You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.01.28 15:48

Weekly Fundamental Forecast for USD/CNH (based on the article)USD/CNH - "Two major event risks from China’s counterpart is Fed’s February rate decision on Wednesday and the U.S. January Non-farm Payroll (NFP) print on Friday. The USD/CNH has been retracing within a range after the offshore Yuan strengthened to a two-month high. Within such a context, moves from the U.S. side may give out more clues on the next trend for the Dollar/Yuan. For Fed’s release on Wednesday, the benchmark interest rates will likely remain unchanged, with an odds of only 12% of a rate hike. There will be no updates on economic forecasts and no press conference from Chair Yellen; the major focus will be on the sentiment in Fed’s minutes. Also, the January U.S. labor market report is expected to heavily weigh on the Dollar/Yuan after China’s onshore markets reopens. Two weeks ago, Yellen addressed on positive development in the labor market. If the NFP print on Friday came in stronger, it will provide more support to the U.S. Dollar."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.01 07:37

USD/CNH Intra-Day Fundamentals: China Manufacturing PMI and 63 pips range price movement

2017-02-01 01:00 GMT | [CNH - Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNH - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From businessinsider article:

"The manufacturing sector in China continued to expand in January, albeit at a slightly slower pace, the National Bureau of Statistics said on Wednesday with a manufacturing PMI score of 51.3."

==========

USD/CNH M5: 63 pips range price movement by China Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.03 09:30

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 112 pips range price movement

2017-02-03 01:45 GMT | [CNH - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNH in our case)

[CNH - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

==========

USD/CNH M5: 112 pips range price movement by Caixin Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.03 09:49

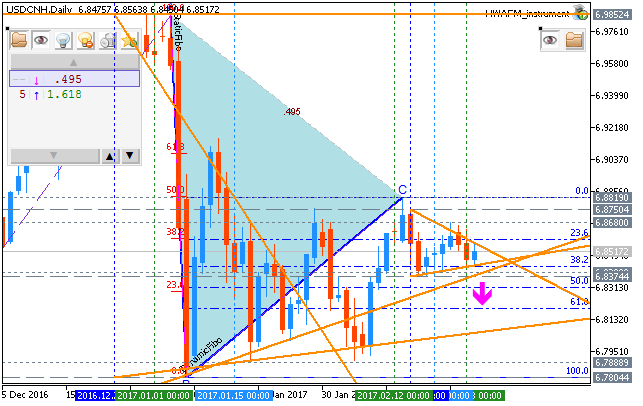

USD/CNH - weekly correction, daily bearish (adapted from the artile)

Weekly price is above Ichimoku cloud: the price was bounced from 6.9869 resistance level to below for support level at 6.7818 to be testing for the correction to be started.

Daily price in on bearish ranging located below Ichimoku cloud within the following s/r levels:

Chinkou Span line and Absolute Strength indicator are estimating the trend as the ranging bearish, and Trend Strength indicator is evaluating the future possible trend as the bullish.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.10 06:45

USD/CNH Intra-Day Fundamentals: China Trade Balance and 56 pips range price movement

2017-02-10 02:57 GMT | [CNY - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month.

==========

From whylose article: China Trade balance, exports & imports beat expectations in CNY terms

==========

USD/CNH M5: 56 pips range price movement by CGAC Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.14 07:56

USD/CNH Intra-Day Fundamentals: China Consumer Price Index and 29 pips range price movement

2017-02-14 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

From rttnews article:

==========

USD/CNH M5: 29 pips range price movement by China Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.25 07:16

Weekly Outlook: 2017, February 26 - March 05 (based on the article)

Durable Goods Orders, GDP data from the US, Australia, and Canada, US Consumer Confidence, Manufacturing PMI, Crude Oil Inventories, Unemployment Claims and rate decision in Canada. These are the main events on forex calendar.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.26 12:14

Weekly Fundamental Forecast for USD/CNH (based on the article)USD/CNH - "One of the most important events for the NPC conference will be Premier Li Keqiang’s government work report. This will be delivered at the opening day of the NPC meetings. Economic growth and CPI targets for 2017 are expected to be released in this report. Another key measure to be released in the report is the fiscal deficit ratio, which reflects China’s fiscal policy. China’s Central Bank has been tightening liquidity in the effort to bring monetary policy back to neutral, from slightly loose. Within such context, the country may have to reply more on fiscal policy to stimulate the economy. In the annual Central Economic Work Conference held in December 2016, policymakers told that China will adopt a more proactive fiscal policy."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.01 07:03

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 40 pips range price movement

2017-03-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

==========

USD/CNH M5: 40 pips range price movement by Caixin Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.04 11:39

Weekly Fundamental Forecast for USD/CNH (based on the article)USD/CNH - "The New Yuan loans, a major indicator that may impact the PBOC’s monetary policy, is expected to drop to 920 billion Yuan in February from 2.030 trillion Yuan in the month prior, the second-highest level on record. In order to curb excess liquidity flowing into the housing market and other financial markets, the PBOC has been delicately managing its cash injections through open market operations. The Central Bank withdrew a net of 280 billion Yuan this week and has been removing liquidity from markets for the seventh consecutive trading days. The regulator targets to bring monetary policy back to neutral from slightly loose. Total new credit issued, home loans and property prices are three key gauges that the regulator may use to evaluate whether monetary policy has returned to neutral."