data is 6.8%

- actual data is 6.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From rttnews article:

- "Gross domestic product advanced 6.9 percent year-over-year in the first quarter, just above the 6.8 percent rise in the fourth quarter. Meanwhile, economists had expected the growth to remain stable at 6.8 percent."

- "During the first three months of the year, the national fixed asset investment grew 9.2 percent from a year ago."

==========

USD/CNH M5: range price movement by China Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.28 15:09

Intra-Day Fundamentals - EUR/USD and USD/CNH: U.S. Gross Domestic Product

2017-04-28 13:30 GMT | [USD - GDP]

- past data is 2.1%

- forecast data is 1.3%

- actual data is 0.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

- "Real gross domestic product (GDP) increased at an annual rate of 0.7 percent in the first quarter of 2017(table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In thefourth quarter of 2016, real GDP increased 2.1 percent."

- "The Bureau emphasized that the first-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The "second" estimate for the first quarter, based on more complete data, will be released on May 26, 2017."

==========

EUR/USD M5: range price movement by U.S. Gross Domestic Product news events

==========

USD/CNH M5: range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.29 17:28

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "While the Chinese Yuan traded in a range, Chinese equities have been on a wide ride since the launch of a Special Economic Zone at the beginning of April. Shanghai Composite Index dropped -1.37% this Monday following a -2.25% loss last week. We discussed that it is not uncommon that Chinese investors rush to buy stocks on news and then sell them after a short holding period. Chinese stock market may not directly impact the Chinese Yuan, but it reflects the financial stability of the country. In January 2016, when the newly introduced circuit-break system caused chaos and a big selloff in the equity market, the fear eventually spread to the FX market and led to investors rushing to get rid of Yuan-denominated assets. As a result, keeping an eye on the Chinese equity market when it becomes volatile may help FX investors to manage risks."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.02 07:57

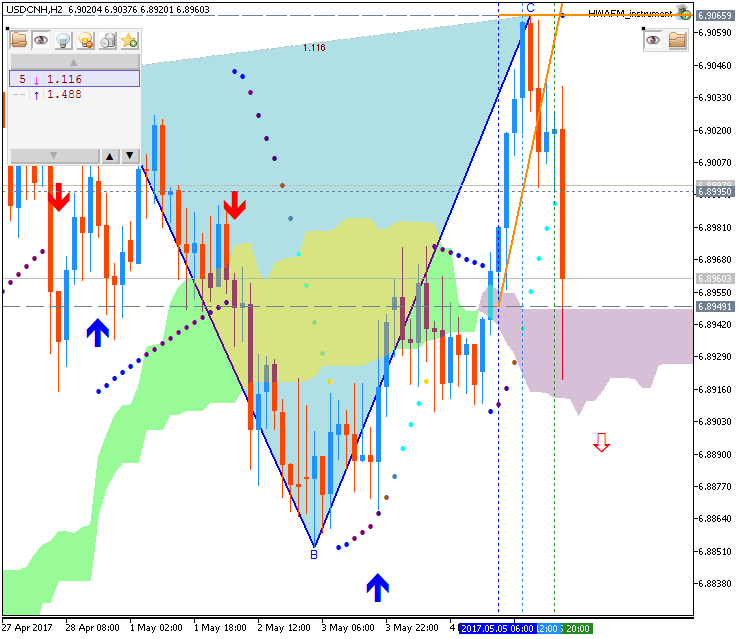

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and range price movement

2017-05-02 02:45 GMT | [CNY - Caixin Manufacturing PMI]

- past data is 51.2

- forecast data is 51.4

- actual data is 50.3 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

- "The seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – registered 50.3 in April, down from 51.2 in March to signal only a marginal improvement in overall operating conditions. Moreover, the latest upturn in the health of the sector was the weakest seen since last September."

==========

USD/CNH M5: range price movement by Caixin Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.06 13:32

Weekly Fundamental Forecast for USD/CNH (based on the article)

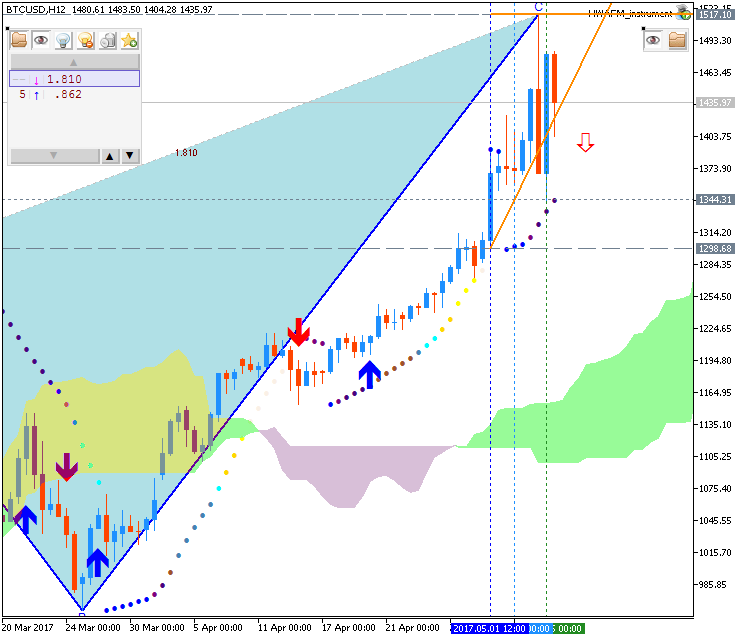

USD/CNH - "The PBOC continued to manage liquidity in the financial system in a delicate way, through open market operations. The regulator has reiterated several times that it will keep monetary policy neutral, ruling out a possibility of using easing measures to support the economy before the price bubble risk is fully curbed. The April New Yuan Loans and home loans prints to be released on May 10th will give some update on this. These gauges have been used to evaluate whether excessive cash has flown into the housing sector, where the price bubble risk is seen the most. In addition to the Dollar/Yuan rate, the Bitcoin/Yuan price is worth to keep an eye on as well. On Friday, the BTC/CNY hit a record high after the BTC/USD went on a record-breaking run for a week. Unlike the Japanese regulator that said yes to further Bitcoin development, or the U.S. regulator that said no but keep the door open for a yes, the Chinese regulator sent out a clear signal that China is not ready to have a digital currency to be used widely, even not to have a digital currency invented by itself. These mixed attitudes have Bitcoin exposed to different risks in its three largest markets and in turn elevate its volatility."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is located above Ichimoku cloud in the bullish area of the chart within the following support/resistance levels:

Chinkou Span line is above the price indicating indicating the ranging bullish condition, Trend Strength indicator is estimating the future trend as a correction, and Absolute Strength indicator is evaluating the trend as a ranging. Non-lagging Tenkan-sen/Kijun-sen signal is for ranging bullish market condition for now and for very near future for example.

By the way, ascending triangle pattern was formed by the price to be crossed with 6.9314 resistance to above for 6.9868 target to re-enter.

Trend:

W1 - ranging